Creating the Trustee Extract File

This topic provides overviews of the Trustee Extract process and the Trustee Extract file and discusses how to generate the Trustee Extract file.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_PAPP02 |

Run the Trustee Extract process. The Retiree Payment process automatically runs the Trustee Extract process. You select Pension, Payments, Create Retiree Payments to run the Retiree Payment process. |

|

|

RUNCNTL_RO_DETAIL |

Enter run control parameters for the Payment Rollover Report. |

The Retiree Payment process includes the Trustee Extract process.

The Trustee Extract process generates the Trustee Extract file, which includes all of the payment-related data that a third-party requires in order to produce pension checks.

The system creates the Trustee Extract file when you run the Retiree Payment process in Confirmation Processing mode. It writes the data to the file that you define using the system variable TRSPYMT.

Note: The trustee extract data is also written to database records so that you can review it online; however, the online data is not the primary file. The Trustee Extract file is the output that you send to your trustee.

You can also produce the Trustee Extract file outside of the Retiree Payment process. You only do this in unusual circumstances—for example, if you lose or damage the original version created by the payment process.

When you create the extract file outside of the payment process, you still must have run the payment process in order to generate the data that is fed into the extract process. Although it is possible to create a file after preliminary payment processing, it is advisable to create it only after running confirmation processing for the retiree payments.

The Trustee Extract file includes the following types of payment-related data: payment data, tax elections, direct deposit instructions, and deduction data.

Payment Data

Payment data is only available after you run the Retiree Payment process in Confirmation Processing mode. The process creates this information using the payment schedules that you set up, both for recurring payments and one-time payments or adjustments.

Tax Elections

You must record payee tax elections in the system prior to paying retirement benefits. There are no default elections.

If federal, state, or local tax information is missing, the Trustee Extract process logs a warning message.

Direct Deposit Instructions

Direct deposit instructions are not required. If you have entered the direct deposit information, the Trustee Extract process includes it in the extract file.

Note: There is no warning message when direct deposit information is missing.

Deduction Data

There are two ways that you can set up deduction information if you want to include it in the Trustee Extract file:

Set up a general deduction in PeopleSoft Payroll for North America.

If you specify a deduction calculation routine that uses a flat amount, there is no need to calculate the deduction each period.

If you set up the deduction to use a percentage, the Trustee Extract process can pass that percentage to the trustee, who can then calculate the appropriate deduction amount.

If you use any other calculation routine, you must use Payroll Interface's DedCalc (deduction calculation) process to compute the deduction amount.

Enroll the payee in one or more benefit plans through the PeopleSoft HR: Manage Base Benefits or PeopleSoft Benefits Administration. This always requires that you use the DedCalc process to compute the deduction amount.

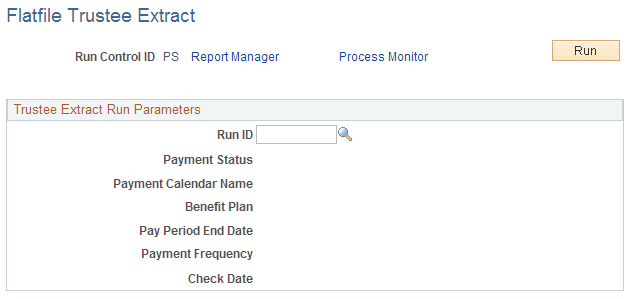

Use the Flatfile Trustee Extract page (RUNCTL_PAPP02) to run the Trustee Extract process.

Navigation:

This example illustrates the fields and controls on the Flatfile Trustee Extract page.

Field or Control |

Description |

|---|---|

Run ID |

Select the run ID for the Retiree Payment process job that created the trustee extra data. The system then displays information associated with that run ID: the payment status, payment calendar name, benefit plan, pay period end date, payment frequency, and check date. |

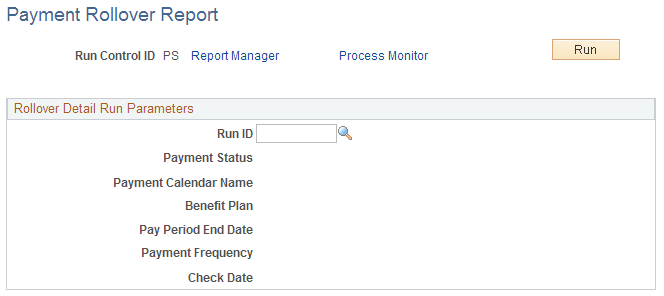

Use the Payment Rollover Report page (RUNCNTL_RO_DETAIL) to enter run control parameters for the Payment Rollover Report.

Navigation:

This example illustrates the fields and controls on the Payment Rollover Report page.

Field or Control |

Description |

|---|---|

Run ID, Payment Status, Payment Calendar Name, Benefit Plan, Pay Period End Date, Payment Frequency and Check Date. |

These fields provide summary information about the pay run that is the basis for the extract. The run ID determines the payment status, payment calendar name, benefit plan, pay period end date, payment frequency and check date. |