Setting Up Actuarial Valuation

To set up actuarial valuation, use the Codes (STATUS_ASSIGNMENT) and Actuarial Valuation Matrix (VAL_MATRIX) components.

This topic provides an overview of actuarial valuation setup and discusses how to set up your actuarial valuation categories.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_PEN_VAL |

Map the appropriate valuation categories to a participant's pension statuses. You must first assign the status codes on the Status Codes - Status Codes Assignment page. |

|

|

PA_PEN_VAL_MTX |

Specify how to treat combinations of valuation categories. |

A pension plan is subject to an annual actuarial valuation so that an actuary can determine plan liabilities. Pension Administration produces the Actuarial Valuation Extract with the data necessary for the valuation.

Note: The Actuarial Valuation Extract does not analyze the data or offer conclusions about the plan's liabilities. It simply presents the relevant data that a qualified actuary can use to perform the valuation.

The extract creates two data files:

Active extract containing the data for those whose benefits are still accruing.

Inactive extract containing the data for those whose benefits are no longer accruing and who have not yet been paid.

Current employees covered under a plan, whether or not they have begun to participate, are typically active. Employees who have separated from service, whether receiving benefits or awaiting deferred benefits, are typically inactive. Beneficiaries and QDRO alternate payees are also typically inactive.

An employee's valuation category indicates to the system whether the employee belongs in the active file, the inactive file, both files, or neither file. When you run the Actuarial Valuation Extract, the system populates a table with the employee's valuation category as of the extract date: Active, Inactive, Both, or Done.

The next time you run the extract, an employee's previous valuation category can impact whether the employee appears in the active or inactive valuation file. For example:

An employee who was previously active but who is now done (for example, an employee who terminated at some point during the year with a small benefit cashout) appears in that year's active file.

An employee whose status was done both last time and this time does not appear in either extract file.

An employee with no recorded prior year valuation category is automatically assigned a prior category of none to indicate that no record exists.

Events that most likely change an employee's valuation category are terminations and rehires. Rehired retirees and employees over age 70 1/2 who are receiving mandatory pension distributions are the most likely to have a valuation category of both.

For your implementation, you must determine which pension status codes to associate with which valuation categories. You must also determine which extract files include which employees, based on every possible combination of the prior and current years' valuation categories.

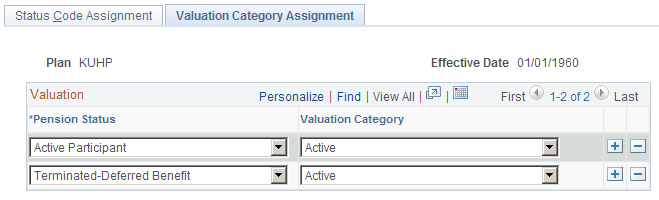

Use the Valuation Category Assignment page (PA_PEN_VAL) to map the appropriate valuation categories to a participant's pension statuses. You must first assign the status codes on the Status Codes - Status Codes Assignment page.

Navigation:

This example illustrates the fields and controls on the Valuation Category Assignment page.

Field or Control |

Description |

|---|---|

Pension Status |

Insert a row for each of the system's 21 pension status codes. |

Valuation Category |

For each status, identify one of the following valuation categories: Active: Participants who still accrue benefits. Inactive: Participants who are no longer accruing benefits, but have not yet been completely paid. Both: Participants who fall into both the active and inactive categories—for example, a rehired retiree who is receiving pension payments and is also continuing to accrue additional benefits. Done: Participants who have received their entire benefit. The plan no longer owes them anything. No Record Exists: You do not assign this value; the system sets it as the prior-year valuation category when an employee appears in the system for the first time. |

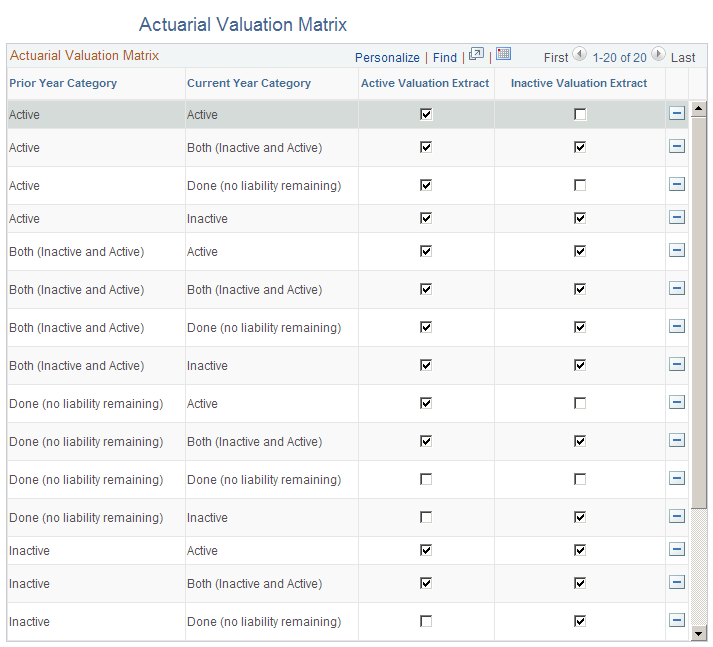

Use the Actuarial Valuation Matrix page (PA_PEN_VAL_MTX) to specify how to treat combinations of valuation categories.

The Actuarial Valuation Extract uses a combination of the current and prior years' valuation categories to determine how to create the extract files. You use the Actuarial Valuation Matrix page to specify how the system should treat combinations of these valuation categories. The information that you set up on this page applies to all plans.

Navigation:

This example illustrates the fields and controls on the Actuarial Valuation Matrix page.

Field or Control |

Description |

|---|---|

Active Valuation Extract and Inactive Valuation Extract |

For each combination of prior year and current year valuation categories, select:

The delivered values appear by default, but be sure to conduct your own analysis. Note: You must scroll to review all of the possible combinations. |