Administering the QDRO Process

This topic provides an overview of the QDRO administration process and discusses how to administer QDROs.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_DRO_SPEC |

Record receipt of a DRO and record DRO activities up to the point when the DRO is determined to be qualified. |

|

|

PA_QDRO_SPEC |

Record the amount awarded to the alternate payee. This amount is crucial because it is the basis for the QDRO payments. |

Use the Create DRO page and the Administer QDRO page to record information related to a QDRO.

Additionally, you will need to perform these steps as you administer a QDRO :

Create an alternate payee record.

Calculate an alternate payee’s benefit.

Pay the QDRO alternate payee.

Creating Alternate Payee Records

If it is determined that a DRO is qualified, you track the QDRO information under the IDs of both the employee who earned the benefit and the QDRO alternate payee. This means that the alternate payee needs a personal data record.

Eventually, you also need to create a job record for the QDRO alternate payee so that you can perform QDRO calculations and make QDRO payments.

Note: You must establish an EmplID for the alternate payee before you can record any QDRO information.

If the alternate payee is also an employee of the company, you use the Create Payee page to set up a payee record using his current EmplID as the Payee ID. Someone who is an alternate payee for two employees requires two separate payee records, one for each QDRO. Each of those payee records uses the same EmplID

For example, Jane, who is an employee of your organization, gets divorced from her husband Jack. A payee record is created for Jack. Jack becomes a QDRO alternate payee, with EmplID 902. Jack then marries another employee, Daisy, and they also get a divorce. A second payee record is created for Jack using the alternate payee EmplID 902, and this payee record reflects his association with Daisy.

An alternate payee who will receive benefits from multiple plans (based on benefits earned by one employee) will use the same EmplID for both plans. However, you have to create separate job records for the separate plans.

Calculating an Alternate Payee's Benefit

After setting up an EmplID for a QDRO alternate payee, you can run calculations.

Your plan rules should include parameters that check the payee type and skip functions irrelevant to QDRO alternate payees when necessary. For example, you do not need to calculate service, average earnings, or other pension components that are only relevant to employees. Nor is it necessary to calculate the unreduced benefit amount because that is stored in the database and shown on the Administer QDRO page. Typically, you only run the early and late retirement factors, the reduced benefit (QDRO amount times early retirement factors), and the optional forms of payment.

Warning! QDRO calculations only work as described if your company sets up QDRO-specific calculation rules so that irrelevant processes are skipped and relevant processes are calculated correctly for QDRO alternate payees. Early and late retirement factors, in particular, need careful setup if the plan rules require that early retirement reductions be calculated using the original employee's age instead of the alternate payee's age.

Paying QDRO Alternate Payees

After you enter an alternate payee into Pension Administration and run a calculation, you pay the alternate payee just as you would pay a retiree.

The only difference is that you do not have to set up a retiree "job" separate from the original working job because there is no working job to begin with. If an alternate payee receives benefits from multiple plans, however, you need to set up a separate job for each plan.

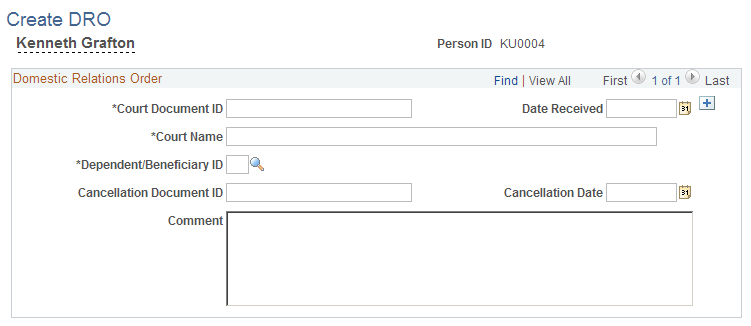

Use the Create DRO page (PA_DRO_SPEC) to:

Record receipt of a DRO.

Record DRO activities up to the point when the DRO is determined to be qualified.

