Reviewing Trustee Extract Data

This topic provides overviews of how to review trustee extract data and of trustee extract record layouts. It then discusses how to review the trustee extract data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_TE_SUM_INFO |

|

|

|

PA_TE_BIO_INFO |

View personal information about a payee. This information is based on one retiree record, so a payee with multiple retiree records has multiple bio records. |

|

|

PA_TE_FTX_INFO |

View a payee's federal tax elections for one retiree record. |

|

|

PA_TE_STX_INFO |

View a payee's state tax elections for one retiree record. A payee who is subject to withholding from more than one state can have multiple state tax records for a single retiree record. |

|

|

PA_TE_LTX_INFO |

View a payee's local tax elections for one retiree record. A payee who is subject to withholding from more than one locality can have multiple local tax records for a single retiree record. |

|

|

PA_TE_GDED_INFO |

View a payee's general deductions for one retiree record. Payees can have multiple deductions per job. General deductions are typically deductions for anything other than benefits, although some organizations use general deductions for benefits, as well. |

|

|

PA_TE_BDED_INFO |

View a payee's benefit deductions for one retiree record. Payees can have multiple deductions per job. |

|

|

PA_TE_DDEP_INFO |

View a payee's direct deposit instructions for one retiree record. |

|

|

PA_TE_APAY_INFO |

View a payee's additional pay for one retiree record. Payees can have multiple additional pay records per job. |

|

|

PA_TE_BADJ_INFO |

View information that can be used to adjust running payment totals for a retiree. The adjustment data is informational only; the system does not apply the adjustments to the running totals. You must make the adjustment manually. Adjustments apply to one retiree record only. Payees can have multiple balance adjustments per job. |

|

|

PA_TE_SPMT_INFO |

View payment amounts and descriptions for recurring payments for one retiree record. Each retiree record corresponds to a single plan, but payees can have multiple scheduled payment records per retiree record if there are multiple payment streams from a plan. |

|

|

PA_TE_1PMT_INFO |

View payment amounts and descriptions for one-time payments for a single payment number under a single retiree record. One-time payments can be positive or negative. Negative payments offset any regularly scheduled payment occurring in the same period. |

|

|

PA_TE_SCHED_RLOVR |

Displays rollover information for a particular RUN ID with regard to scheduled payments. |

|

|

PA_TE_CTB_RLOVR |

Displays rollover information for a particular RUN ID with regard to contribution withdrawals. |

|

|

PA_RT_EMP_SUM |

|

|

|

RUNCNTL_PMTDTL |

|

The contents of the Trustee Extract file are displayed on:

A summary page that lists summary payment information for all the employees included in the extract.

Detail pages that show, by employee, the detailed data included in the extract.

This section includes information on the summary and detail trustee extract pages. The documentation on the detail pages provides technical detail about the layout of the Trustee Extract file. This information can help you and your trustee use the file effectively.

You can also review the contents of the Trustee Extract file by running the Trustee Extract reports: PAT08 - Trustee Extract Detailed Report and PAT09 - Trustee Extract Summary Report - Record Type.

The Trustee Extract file contains rows of 450 characters each. Each row starts with a two-digit record type. Payment data for a single employee occupies multiple rows.

Header Record

The Trustee Extract file has one header record. The header record contains information about the payments that is not specific to individual employees. Therefore, the employee-based Review Trustee Extract Content pages do not display the header information.

Header records have the record type 10.

|

Header Record Data |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Run ID |

Character |

10 |

3 |

12 |

|

Payment End Date |

Character |

10 |

13 |

22 |

|

Check Date |

Character |

10 |

23 |

32 |

Control Total Record

A control total record contains a summary and count of all the records on a Trustee Extract file. This record shows the number of records of each type and the total payment amounts on the file.

You can use the control total record to verify record counts and payment amounts.

Control total records have the record type 99.

|

Control Totals |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Payment End Date |

