Tracking Assignment Compensation and Currency Fluctuation

This topic discusses how to track assignment compensation.

Warning! The Global Assignment Compensation page isn't linked to payroll processing in Payroll for North America.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ASSGNMT_EARNS_DED |

Enter supplemental earnings and deductions that the home location pays, such as hardship premiums and relocation costs, or that an employee receives from the host location, such as foreign housing or rent. |

Use the Global Assignment Compensation page (ASSGNMT_EARNS_DED) to enter supplemental earnings and deductions that the home location pays, such as hardship premiums and relocation costs, or that an employee receives from the host location, such as foreign housing or rent.

Navigation:

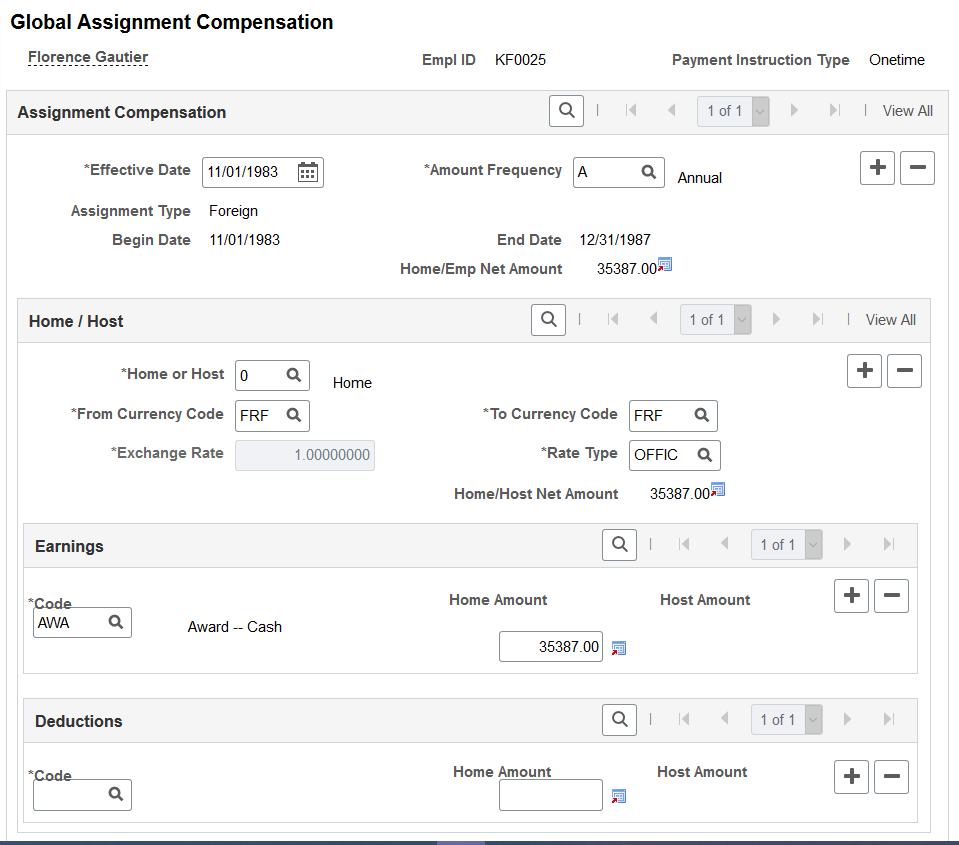

This example illustrates the fields and controls on the Global Assignment Compensation page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Amount Frequency |

Enter the amount of compensation frequency from the values that are in the Frequency table. Values are Annual, Hourly, or Monthly. All the amounts that you specify for both earnings and deductions must be for the frequency that you select in this field. |

Assignment Type |

Displays the assignment type, which is based on the effective date that is entered on this page. If no information appears, then the information that you enter takes effect after the end date that you enter in the Assignment Data component. A warning message appears. If you make a onetime payment that occurs after the end date of the assignment, ignore the message. Otherwise, to see assignment data, adjust either the effective date here or the end date in the Assignment Data component. |

Home or Host |

Enter the employee record numbers that correspond to the home or host records. Generally, enter 0 for the home record and1 for the host record. |

From Currency Code and To Currency Code |

If assignment data exists, in the From Currency Code field, view the currency for the country that is designated in the employee's home data. View the home currency in theTo Currency Code field. The system automatically populates these fields. Override these default values by selecting another currency code from the Currency Code table. |

Exchange Rate |

Displays the exchange rate type. The rate that is specified in the Installation table appears by default. |

Rate Type |

Displays the rate type. The rate type that is specified in the Installation table appears by default. You can override this default value. |

Code |

Enter a code that denotes additional earnings that are charged to the home location. Create these codes in the Earnings table. |

Base Compensation |

Displays the amount that the employee earns at the home location, which you specify in Job Data Compensation. |

Home Amount |

Enter the home amount. Because you are entering information about home data, the Host Amount field doesn't appear. |

Base Compensation |

Displays the amount that the employee earns at the home location, which you specify on the Job Data - Payroll page. |

Code |

Enter a code from the Deductions table that denotes deductions that should be taken from the employee compensation that you specify for the home location. |

Home Amount |

Enter the home amount for the deduction code. The net earnings and deductions that are specified for the home location appear. The Home/Host Net Amount field displays the net amount of all supplemental earnings and deductions for both home and host. Both amounts appear in the home currency. Because you are entering information that is related to home data, the Host Amount field doesn't appear. |