Defining Pension Plan Contributions

To define pension plan contributions, use the Pension Plan Table (PENS_PLAN_TABLE_US) component.

This topic provides an overview of pension plan contributions and discusses how to define pension plan contributions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PENS_PLAN_TABLE_US |

Set up the pension plan for which deductions are processed. |

The process of taking pension deductions from employee paychecks is identical to the process used for other benefit deductions such as those for medical or life benefits. After you set up a benefit plan with the appropriate calculation rules, you administer the deduction process using other HCM applications:

Use PeopleSoft HR: Base Benefits or PeopleSoft Benefits Administration to enroll employees in the plan.

It is not enough for a plan to simply exist; you must also sign employees up for pension deductions.

Use PeopleSoft Payroll for North America or PeopleSoft Payroll Interface to calculate and apply the deductions in a particular pay run.

Use the Pension Plan Table page (PENS_PLAN_TABLE_US) to set up the pension plan for which deductions are processed.

Navigation:

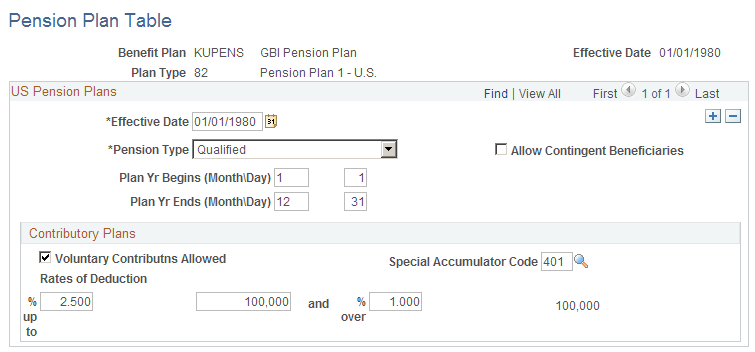

This example illustrates the fields and controls on the Pension Plan Table page.

US Pension Plans

Field or Control |

Description |

|---|---|

Allow Contingent Beneficiaries |

Select if the plan allows non-spouse beneficiaries. |

Plan Yr Begins (Month\Day) (plan year begins [month\day]) and Plan Yr Ends (Month\Day) (plan year ends [month\day]) |

Specify the month and day when the plan year begins and ends. A plan year normally ends the day before the next year begins. However, if you change the plan year, the row for the resulting short plan year will have nonstandard beginning and end dates. Important! Be sure to include a row for a short plan year. Failure to do this can cause calculation errors. |

Contributory Plans

You can only incorporate a U.S. pension plan (plan types 82 to 87) into a manual or automated benefit program if the plan is defined as a contributory plan in which employees contribute some portion of their earnings.

Use this group box to enter information about a contributory plan.

Note: The system makes no determination as to whether the rules that you set up meet Internal Revenue Code qualification standards. Such compliance is your responsibility.

Field or Control |

Description |

|---|---|

Voluntary Contributns Allowed (voluntary contributions allowed) |

Select this option if the plan allows voluntary contributions. There are no parameters for defining voluntary contribution rates. These are established on an employee-by-employee basis when you enroll employees in the plan. |

Special Accumulator Code |

Select the code that tracks pensionable earnings. |

Rates of Deduction |

Enter the contribution rates. You can have different rates above and below a threshold. For example, employees can contribute 2 percent of earnings up to 50,000 USD and 3 percent of earnings above that. Enter the rate up to the threshold in the first Rates of Deduction field, the threshold in the next field, and the rate beyond the threshold in the final field. If the threshold changes—for example, if you use the taxable wage base as the threshold—insert additional effective-dated rows to record the changes. |