Number |

10 |

3 |

12 |

|

Check Date |

Number |

10 |

13 |

22 |

|

Total Type 20 Records |

Number |

4 |

23 |

26 |

|

Total Type 30 Records |

Number |

4 |

27 |

30 |

|

Total Type 31 Records |

Number |

4 |

31 |

34 |

|

Total Type 32 Records |

Number |

4 |

35 |

38 |

|

Total Type 40 Records |

Number |

4 |

39 |

42 |

|

Total Type 41 Records |

Number |

4 |

43 |

46 |

|

Total Type 50 Records |

Number |

4 |

47 |

50 |

|

Total Type 60 Records |

Number |

4 |

51 |

54 |

|

Total Type 70 Records |

Number |

4 |

55 |

58 |

|

Total Type 80 Records |

Number |

4 |

59 |

62 |

|

Total Type 81 Records |

Number |

4 |

63 |

66 |

|

Total Type 82 Records |

Number |

4 |

67 |

70 |

|

Total Type 83 Records |

Number |

4 |

71 |

74 |

|

Total Other Pay |

Signed Decimal |

9.2 |

75 |

85 |

|

Total Adjustment Amount |

Signed Decimal |

9.2 |

86 |

96 |

|

Total Adjustment Amount Nontaxable |

Signed Decimal |

9.2 |

97 |

107 |

|

Total Payment Amount |

Signed Decimal |

9.2 |

108 |

118 |

|

Total Payment Amount Nontaxable |

Signed Decimal |

9.2 |

119 |

129 |

|

Total One Time Payment Amount |

Signed Decimal |

9.2 |

130 |

140 |

|

Total One Time Payment amount Nontaxable |

Signed Decimal |

9.2 |

141 |

151 |

|

Total Rollover Amounts From Scheduled Payments |

Signed Decimal |

9.2 |

152 |

162 |

|

Total Non-Taxable Rollover Amounts From Scheduled Payments |

Signed Decimal |

9.2 |

163 |

173 |

|

Total Rollover Amounts From Contribution Withdrawals |

Signed Decimal |

9.2 |

174 |

184 |

|

Total Non-Taxable Rollover Amounts From Contribution Withdrawals |

Signed Decimal |

9.2 |

185 |

195 |

Detail Records

This topic provides a record layout for each record type in the Trustee Extract file. Each record layout follows the sample page for that record type—for example, the bio record layout appears after the Employee Bio page. The header and control totals records are described at the end of this topic (there are no pages for these records).

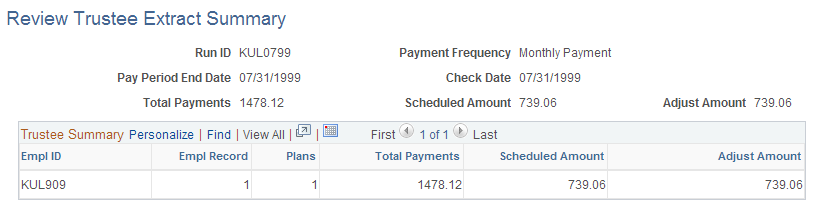

Use the Review Trustee Extract Summary page (PA_TE_SUM_INFO) to:

View a list of the employees included in a particular trustee extract run.

View summary payment information about each employee.

Navigation:

This example illustrates the fields and controls on the Review Trustee Extract Summary page.

Field or Control |

Description |

|---|---|

Run ID, Payment Frequency, Pay Period End Date, and Check Date |

These fields provide summary information about the pay run that is the basis for the extract. The run ID determines the payment frequency, pay period end date, and check date. |

Total Payments |

This is the sum of all payments—for all plans and all payees—included in this pay run. This amount comprises the total of the scheduled amount and adjusted amount. |

Scheduled Amount |

The total of payments scheduled on the Payee Payment Schedule and Payee Manual Schedule pages. |

Adjust Amount (adjusted amount) |

The total of one-time payments (positive and negative) entered on the Make One-Time Adjustments page. |

Trustee Summary

This scrolling area displays a list of all employees included in the extract. If an employee is being paid based on more than one retiree job record, there is a separate row for each record.

For each retiree job record receiving payments, the page displays the EmplID and record number, the number of plans providing a benefit (typically one because you create an additional job record for each plan), and the total payments, scheduled amount, and adjusted amount for that payee.

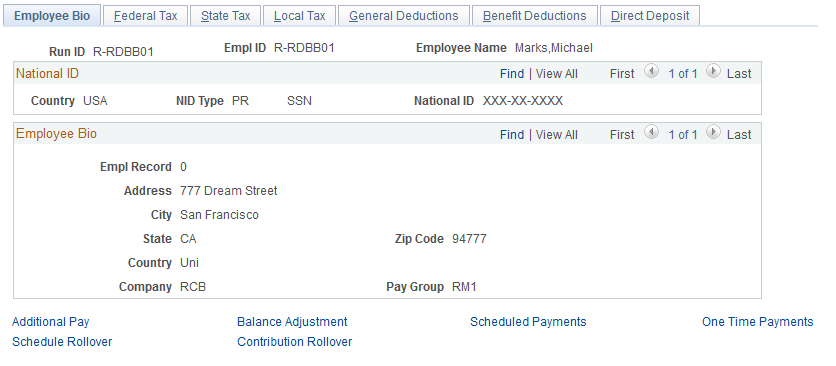

Use the Employee Bio (employee biography) page (PA_TE_BIO_INFO) to view personal information about a payee.

Navigation:

This example illustrates the fields and controls on the Employee Bio page.

