Creating an Optional Forms of Payment Definition

To create a definition for an optional form of payment, use the Optional Forms (OPTIONAL_FORMS) component.

This topic discusses how to create an optional form of payment definition.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_OPT_FORMS1 |

Describe an entire form set. |

|

|

PA_OPT_FORMS2 |

|

|

|

PA_OPT_FORMS3 |

Enter additional information about lump sum forms. |

|

|

PA_OPT_FORMS4 |

|

|

|

PA_OPT_FORMS5 |

Enter additional information about level income option (LIO) forms. |

Use the General Parameters page (PA_OPT_FORMS1) to describe an entire form set.

Navigation:

This example illustrates the fields and controls on the General Parameters page.

If a single optional forms of payment function result contains multiple definitions, be sure that all the definitions:

Use the same benefit formula name, employee age option, and beneficiary age settings

Are treated the same for 415 processing.

Normally, you calculate optional forms of payment as of different dates by running multiple calculations with different benefit commencement dates. However, you can also set up multiple optional forms of payment function results so that a single calculation produces optional forms of payment for multiple dates. For example, you could create one optional form of payment function result based on event date and another based on benefit commencement date.

Field or Control |

Description |

|---|---|

Benefit Formula Name |

Enter the name of the benefit formula function result. Each set of optional forms is linked to a single benefit formula. |

Use Formset in 415 Processing |

Select this option if the benefit is subject to 415 limits, and enter the name of your 415 limits rule. The 415 function applies Internal Revenue Code limits across plans, using results from optional forms processing as its benefit information source. |

Bypass This Set If Custom Statement is True and Custom Statement |

Select this option to bypass this formset under specified conditions, then enter the custom statement that defines those conditions. For example, you can bypass a set of early retirement optional forms if the employee is not eligible for early retirement. |

Employee Age Option

Each set of forms is based on a particular benefit commencement date. This date is important when determining actuarially equivalent payment forms.

Field or Control |

Description |

|---|---|

Use Benefit Commencement Age and Use Lump Sum Age |

These values come from the calculation page, where the plan administrator can enter appropriate values at the time the calculation runs. |

Use Other Age and Employee Age Alias |

To use any other age, select the Use Other Age options and enter the alias that provides the age.` |

Beneficiaries

Field or Control |

Description |

|---|---|

Beneficiary Age |

Always use a duration alias to produce the age. The duration should be from the beneficiary's date of birth (the delivered BENEF_DOB alias) to the date that you use for the employee's age. Note: Using the BENEF_DOB alias is preferable to using an alias for the spouse's birth date because BENEF_DOB can find both spouse and non-spouse beneficiary birth dates. |

Allow Contingent Beneficiaries if Plan Allows |

Select this option if the plan allows non-spouse beneficiaries. Selecting this option makes the Spouse J&S Demonstration optional form type available within this definition. This form type calculates a joint and survivor benefit, but bases the calculation on the spouse's age rather than the non-spouse beneficiary's age. This shows how much the spouse is forfeiting when a retiree selects a non-spouse beneficiary. |

Non-Taxable Amount Calculation

If an employee has been contributing after-tax money toward a pension, a portion of the final benefit is treated as nontaxable until the employee has recovered the after-tax contributions. For lump sum payments, this is the entire cost basis—that is, the accumulated value of all the employee's after-tax contributions. For other forms of payments, the cost basis must be divided by a divisor to spread the cost basis over the expected number of monthly payments.

For example, a retiree with a cost basis of 2,600 USD and a divisor of 260 would recover the 2,600 USD over 260 monthly payments. This means that 10 USD of the retiree's monthly benefit would be nontaxable for the first 260 months that the retiree was receiving benefits. After the 260 months, the retiree's gross monthly pension benefit would still be the same, but all of it would be taxed.

