Setting Up Interest Methods

To set up interest methods, use the Interest Method (INTEREST_METHOD) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_INTEREST_P1 |

Set the interest rate. |

|

|

PA_INTEREST_P2 |

Set rules for applying the interest rate over full periods and partial periods. |

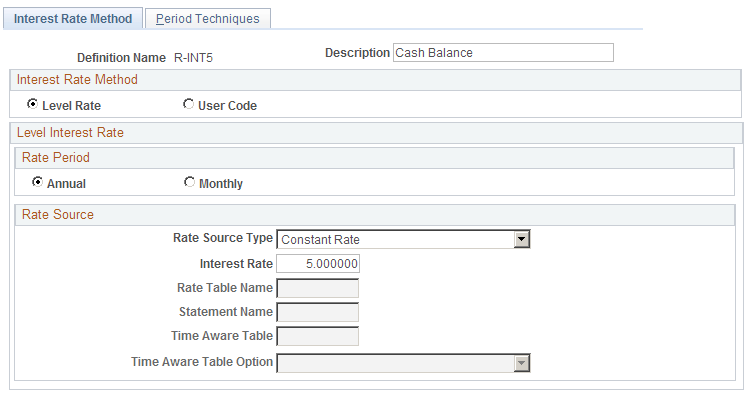

Use the Interest Rate Method page (PA_INTEREST_P1) to set the interest rate.

Navigation:

This example illustrates the fields and controls on the Interest Rate Method page.

Interest Rate Method

Field or Control |

Description |

|---|---|

Level Rate |

Select this option unless you use your own user code. |

User Code |

Select this option to use your own user code. |

Level Interest Rate

Field or Control |

Description |

|---|---|

Annual or Monthly |

Indicate whether the this method provides an annual or monthly interest rate. |

Rate Source Type |

Select from the following options:

|

Time Aware Table |

If you selected Program Generated Table Lookup in the Rate Source Type field, select a time-aware table to use. Note: This field prompts against this type of table lookup. If you do not see the alias you're looking for, verify that you have identified the lookup as a program-generated table lookup on the Table Lookup Alias page. |

Time Aware Table Option |

If you selected Program Generated Table Lookup in the Rate Source Type field, choose which date the to use to look up the interest rate for each period. The options are First Day of Calendar Year, First Day of Period, First Day of Plan Year, and Last Day of Period. |

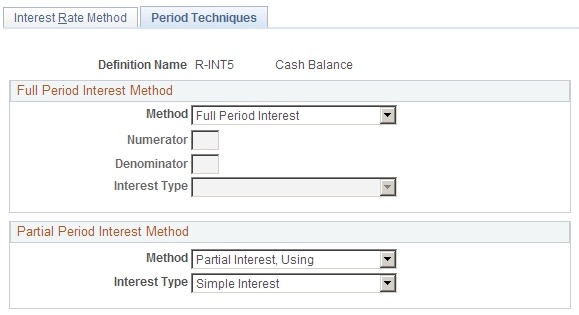

Use the Period Techniques page (PA_INTEREST_P2) to set rules for applying the interest rate over full periods and partial periods.

Navigation:

This example illustrates the fields and controls on the Period Techniques page.

Full Period Interest Method

Field or Control |

Description |

|---|---|

Method |

Select from these options: No Interest, Full Period Interest, Fractional Interest for Period, or User Code. You can use the No Interest option for both full and partial periods. If you choose Fractional Interest for Period, you can approximate the interest that would be credited if contributions were collected at intervals throughout the period. For example, if contributions were collected monthly over an annual period, employees would receive 12 months of interest on the first contribution, then 11 months of interest on the next, and so on until they receive one month of interest on the last month. An approximation of the total interest on the consolidated annual amount would be the average amount of interest, which would be five and a half months of interest, or 11/24 of the year. |

Numerator and Denominator |

If the method is Fractional Interest for Period, enter the numerator and denominator of the fraction in these fields. |

Interest Type |

If the method is Fractional Interest for Period, choose whether to use Compound Interest or Simple Interest.

|

Partial Period Technique

Field or Control |

Description |

|---|---|

Partial Interest, Using |

This option prorates interest over the number of days in the partial period. With partial interest, you can select compound or simple interest:

|