Bio records have the record type 20.

|

Bio Record Data |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Employee Name |

Character |

50 |

18 |

67 |

|

Alternate Name for Payee* |

Character |

30 |

68 |

97 |

|

Address 1 |

Character |

35 |

98 |

132 |

|

Address 2 |

Character |

35 |

133 |

167 |

|

Address 3 |

Character |

35 |

168 |

202 |

|

Address 4 |

Character |

35 |

203 |

237 |

|

City |

Character |

30 |

238 |

267 |

|

County |

Character |

30 |

268 |

297 |

|

State |

Character |

6 |

298 |

303 |

|

Postal |

Character |

12 |

304 |

315 |

|

Country |

Character |

30 |

316 |

345 |

|

National ID |

Character |

15 |

346 |

360 |

|

Company Code |

Character |

10 |

361 |

370 |

|

Paygroup Code |

Character |

3 |

371 |

373 |

*This is the designated payee name from the payment schedule. If there are multiple payment numbers for a single employee record number, this name comes from the first payment.

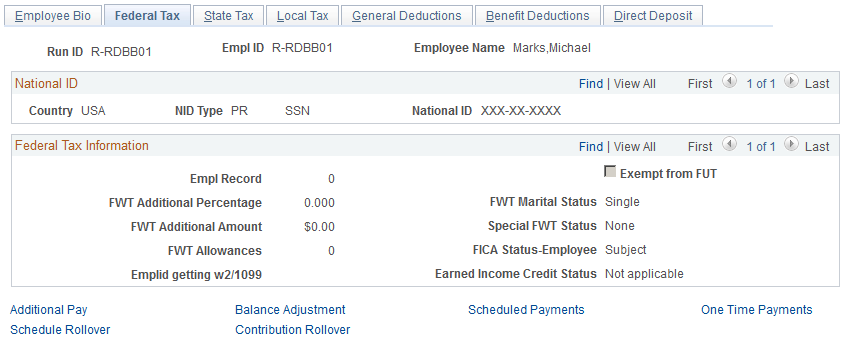

Use the Federal Tax page (PA_TE_FTX_INFO) to view a payee's federal tax elections for one retiree record.

Navigation:

This example illustrates the fields and controls on the Federal Tax page.

Federal tax records have the record type 30.

|

Federal Tax Data |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Marital Status for Federal Withholding |

Character |

1 |

18 |

18 |

|

Allowances for Federal Withholding |

Number |

4 |

19 |

22 |

|

Additional Amount to Withhold |

Signed Decimal |

5.2 |

23 |

29 |

|

Additional Percentage to Withhold |

Signed Decimal |

2.3 |

30 |

34 |

|

Special Withholding Status |

Character |

1 |

35 |

35 |

|

FICA Status |

Character |

1 |

36 |

36 |

|

FUTA Exempt Status |

Character |

1 |

37 |

37 |

|

EIC Status |

Character |

1 |

38 |

38 |

|

Employee ID for W-2 |

Character |

11 |

39 |

49 |

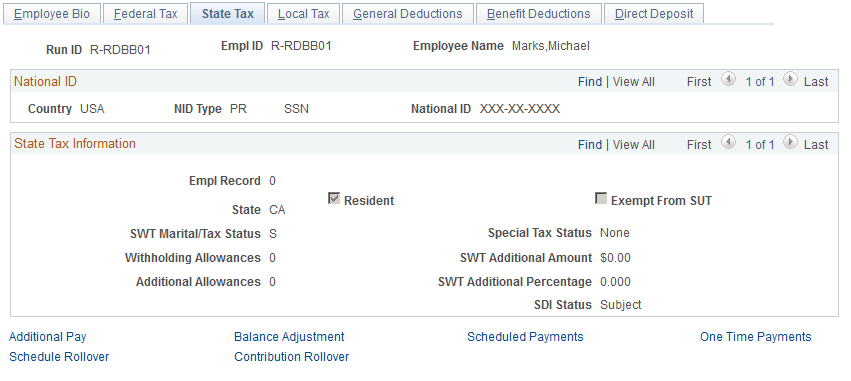

Use the State Tax page (PA_TE_STX_INFO) to view a payee's state tax elections for one retiree record.

Navigation:

This example illustrates the fields and controls on the State Tax page.

