Consolidating Contributions

To consolidate contributions, use the Contributions Consolidation (CONTRIBUTIONS) component.

This topic provides an overview of contributions consolidation and discusses how to configure rules for consolidating contributions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_CONS_DED_PARMS |

Produce annual or monthly totals of consolidated contributions. |

When employees contribute toward their pensions, you need to keep track of the amounts they contribute. Because contributions are deducted from employee paychecks, contributions are recorded in the payroll system. Use the Contributions Consolidation page to gather this information and produce annual or monthly totals. The Employee Accounts function can then use this consolidated data to keep track of total contributions and interest.

Use the Contributions Consolidation page (PA_CONS_DED_PARMS) to produce annual or monthly totals of consolidated contributions.

Navigation:

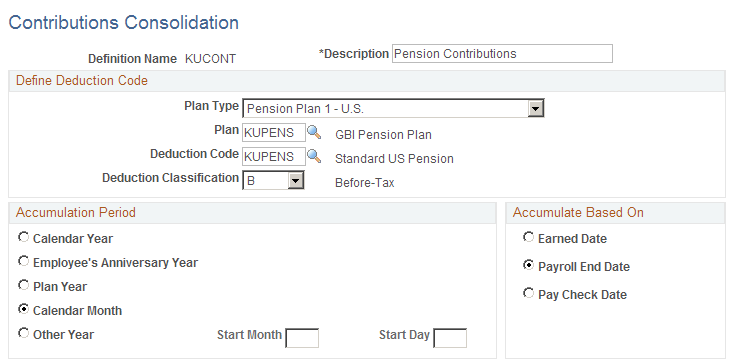

This example illustrates the fields and controls on the Contributions Consolidation page.

Defining Deduction Code

Field or Control |

Description |

|---|---|

Plan Type and Plan |

Enter the plan type and plan under which you set up the deduction. For regular pension deductions, you use plan types 82-89 and 8A-8Z. When you set up consolidations to track service buyback or service purchase payments, you use a "general" deduction rather than a plan-specific deduction. In that case, the plan type is 00 - General, and you do not enter a plan. |

Deduction Code |

Enter the code that is used to identify payroll deductions. The deduction code must already exist and must already be associated with the indicated plan on the Benefit Plan table. |

Deduction Classification |

Enter a value that indicates whether the deduction is after-tax or before-tax. If you have both before- and after-tax contributions, create separate consolidated contributions definitions (and function results) for each. |

Accumulation Period

Field or Control |

Description |

|---|---|

Accumulation Period |

Consolidated contributions are subtotaled by accumulation period. Use one of the following options to indicate the type of accumulation period: Calendar Year, Employee's Anniversary Year, Plan Year, Calendar Month, orOther Year. This accumulation period must align with the accumulation period for the Employee Accounts definition where you use your consolidated hours. Because the service definition does not support the Employee's Anniversary Year and Other Year options, do not use these options unless you make modifications. |

Start Month/Day |

If you select Other Year, you also need to specify the Start Month and Start Day of that year. Use a number (1-12) to represent the month. |

Accumulate Based On

Because contribution data comes from payroll, you need to align your payroll dates with your consolidation periods. Select the period into which earnings fall into by selecting an Accumulate Based On option.

Field or Control |

Description |

|---|---|

Earned Date |

Select this option to divide total contributions for the pay period evenly among days in the period to produce daily contribution amounts. For example, a contribution deducted from a paycheck that covers the one-week period June 26–July 2 includes pay from both June and July. It is prorated so that 5/7 of the earnings falls in the June period and 2/7 of the earnings falls in July. Note: Proration by day always includes all days in a consolidation period, not just work days. |

Payroll End Date |

Select this option to put contributions into the period containing the last day of the pay period. |

Pay Check Date |

Select this option to put contributions into the period containing the date printed on the paycheck. |