Organizing Your Payroll Processes

To organize your payroll process, use the Pay Group Table (PAYGROUP_TABLE1), The Pay Run Table (PAY_RUN_TABLE), and the Pay Calendar Table (PAY_CALENDAR_TABLE) components.

This topic provides an overview of pay groups and the pay group setup.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BANK_EC |

Identify every bank and savings institution where your company has accounts established for payroll purposes, with the exception of employee's direct deposit accounts. |

|

|

BANK_BRANCH_EC |

Identify bank branches for your company. |

|

|

ACCT_CD_TABLE |

Assign unique account codes that you can reference in your payroll system and track the distribution of your organization's payments and expenses against budgeted accounts. If you plan to implement extensive account reporting, this table may be large. |

|

|

HOLIDAY_SCHED_TBL |

Define a list of scheduled holidays that can be used on the Pay Group table. Holiday schedules that you set up through either navigation can be passed on to a third-party payroll system. Do not include personal floating holidays on this list. Because holidays may vary for different segments of your employee population, depending on location, work schedules, or other factors, you can set up as many holiday schedules on this table as needed. |

|

|

PAYGROUP_TABLE1 |

Create and maintain pay groups. |

|

|

PAYGROUP_TBL3_GBL |

Enter additional pay group processing parameters, including the bank and account, net pay minimums and maximums, and valid earnings codes. When you first add a pay group, a dialog box prompts you for a company ID and pay group ID. The company ID is a key field on the Pay Group table, implying that all employees in a pay group are also in the same company. For the pay group ID, use any three-character alphanumeric ID that conforms to your payroll system standards. |

|

|

PAY_RUN_TABLE_NLD |

Set up the pay run IDs that you use to combine pay calendar entries from different pay groups for payroll processing. The Pay Run Table page and procedures for establishing pay run IDs are the same for several other PeopleSoft payroll applications. |

|

|

PAY_CAL_TBL_NLD |

Schedule payroll cycles for your pay groups and specify when pay periods begin and end. You must have a calendar entry for every pay period for each pay group that you set up. Each entry on the Pay Calendar Table page corresponds to a specific pay period for a pay group, defined by the begin and end dates. For example, a monthly pay group would have 12 entries on the Pay Calendar Table page, representing a year of processing. |

When you implement Human Resources, one of the major decisions is which pay groups to set up. A pay group gathers a set of employees for payroll processing. Your HR system provides an SQR, the Pay Groups report, so that you can review an overview of the valid pay groups in the system.

Before grouping people into pay groups, consider that all employees in a pay group must:

Belong to the same company.

Be paid at the same pay frequency.

Use the same check form or direct deposit advice form.

Have the same check date.

Share the same pay period begin and end dates.

Work in the same country.

Be paid by the same bank.

Have the same work schedule for proration.

Have the same minimum net pay.

Have the same earnings program.

For example, when setting up pay groups for a fictional company, GBI, group employees as follows:

Term |

Definition |

|---|---|

KN1—Monthly |

Employees who are paid monthly and share the same pay period, which ends on the last day of the month, may belong to the same pay group. Salaried employees at GBI are paid monthly. |

KN2—Semi-Monthly |

Employees who are paid semimonthly and share the same pay periods, ending on the 15th and last day of the month, may also belong to the same pay group. Exception hourly and hourly employees at GBI are paid semimonthly. |

Establish pay groups using the three pages in the Pay Group Table. With these pages, you can create pay groups, assign valid pay group employee types, and enter additional bank and earning parameters for your pay groups. Pay groups default to employee job records from the company level.

Important! The Pay Group Table component in the system, located outside Administer Salaries for the Netherlands, isn't identical to the Pay Group Table component used for the Netherlands. There are distinct differences in the fields. For users of Administer Salaries for the Netherlands, it is important that you use the Pay Group Table component that appears on the Benefits NLD menu.

Use the Bank Table page (BANK_EC) to identify every bank and savings institution where your company has accounts established for payroll purposes, with the exception of employee's direct deposit accounts.

Navigation:

The system uses the bank number (or transit number) that you enter here to identify the bank from which checks or electronic funds transfers (direct deposits) are drawn for a pay group. Always create at least one entry on this table for the bank from which paychecks or direct deposits are drawn.

Note: We don't recommend using this table to edit against the bank transit numbers for your employees' direct deposit accounts. If you allow employees to direct deposit to any bank, it would be almost impossible to maintain a table of all valid bank numbers.

Use the Holiday Schedule page (HOLIDAY_SCHED_TBL ) to define a list of scheduled holidays that can be used on the Pay Group table.