State tax records have the record type 31.

|

State Tax Data |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

State |

Character |

6 |

18 |

23 |

|

Resident |

Character |

1 |

24 |

24 |

|

Special Status for State Withholding |

Character |

1 |

25 |

25 |

|

Marital Status for State Withholding |

Character |

1 |

26 |

26 |

|

Allowances for State Withholding |

Number |

4 |

27 |

30 |

|

Additional Allowances for State Withholding |

Number |

4 |

31 |

34 |

|

Additional Amount to Withhold |

Signed Decimal |

5.2 |

35 |

41 |

|

Additional Percentage to Withhold |

Signed Decimal |

2.3 |

42 |

46 |

|

SDI Status |

Character |

1 |

47 |

47 |

|

SUT Exempt |

Character |

1 |

48 |

48 |

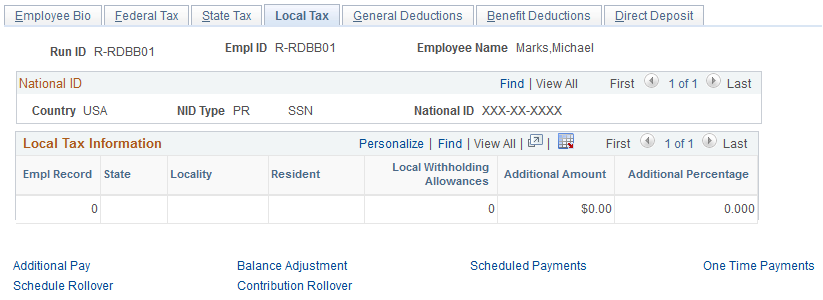

Use the Local Tax page (PA_TE_LTX_INFO) to view a payee's local tax elections for one retiree record.

Navigation:

This example illustrates the fields and controls on the Local Tax page.

Local tax records have the record type 32.

|

Local Tax Data |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

State |

Character |

6 |

18 |

23 |

|

Locality |

Character |

7 |

24 |

30 |

|

Resident |

Character |

1 |

31 |

31 |

|

Allowances for Local Withholding |

Number |

4 |

32 |

35 |

|

Additional Amount to Withhold |

Signed Decimal |

5.2 |

36 |

42 |

|

Additional Percentage to Withhold |

Signed Decimal |

2.3 |

43 |

47 |

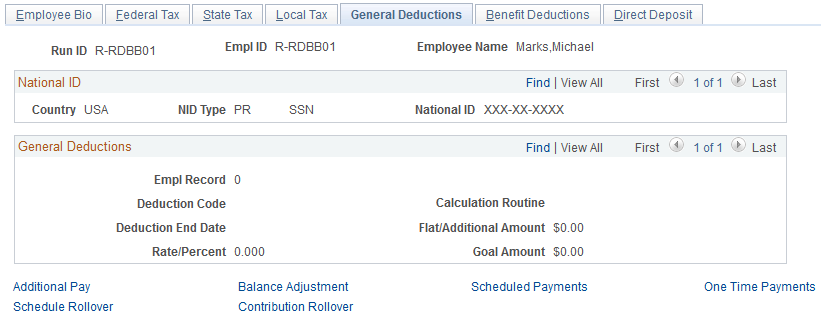

Use the General Deductions page (PA_TE_GDED_INFO) to view a payee's general deductions for one retiree record.

Navigation:

This example illustrates the fields and controls on the General Deductions page.

General deduction records have the record type 40.

|

General Deduction Data |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Deduction Code |

Character |

6 |

18 |

23 |

|

Deduction End Date |

Character |

10 |

24 |

33 |

|

Deduction Calculated |

Character |

1 |

34 |

34 |

|

Additional Amount to Deduct |

Signed Decimal |

8.2 |

35 |

44 |

|

Percentage Rate for Deduction |

Signed Decimal |

4.3 |

45 |

51 |

|

Goal |

Signed Decimal |

8.2 |

52 |

61 |

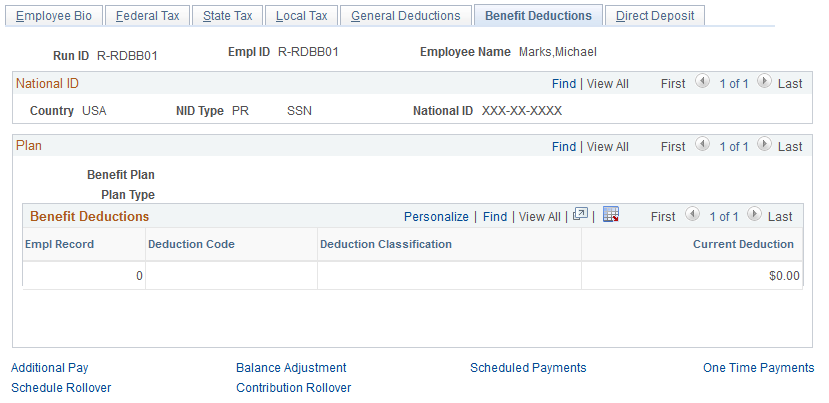

Use the Benefit Deductions page (PA_TE_BDED_INFO) to view a payee's benefit deductions for one retiree record.

