Maintaining Pension Beneficiary Data

This topic provides overviews of beneficiary benefits and automatic spousal benefits and discusses how to identify non-spouse pension plan beneficiaries.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_CONT_BENEF_IDS |

Identify non-spouse beneficiaries. For employees whose spouses are their beneficiaries, you do not need to record beneficiary information. When no beneficiary is explicitly recorded, the system assumes that the spouse is the beneficiary. |

Many optional forms of payment for pension benefits include survivor components (that is, a continuing benefit paid to the retiree's beneficiary after the retiree dies). When the payment amount is actuarially reduced, the system bases the reduction on both the retiree's and beneficiary's ages. Therefore, accurate pension calculations depend on the availability of accurate beneficiary data.

Another important benefit for pension beneficiaries is PRSA coverage, which provides a death benefit when a plan participant dies before becoming eligible for retirement.

Certain plans offer an automatic joint and survivor benefit for the spouses of plan participants. A specified percentage of the employee's monthly pension is automatically paid to the surviving spouse after the death of the employee. This benefit is independent of the employee's optional form selection. The employee's optional form selection and any resulting actuarial reduction to the benefit, therefore, apply only to the portion of the benefit that exceeds the automatic spouse benefit.

For example, Plan A specifies an automatic 25 percent benefit. Fred's benefit is 1,000 USD per month as a single life annuity, but, even if he selects a single life annuity, his wife Norma is entitled to 250 USD per month after Fred dies.

Fred can still elect any optional form, but if he chooses a joint and survivor form, the continuation percentage applies only to the 750 USD portion of the benefit that is not already dedicated to Norma. Therefore, if he elects a 50 percent joint and survivor form, the 750 USD is actuarially reduced (for example, to 700 USD), and Fred's benefit is 950 USD. After Fred dies, his joint and survivor beneficiary receives 350 USD per month. This beneficiary might be Norma, but might also be a child, a trust, or another person. If he named Norma as his beneficiary, she receives the 350 USD in addition to the automatic 250 USD, for a total benefit of 600 USD per month.

If the plan rules specify an automatic benefit, the optional forms calculations reflect the benefit.

Use the Dependent/Beneficiary component in PeopleSoft Human Resources to enter beneficiary data.

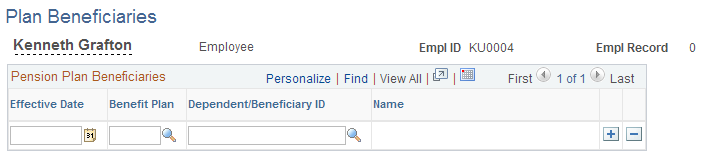

Use the Plan Beneficiaries page (PA_CONT_BENEF_IDS) to identify non-spouse beneficiaries.

For employees whose spouses are their beneficiaries, you do not need to record beneficiary information. When no beneficiary is explicitly recorded, the system assumes that the spouse is the beneficiary.

Navigation:

This example illustrates the fields and controls on the Plan Beneficiaries page.

Employees can have different beneficiaries for different plans. They can also change their beneficiary over time. To enter beneficiary information, enter both an effective date and a benefit plan.

You can enter information only for plans that allow contingent (non-spouse) beneficiaries. If a plan is not available in the list of valid plans, it does not allow contingent beneficiaries.

Specify the dependent or beneficiary ID for the designated beneficiary. Only individuals already added to the employee's dependent or beneficiary list are valid beneficiaries.