Field or Control |

Description |

|---|---|

Simplified Calculation |

If you select this option, the system uses the simplified method (as published in IRS Notice 98-2) to calculate the appropriate nontaxable portion of the benefit. As part of this calculation, the system verifies that the method is applicable. If the method is not applicable, the system calls the Optional Forms User Code module. Note: If you use the system's simplified method calculation, you must implement user code to handle situations where the simplified method is not applicable. The system determines whether the simplified method is applicable and generates a message when it is not. |

User Code |

If you select this option, your own user code is used to perform this calculation. |

No Calculation |

If you select this option, the system does not perform the nontaxable benefit calculation. |

Simplified Method Calculations

When the simplified method is applicable, there are different rules for lump sums, certain only payments, and annuities.

For lump sum payments, all the nontaxable money is paid out at once. For example, Penelope's total after-tax contributions (her cost basis) is 9,000 USD. If she takes a lump sum payment, the nontaxable portion is 9,000 USD.

For certain only payments, the divisor is the same as the number of guaranteed payments. So if Penelope were to choose a five year certain form of payment, she would receive her benefit over 60 monthly payments. Each month, 150 USD of her benefit (1/60 of her cost basis of 9,000 USD) would be considered nontaxable.

For annuity forms of payment, the divisor is based on the age (or ages) of the people receiving benefits:

If the benefit is payable to the retiree only or a single beneficiary (because the retiree has died before the benefit commencement date), the divisor is based on that one person's age.

If the benefit is payable to the retiree and one or more beneficiaries, the divisor is based on the sum of the ages of the retiree and the youngest beneficiary.

If the benefit is payable to multiple beneficiaries but not to the retiree (because the retiree dies before the benefit commencement date), the divisor is based on the sum of the ages of the oldest and youngest beneficiaries.

Note: Pension Administration handles a maximum of two beneficiaries: the spouse and a single non-spouse beneficiary.

When the divisor is based on a single person's life, the system finds the divisor based on the following table:

|

Single Age |

Expected Number of Monthly Payments |

|---|---|

|

55 and under |

360 |

|

56 to 60 |

310 |

|

61 to 65 |

260 |

|

66 to 70 |

210 |

|

71 and over |

160 |

For example, assume that Penelope starts receiving benefits at age 63 and she has no beneficiaries. Applying her divisor of 260 to her cost basis of 9,000 USD, you find that 34.62 USD of her benefit is nontaxable for the first 260 payments.

When the divisor is based on multiple people's lives, the system finds the divisor based on the following table:

|

Combined Ages |

Expected Number of Monthly Payments |

|---|---|

|

110 and under |

410 |

|

111 to 120 |

360 |

|

121 to 130 |

310 |

|

131 to 140 |

260 |

|

141 and over |

210 |

|

71 and over |

160 |

For example, assume that Penelope's husband, Jordan, is her beneficiary. She starts receiving benefits when she is 63 and Jordan is 65. Their combined age of 128 gives a divisor of 310. When this is applied to her cost basis of 9,000 USD, 29.03 USD of the benefit is nontaxable for the first 310 payments. This amount is the same whether Penelope or Jordan is receiving the benefit.

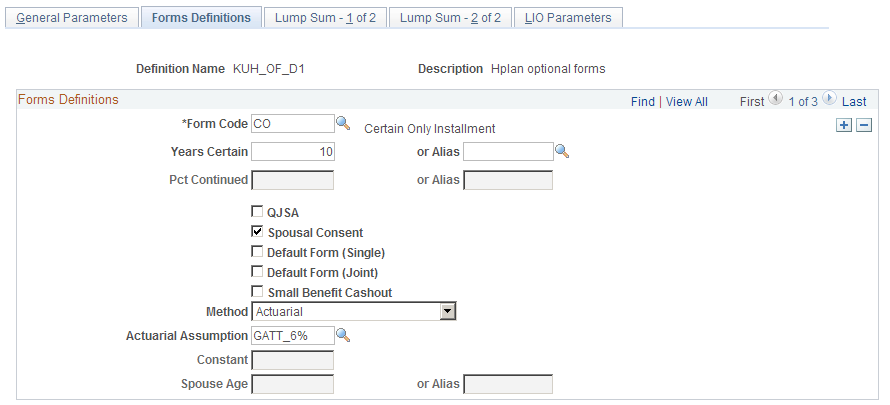

Use the Forms Definitions page (PA_OPT_FORMS2) to:

Add options to an option set, being sure to include your normal form.

Define the conversion method and other characteristics of each option.