Navigation:

This example illustrates the fields and controls on the Benefit Deductions page.

Benefit deduction records have the record type 41.

|

Benefit Deduction Data |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Plan Type |

Character |

2 |

18 |

19 |

|

Plan |

Character |

6 |

20 |

25 |

|

Deduction Code |

Character |

6 |

26 |

31 |

|

Deduction Class |

Character |

1 |

32 |

32 |

|

Current Deduction |

Signed Decimal |

8.2 |

33 |

42 |

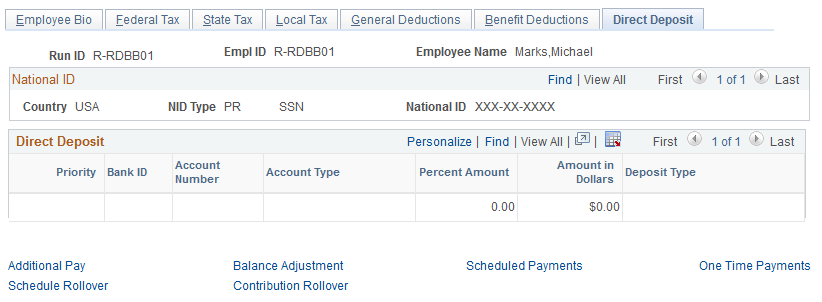

Use the Direct Deposit page (PA_TE_DDEP_INFO) to view a payee's direct deposit instructions for one retiree record.

Navigation:

This example illustrates the fields and controls on the Direct Deposit page.

Direct deposit records have the record type 50.

|

Direct Deposit Data |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Priority |

Number |

4 |

18 |

21 |

|

Transit Number |

Character |

11 |

22 |

32 |

|

Account Number |

Character |

17 |

33 |

49 |

|

Account Type |

Character |

1 |

51 |

55 |

|

Percentage Amount |

Signed Decimal |

3.2 |

56 |

65 |

|

Deposit Amount |

Signed Decimal |

8.2 |

54 |

63 |

|

Deposit Amount |

Signed Decimal |

8.2 |

54 |

63 |

|

Deposit Type |

Character |

1 |

65 |

65 |

Use the Additional Pay page (PA_TE_APAY_INFO) to view a payee's additional pay for one retiree record.

Navigation:

This example illustrates the fields and controls on the Additional Pay page.

Additional pay records have the record type 60.

|

Additional Pay Data |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Earnings Code |

Character |

3 |

18 |

20 |

|

Earnings End Date |

Character |

10 |

21 |

30 |

|

Other Pay Amount |

Signed Decimal |

8.2 |

31 |

40 |

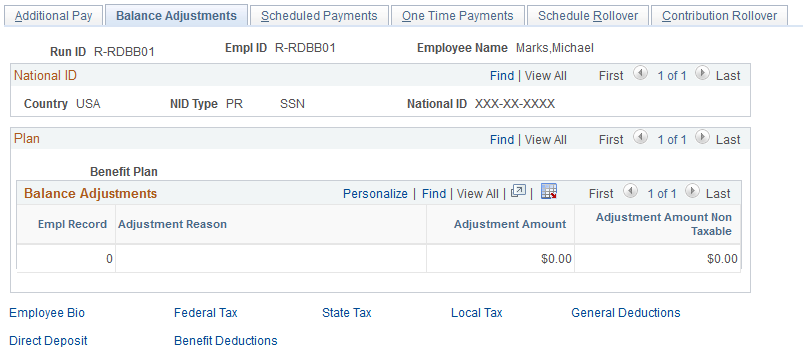

Use the Balance Adjustments page (PA_TE_BADJ_INFO) to view information that can be used to adjust running payment totals for a retiree.

The adjustment data is informational only; the system does not apply the adjustments to the running totals. You must make the adjustment manually.

Navigation:

This example illustrates the fields and controls on the Balance Adjustments page.

Balance adjustment records have the record type 70.

|

Balance Adjustment Data |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Pension Plan |