Holiday schedules that you set up through either navigation can be passed on to a third-party payroll system. Do not include personal floating holidays on this list. Because holidays may vary for different segments of your employee population, depending on location, work schedules, or other factors, you can set up as many holiday schedules on this table as needed.

Navigation:

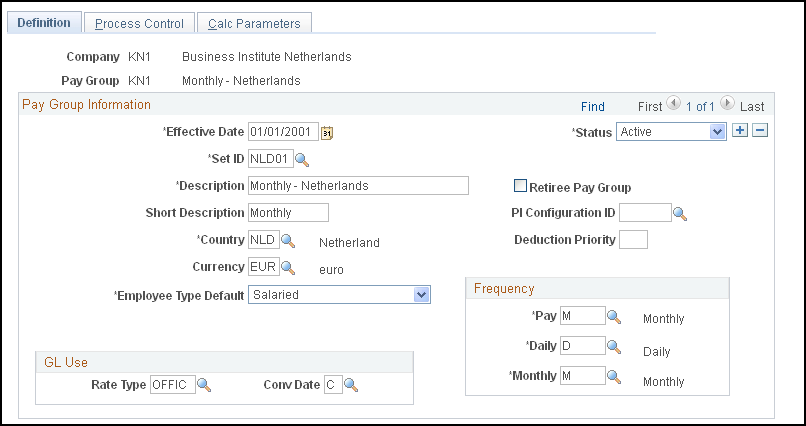

Use the Pay Group Table - Definition page (PAYGROUP_TABLE1 ) to create and maintain pay groups.

Navigation:

This example illustrates the fields and controls on the Pay Group Table - Definition page. You can find definitions for the fields and controls later on this page.

Pay Group Information

Field or Control |

Description |

|---|---|

Retiree Pay Group |

Select only if you are adding a retiree pay group. This check box is informational only; however, it is recommend that you set up a special pay group for retirees because their processing requirements tend to differ from those of active employees. |

PI Configuration ID (payroll interface configuration ID) |

Select an ID for the pay group. The system uses this for the interface with the external payroll application. |

Deduction Priority |

Enter a deduction priority number for your pay group. |

Currency |

Select the appropriate currency. |

Employee Type Default |

Select the employee type default for the most common employee type within the pay group. When you set up a job record for an employee who is assigned to this pay group, this employee type is set by default to that job record. Values are: Excep Hrly (exception hourly): Employees who work a set number of hours each pay period. Enter exceptions to their schedules on their pay sheets. Hourly: Employees who do not work the same number of hours each pay period. Typically, hourly employees require positive time reporting. In this case, enter on their pay sheets the actual hours worked. Not Appl (not applicable): Select this option if the Employee Type Default field isn't applicable. Salaried: Employees whose earnings are based on an amount per pay period, rather than accumulated hours. You can still enter exceptions on their pay sheets. |

Frequency

Field or Control |

Description |

|---|---|

Pay |

Select the frequency of pay for this pay group: Annual, Biweekly, Daily, Monthly, Quarterly, Semimonthly, or Weekly. |

Daily |

Select the daily frequency to be used by HR to calculate the daily rate that appears on the Compensation page of the Job Data component. |

Monthly |

Select the monthly frequency to be used by HR to calculate the monthly rate that appears on the Compensation page of the Job Data component. |

GL Use

The fields in the GL Use (general ledger use) group box are for Canadian and U.S. functionality and are not for operations in the Netherlands.

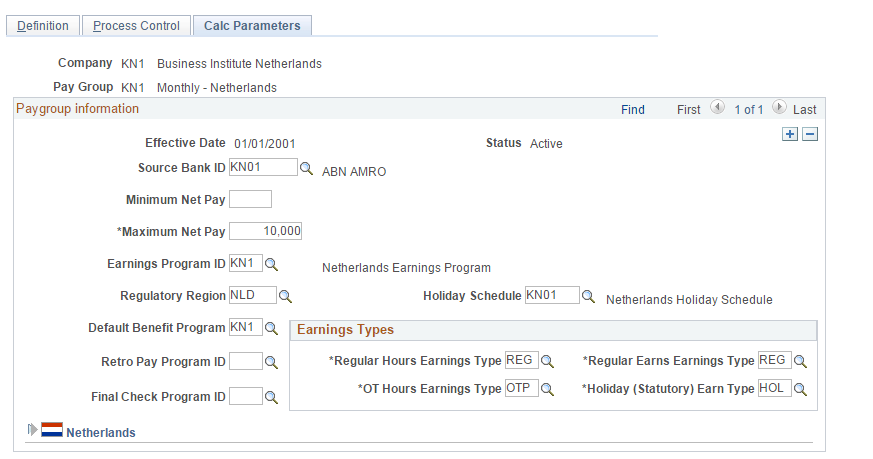

Use the Pay Group Table - Calc Parameters (pay group table - calculation parameters) page (PAYGROUP_TBL3_GBL ) to enter additional pay group processing parameters, including the bank and account, net pay minimums and maximums, and valid earnings codes.