Navigation:

This example illustrates the fields and controls on the Forms Definitions page.

Forms Definitions

Field or Control |

Description |

|---|---|

Form Code |

Select one of these values: Certain Only Installment, Joint & Survivor Annuity, Life Annuity, Level Income Option, Last to Survive Annuity, Lump Sum, Pop Up Annuity, Reversionary Annuity, or Spouse Demonstration JS. Select Spouse Demonstration JS only if you indicate that contingent beneficiaries are allowed. Certain forms require you to set additional parameters. Note: Each form must have a unique combination of values in the Form Code, Years Certain, and Pct Continued fields. Because lump sums never use a years certain or percent continued value, you can only create one lump sum form per form set. See Using Form Codes. |

Years Certain |

If you select the form code Certain Only Installment or you want to specify a guaranteed number of payments for any of the annuity options, enter the number of years certain. |

Pct Continued (percent continued) |

If the option includes a survivor benefit—for example, a joint and survivor annuity or a last to survive annuity—enter a value to indicate the survivor's continuing percentage of the original annuity. For level income options, which have both pre- and post-social security retirement age (SSRA) amounts, any value here is applied to the post-SSRA amount. |

QJSA (qualified joint and survivor) |

Select this option to indicate a qualified joint and survivor option. This setting is informational only. The system does not check that the option is qualified. |

Spousal Consent |

Select this option to indicate that a form requires spousal consent. This setting is informational only. The system does not determine whether a form requires spousal consent, or check that spousal consent has been received before making payments. |

Default Form (Single) and Default Form (Joint) |

Select one of these options to indicate the default form. Each optional form set has two default forms, one form for single participants and one for married participants. The default form is the form of payment the retiree will receive if no election is made. This differs from the normal form, which refers to the form of payment prior to the application of optional forms of payment factors. |

Small Benefit Cashout |

Many form sets include a lump sum form that is used only for small benefit cashouts. That is, the plan requires that benefits with a lump sum value under a specified amount must be paid in the form of a lump sum. If you create such a form, select this option. If the value is too large, the form will appear with no value on the calculation results pages or the calculation worksheet. If the value is under the threshold, however, this will be the only form available. You set the threshold value on the Lump Sum - 1 of 2 page. |

For 415 Only (Only visible for an SLA form) |

The 415 limits function, which applies Internal Revenue Code limits across multiple plans, uses the optional forms of payment results as the source of its benefit information. Because the 415 limits function needs to know the single life annuity value of the benefit, any optional form set subject to 415 limits must include this form. If you do not offer an SLA option to participants (for example, if the normal form is five year certain and continuous), you still create an SLA, but you indicate that the SLA option is for 415 processing only by selecting For 415 Only. This prevents the form from appearing in the calculation results. |

Method |

For each form in the set, select a method for determining the conversion factor: Actuarial, Constant, Custom Statement, Table Use, or User Code. Note: The table lookup, custom statement and constant methods produce an adjustment factor. They do not calculate the actual value of the form. The optional forms of payment calculation applies the factor to find the value. Because a level income option has two values, it has a special method for applying the factor. The factor is applied to the social security amount, and the result is added to the normal benefit amount to determine the pre-SSRA value. The post-SSRA value is the pre-SSRA amount less the social security amount. If you enter a value in the Pct Continued field for the level income option, the factor is still used as described to calculate the pre-SSRA amount, but the system uses its own algorithm (described with the LIO Parameters page) to calculate the post-SSRA amount and the survivor benefit. See LIO Parameters Page. |

Actuarial Assumption, Custom Statement, Table Lookup, or Constant |

Provide additional parameters for your selected method. The fields that appear on the page vary depending on which method you selected.

|

Spouse Age or or Alias |

If you select Actuarial as the method for a spouse joint and survivor demonstration optional form, use one of these fields to indicate the spouse's age. |

User Parameters Returned

Field or Control |

Description |

|---|---|

Factor and Frequency or Amount, Factor, and Frequency |

If your method is User Code, choose one of these options to indicate what parameters your user code returns. |