Character |

6 |

18 |

23 |

|

Adjustment Reason |

Character |

1 |

24 |

24 |

|

Adjustment Amount |

Signed Decimal |

9.2 |

25 |

35 |

|

Nontaxable portion of adjustment amount |

Signed Decimal |

9.2 |

36 |

46 |

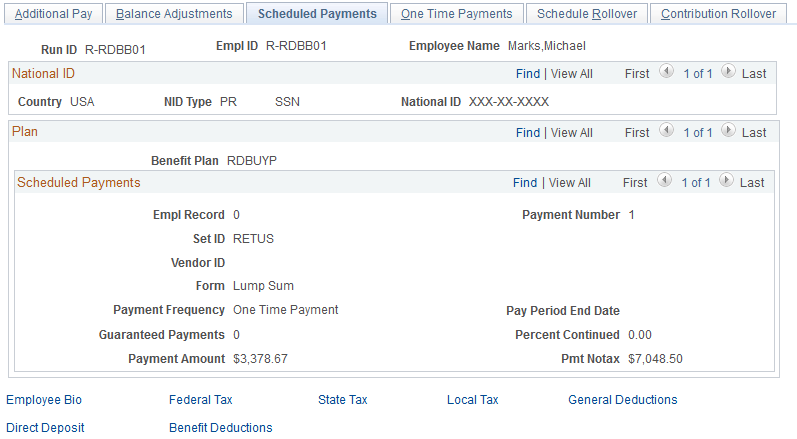

Use the Scheduled Payments page (PA_TE_SPMT_INFO) to view payment amounts and descriptions for recurring payments for one retiree record.

Navigation:

This example illustrates the fields and controls on the Scheduled Payments page.

Scheduled payment records have the record type 80.

|

Scheduled Payment Data |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Pension Plan |

Character |

6 |

18 |

23 |

|

Payment Number |

Number |

4 |

24 |

27 |

|

SetID |

Character |

5 |

28 |

32 |

|

Vendor ID |

Character |

10 |

33 |

42 |

|

Optional Form Code |

Character |

4 |

43 |

46 |

|

Optional Form Years Guaranteed |

Number |

4 |

47 |

50 |

|

Optional Form Percent Continued |

Signed Decimal |

3.2 |

51 |

55 |

|

Payment Frequency |

Character |

4 |

56 |

59 |

|

Payment End Date |

Character |

10 |

60 |

69 |

|

Payment Amount |

Signed Decimal |

9.2 |

70 |

80 |

|

Nontaxable Portion of Payment Amount |

Signed Decimal |

9.2 |

81 |

91 |

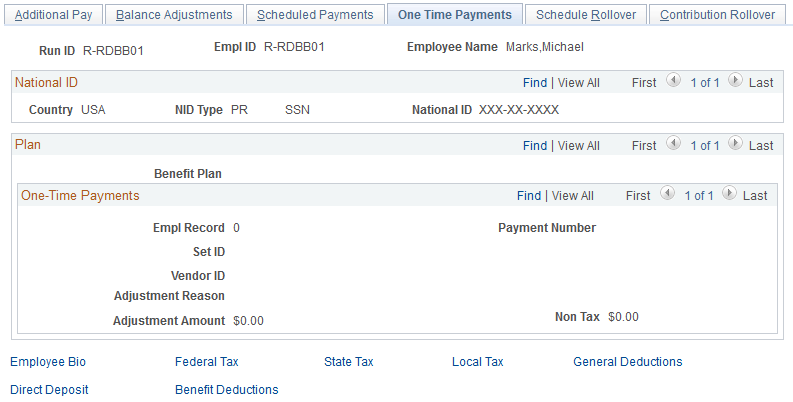

Use the One Time Payments page (PA_TE_1PMT_INFO) to view payment amounts and descriptions for one-time payments for a single payment number under a single retiree record.

Navigation:

This example illustrates the fields and controls on the One Time Payments page.

One-time payment records have the record type 81.

|

One-Time Payment Data |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Pension Plan |

Character |

6 |

18 |

23 |

|

Payment Number |

Number |

4 |

24 |

27 |

|

SetID |

Character |

5 |

28 |

32 |

|

Vendor ID |

Character |

10 |

33 |

42 |

|

Reason for One Time Payment |

Character |

1 |

43 |

43 |

|

Amount of One Time Payment |

Signed Decimal |

9.2 |

44 |

54 |

|

Nontaxable Portion of One Time Payment Amount |

Signed Decimal |

9.2 |

55 |

65 |

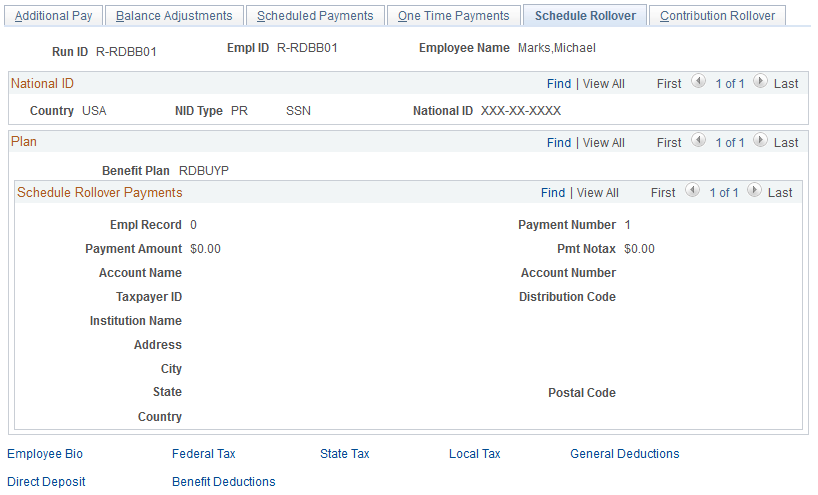

Use the Schedule Rollover page (PA_TE_SCHED_RLOVR) to displays rollover information for a particular RUN ID with regard to scheduled payments.