When you first add a pay group, a dialog box prompts you for a company ID and pay group ID. The company ID is a key field on the Pay Group table, implying that all employees in a pay group are also in the same company. For the pay group ID, use any three-character alphanumeric ID that conforms to your payroll system standards.

Navigation:

This example illustrates the fields and controls on the Pay Group Table - Calc Parameters page. You can find definitions for the fields and controls later on this page.

Paygroup Information

Field or Control |

Description |

|---|---|

Source Bank ID |

For use with Payroll for North America only. |

Minimum Net Pay |

For use with Payroll for North America only. |

Maximum Net Pay |

For use with Payroll for North America only. |

Earnings Program ID |

If you're using Benefits Administration, select an earnings program ID. This value becomes the default for employee records in this pay group. The other fields in this page are optional for Human Resources. |

Regulatory Region |

Enter the regulatory region associated with this pay group. |

Holiday Schedule |

Select a default holiday schedule. The value you enter appears as the default in employee job data. |

Default Benefit Program |

If you use Benefits Administration, select a default benefit program. |

Retro Pay Program ID |

For use with Payroll for North America only. |

Final Check Program ID |

For use with Payroll for North America only. |

Earnings Types

Field or Control |

Description |

|---|---|

Regular Hours Earnings Type |

Select the appropriate earnings code for the regular hours earnings type. |

Regular Earns Earnings Type |

Select the appropriate earnings code for the regular earns earnings type. |

OT Hours Earnings Type (overtime hours earnings type) |

Select the appropriate earnings code for the overtime hours earnings type. |

Holiday |

When the system creates paysheets and detects that a holiday falls within the pay period, it uses the earnings code that you enter here. If the holiday type on the Holiday Schedule page is Canadian, the system uses the holiday earnings code specified on the Pay Group Table - Definition page to set up the holiday earnings on the paysheet. |

Netherlands

Field or Control |

Description |

|---|---|

Collective Labor Agreement |

Select the collective labor agreement: CAO Retail Trade, CAO Wood Industry, CAO Medical Staff, CAO Metal Industry, and CAO Transportation Industry. |

Use the Pay Run Table page (PAY_RUN_TABLE_NLD) to set up the pay run IDs that you use to combine pay calendar entries from different pay groups for payroll processing.

The Pay Run Table page and procedures for establishing pay run IDs are the same for several other PeopleSoft payroll applications.

Navigation:

Use the Pay Calendar Table page (PAY_CAL_TBL_NLD) to schedule payroll cycles for your pay groups and specify when pay periods begin and end.

You must have a calendar entry for every pay period for each pay group that you set up. Each entry on the Pay Calendar Table page corresponds to a specific pay period for a pay group, defined by the begin and end dates.For example, a monthly pay group would have 12 entries on the Pay Calendar Table page, representing a year of processing.

Navigation:

This example illustrates the fields and controls on the Pay Calendar Table page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Pay Period End Date |

Displays the date on which the pay period ends in the payroll cycle. |

Pay Run ID |

Each payroll background process needs a pay run ID to determine which pay group it should process. The system processes all pay calendar entries with the same pay run ID at the same time. Before you start payroll processing for a pay period, you must assign a pay run ID on this page. Establish the pay run ID on the Pay Run Table page. |

Pay Period Begin Date |

Select the date on which the pay period begins in the payroll cycle. |

Paycheck Issue Date |

Select the date that appears on the employee's paycheck or advice slip. |

Calendar Year |

Enter the calendar year for the pay run. |

Month |

Select the month for the pay run. |

Number of workdays |

Enter the number of workdays in the pay period for this pay run. |

Production Code |

Your third-party payroll system uses this field for information for the specific payroll run or for printing on the final pay slip. |

Text Payment Order |

Your third-party payroll system uses this field for including information for the specific payroll run or for printing on the final pay slip. |

Payroll Calculation Run |

(Optional). Use this check box to indicate whether the calendar has been processed. The system doesn't automatically set this check box. |