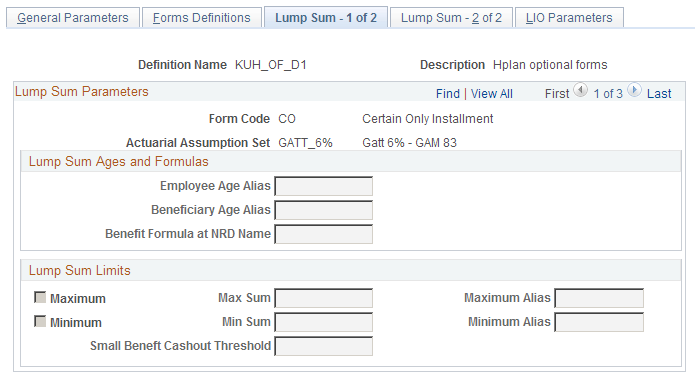

Use the Lump Sum - 1 of 2 page (PA_OPT_FORMS3) to enter additional information about lump sum forms, including alternative employee ages and any minimums, maximums, or small benefit cashout thresholds. Scroll through the forms you have created; the fields here are only available for lump sums.

Navigation:

This example illustrates the fields and controls on the Lump Sum - 1 of 2 page.

Lump Sum Ages and Formulas

If you use an actuarial method to find the lump sum value, the system needs to know the date when the lump sum is payable. And although this documentation says that all forms in the set apply at the same date, lump sum forms present a possible exception.

You can enter a lump sum date override, typically based on the lump sum date entered into the calculation page when the calculation is run. For example, for small benefit cashouts, the lump sum is paid out upon termination rather than on a retirement date twenty years in the future.

Field or Control |

Description |

|---|---|

Employee Age Alias, Beneficiary Age Alias, and Benefit Formula at NRD Name (benefit formula at normal retirement date name) |

These options are the same as those on the General Parameters page, but the values that you enter here override the others for this form only. By entering overrides, you save yourself from having to set up a separate optional forms of payment function result for the other date or from having to run a separate calculation to get the lump sum value on a different date. These fields are only available for lump sums calculated with an actuarial method. |

Lump Sum Limits

Field or Control |

Description |

|---|---|

Maximum and Minimum |

Set minimum and maximum values for the lump sum by selecting either or both of the check boxes and entering the limits, either as constants or aliases. If the lump sum falls outside the range, the system still offers the form, but it adjusts the value to within the limits. |

Small Benefit Cashout Threshold |

On the Forms Definitions page, you can specify whether the lump sum is a small benefit cashout. That is, the plan requires that benefits with a lump sum value under a specified amount must be paid in the form of a lump sum. For such forms, indicate the threshold amount—typically 5,000 USD for plan years starting after August 1997. |

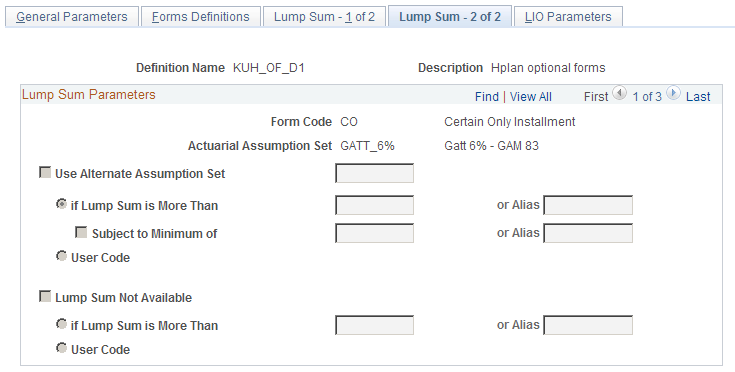

Use the Lump Sum - 2 of 2 page (PA_OPT_FORMS4) to:

Establish alternative lump sum actuarial assumptions.

Set a threshold above which the lump sum is not offered.

Navigation:

This example illustrates the fields and controls on the Lump Sum - 2 of 2 page.