Navigation:

This example illustrates the fields and controls on the Schedule Rollover page.

Records that contain rollover information from a Payment Schedule or a Manual Schedule have Record Type 82.

|

Scheduled Payment Rollover Data |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Pension Plan |

Character |

6 |

18 |

23 |

|

Payment Number |

Number |

4 |

24 |

27 |

|

Account Name |

Character |

50 |

28 |

77 |

|

Account Number |

Character |

17 |

78 |

94 |

|

Taxpayer ID |

Character |

14 |

95 |

408 |

|

Distribution Code |

Character |

2 |

109 |

110 |

|

Institution Name |

Character |

40 |

111 |

150 |

|

Institution Line Address 1 |

Character |

55 |

151 |

205 |

|

Institution Line Address 2 |

Character |

55 |

206 |

260 |

|

Institution Line Address 3 |

Character |

55 |

261 |

315 |

|

Institution City |

Character |

30 |

316 |

345 |

|

Institution County |

Character |

30 |

346 |

375 |

|

Institution State |

Character |

6 |

376 |

381 |

|

Institution Postal Code |

Character |

12 |

382 |

393 |

|

Institution Country |

Character |

30 |

394 |

423 |

|

Rollover Amount |

Signed Decimal |

9.2 |

424 |

434 |

|

Nontaxable Portion of Rollover Amount |

Signed Decimal |

9.2 |

435 |

445 |

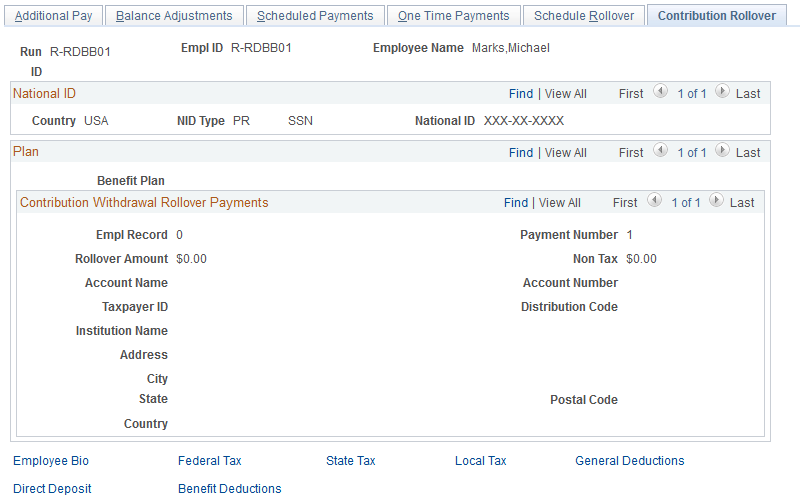

Use the Contribution Rollover page (PA_TE_CTB_RLOVR) to displays rollover information for a particular RUN ID with regard to contribution withdrawals.

Navigation:

This example illustrates the fields and controls on the Contribution Rollover page.

Records that contain rollover information from a Contribution Withdrawal have Record Type 83.