Navigation:

This example illustrates the fields and controls on the Create DRO page.

When you first learn of an impending QDRO, the court order is not yet qualified, so you are actually dealing with a DRO, not a QDRO. During the process of qualifying the DRO, you will probably be in regular communication with the attorneys for the parties.

You can create a DRO only for an employee.

Field or Control |

Description |

|---|---|

Court Document ID |

Enter the identification (ID) number of the DRO. |

Date Received |

Enter the date when you first receive the court documents. |

Court Name |

Enter the name of the court issuing the DRO. |

Dependent/Beneficiary ID |

Select the ID of the former dependent or beneficiary on whose behalf the DRO has been issued. This individual (typically a former spouse) must be recorded in the PeopleSoft system as a dependent or beneficiary. |

Comment |

Enter any comments. Record ongoing activity by appending additional comments (appropriately dated) in this field. |

Cancellation Document ID and Cancellation Date |

If it is determined that the DRO is not qualified, enter the cancellation document ID number and cancellation date. |

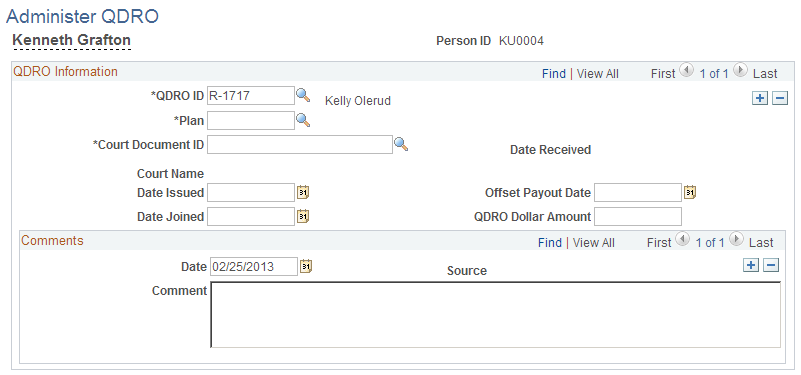

Use the Administer QDRO page (PA_QDRO_SPEC) to record the amount awarded to the alternate payee.

This amount is crucial because it is the basis for the QDRO payments.

Navigation:

This example illustrates the fields and controls on the Administer QDRO page.

Before you can enter information on this page, you must use the Create DRO page to input the DRO. You must also set up the QDRO alternate payee's EmplID.

Note: You cannot access the QDRO pages until you set up the QDRO alternate payee's EmplID.

Field or Control |

Description |

|---|---|

QDRO ID |

Select the alternate payee's employee ID. |

Plan |

Select the employee's pension plan. |

Court Document ID |

Enter the court document ID that you entered on the DRO page. When you enter the court document ID for the DRO information, the system automatically transfers the following fields from the DRO page: Date Received, Court Name, Comments, and Date (comment date). |

Date Issued |

Enter the date the QDRO was issued. |

Date Joined |

Enter the date of the court order itself. |

Offset Payout Date |

Enter the earliest date at which the QDRO alternate payee can begin receiving the benefit. Note: If the QDRO alternate payee begins receiving payments earlier than the participant's normal retirement date, the QDRO dollar amount entered on this page (which is the amount as of the participant's normal retirement date) may be reduced. |

QDRO Dollar Amount |

Enter the amount that the QDRO alternate payee will receive. This amount must be expressed in the same terms as the normal plan retirement date with a normal form of payment. For example, John's benefit of 200 USD is his benefit as of the date Caroline reaches normal retirement age, assuming a single life annuity and monthly payments. If the HPLAN normal benefit amount is expressed yearly, enter the yearly benefit, 6,840 USD. Note: The implied payment form, frequency, and commencement date are important because this is the amount which is taken from the employee's final benefit. If you enter a monthly amount here, and the benefit formula subtracts this amount from Jane's yearly benefit, the offset calculation would be incorrect. |