Lump Sum Parameters

Select one of these options:

Field or Control |

Description |

|---|---|

Use Alternate Assumption Set |

For qualified plans, there are government regulations regarding the conversion method used for lump sums over 25,000 USD. If your actuarial conversion method does not already use acceptable assumptions, you can specify that it should in cases where the lump sum value exceeds the threshold. To activate this option, select this check box, and enter the name of the alternate assumption in the text box. Also select one of these options:

|

Lump Sum Not Available |

Select this option to make the lump sum option unavailable if it is above a specified threshold value. Also select one of these options:

|

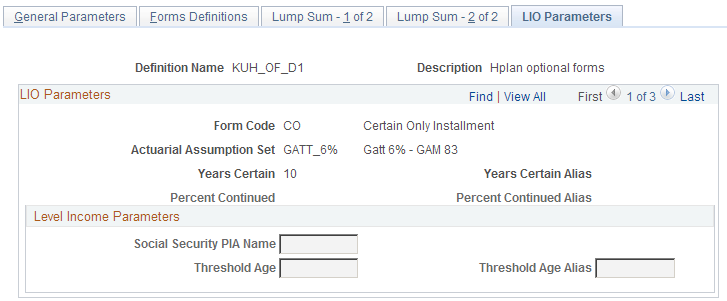

Use the LIO Parameters page (PA_OPT_FORMS5) to enter additional information about level income option (LIO) forms.

Navigation:

This example illustrates the fields and controls on the LIO Parameters page.

Level Income Parameters

Field or Control |

Description |

|---|---|

Social Security PIA Name (social security primary insurance amount name) |

A level income option attempts to make the combination of pension and social security benefits equal both before and after social security benefits begin by providing an increased benefit before social security retirement age and a decreased benefit afterwards. Indicate the social security function result that provides the estimated monthly social security benefit. |

Threshold Age or Or Alias |

To adjust the benefit at the appropriate time, the system also needs to know the threshold age at which the social security benefit is assumed to begin. Enter either a constant age or an alias. The level income option is not available to employees older than the threshold age, and therefore does not appear in the calculation results for such employees. There is a system-delivered alias, SSRA_DT, that provides an employee's social security retirement date. To create a duration alias for the SSRA, use the employee's birth date (the delivered BIRTH_DT alias) and SSRA_DT as the duration endpoints. |

Calculations for Level Income Option Survivor Benefits

The system calculates the value of n percent continued level income option as follows:

The level income option is calculated as if it were a single life LIO, disregarding the percent continued aspect. This calculation uses the method you specified in the form definitions: actuarial, table lookup, custom statement, constant, or user code.

The employee's pre-SSRA amount is offset by the difference between a single life annuity and an n percent joint and survivor (J&S) benefit. The employee's post-SSRA amount is the difference between this pre-SSRA amount and the social security benefit.

The beneficiary amount is n percent of the employee's single life annuity benefit. There are no separate pre-SSRA and post-SSRA amounts for the beneficiary.

For example:

|

Form |

Employee |

Beneficiary |

Comments |

|---|---|---|---|

|

Single life annuity |

1,000 USD |

NA |

NA |

|

50 percent J&S (assume cost is 10 percent) |

900 USD |

450 USD |

Cost of the J&S is 100 USD. |

|

Single life LIO |

1,750 USD pre-SSRA and 750 USD post-SSRA |

NA |

The assumed social security benefit is 1,000 USD. |

|

50 percent J&S LIO |

1,650 USD pre-SSRA and 650 USD post-SSRA |

450 USD |

|

These figures are obtained through the following calculation steps:

Calculate employee's LIO benefits without considering J&S component: Employee pre-SSRA = 1,750 USD. Employee post-SSRA = 750 USD.

Compare single life annuity to 50 percent J&S to find the dollar cost of the J&S: 1,000 USD - 900 USD = 100 USD.

Offset employee's pre-SSRA benefit by the J&S reduction. The new pre-SSRA amount is: 1,750 USD - 100 USD = 1,650 USD. The new post-SSRA amount is calculated by subtracting the PIA amount from the new pre-SSRA amount: 1,650 USD - 1,000 USD = 650 USD.

Beneficiary amount = 50 percent times employee J&S benefit amount: 50 percent x 900 USD = 450 USD.

Note: In order to perform an n percent J&S LIO calculation, the optional form set must also include a single life annuity, an n percent J&S, and a single life LIO.