|

Contribution Withdrawal Rollover Data |

Format |

Length |

Beginning Position |

Ending Position |

|---|---|---|---|---|

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Pension Plan |

Character |

6 |

18 |

23 |

|

Payment Number |

Number |

4 |

24 |

27 |

|

Account Name |

Character |

50 |

28 |

77 |

|

Account Number |

Character |

17 |

78 |

94 |

|

Taxpayer ID |

Character |

14 |

95 |

408 |

|

Distribution Code |

Character |

2 |

109 |

110 |

|

Institution Name |

Character |

40 |

111 |

150 |

|

Institution Line Address 1 |

Character |

55 |

151 |

205 |

|

Institution Line Address 2 |

Character |

55 |

206 |

260 |

|

Institution Line Address 3 |

Character |

55 |

261 |

315 |

|

Institution City |

Character |

30 |

316 |

345 |

|

Institution County |

Character |

30 |

346 |

375 |

|

Institution State |

Character |

6 |

376 |

381 |

|

Institution Postal Code |

Character |

12 |

382 |

393 |

|

Institution Country |

Character |

30 |

394 |

423 |

|

Rollover Amount |

Signed Decimal |

9.2 |

424 |

434 |

|

Nontaxable Portion of Rollover Amount |

Signed Decimal |

9.2 |

435 |

445 |

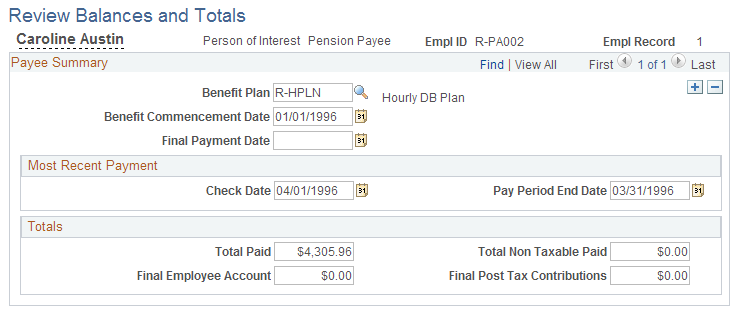

Use the Review Balances and Totals page (PA_RT_EMP_SUM) to:

Track the payment process that automatically updates information under the appropriate payee record number.

View the amount of a retiree's contributions that has been repaid.

Navigation:

This example illustrates the fields and controls on the Review Balances and Totals page.

Note: The payment summary does not adjust running totals based on scheduled balance-only adjustments. When you schedule a balance-only adjustment, you should manually update the payment summary information.

Field or Control |

Description |

|---|---|

Benefit Plan |

The benefit plan is the plan paying the retirement benefits for the specified record number (job number). Remember, a payee has separate jobs for separate plan benefits. |

Benefit Commencement Date |

The benefit commencement date is the effective date of the first active payment record on a payee's payment schedule. This gets set after the first payment. |

Final Payment Date |

The final payment date is the date of the last payment. This is set during the payment period after the last payment. |

Most Recent Payment

The Most Recent Payment group box provides information about the most recently processed pension payment.

Field or Control |

Description |

|---|---|

Check Date |

The check date of the most recently processed pension payment. |

Pay Period End Date |

The pay period end date of the most recently processed pension payment. |

Totals

The Totals group box contains several running totals for the payments.

Field or Control |

Description |

|---|---|

Total Paid |

The total amount paid is the sum of all payments. This amount is updated each time a person is paid. |

Total Non Taxable Paid |

When the total nontaxable amount paid is equal to the final posttax contributions, the system automatically overrides instructions to treat any part of a recurring or one-time payment as nontaxable. You can still, however, make an adjustment to the nontaxable balance with a one-time balance adjustment. If such an adjustment leaves room for additional nontaxable payments, the system once again permits them. The total nontaxable amount paid is the portion of the total paid amount that was treated as nontaxable. This amount is updated each time a person is paid. |

Final Employee Account |

The final employee account amount is the final value of employee contributions (including interest) at the benefit commencement date. This amount includes taxable and nontaxable components. When a payee dies, you can compare this amount to the total paid amount to determine whether the payee recovered the entire value of the account. |

Final Post Tax Contributions |

The Final Post Tax Contributions field provides the nontaxable component of a final employee account. You can use this to track total nontaxable payments. When the total nontaxable amount paid is equal to the final posttax contributions amount, the system automatically overrides instructions to treat any part of a recurring or one-time payment as nontaxable. You can still, however, make an adjustment to a nontaxable balance with a one-time balance adjustment. If such an adjustment leaves room for additional nontaxable payments, the system once again permits them. |

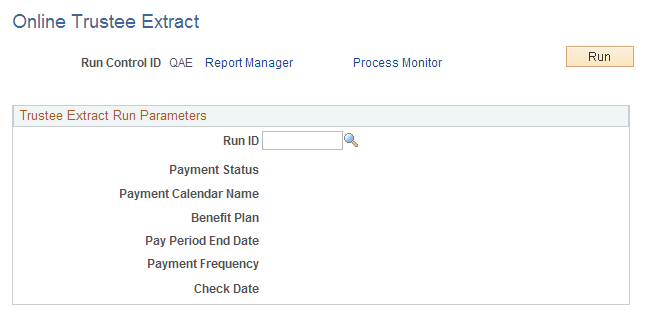

Use the Online Trustee Extract page (RUNCNTL_PMTDTL) to:

Print the details of the information on the Trustee Extract file (PAT08 - Trustee Extract Detailed Report).

List the participants receiving payments from a particular pay run, and provide summary totals for the pay run (PAT09 - Trustee Extract Summary Report - Record Type).

Navigation:

This example illustrates the fields and controls on the Online Trustee Extract page.