Identifying Employee Social Insurance Providers

This topic discusses how to identify employee participation in national social insurance programs.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Social Insurance |

SOCIAL_ASSUR_NL |

Identify an employee's participation in one of the national social insurance programs and identify the insurance provider. |

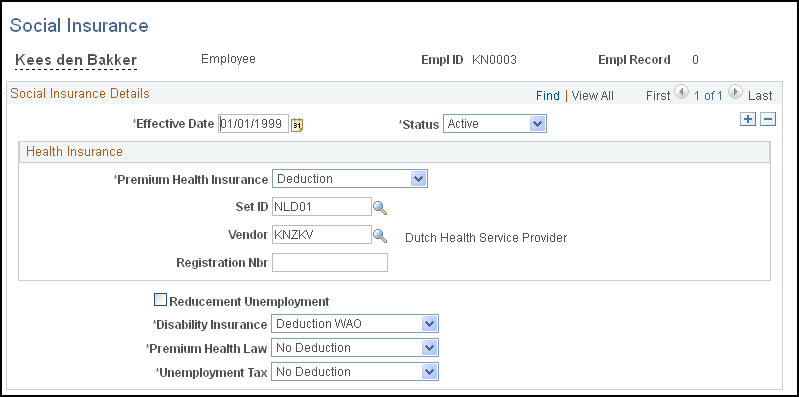

Use the Social Insurance page (SOCIAL_ASSUR_NL) to identify an employee's participation in one of the national social insurance programs and identify the insurance provider.

Navigation:

This example illustrates the fields and controls on the Social Insurance page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Premium Health Insurance |

This field appears if the effective date is earlier than January 1, 2006 only. From January 1, 2006 the ZFW health insurance is replaced by the ZVW health insurance. If the employee's income is below the national health care limit, then that employee is required by law to participate in a national health service scheme. Options are: Deduction: Select if the law requires the employee's participation in a national health service scheme. No Ded (no deduction): Select if the law doesn't require the employee's participation in a national health service scheme (ZFW). |

Health Insurance |

Select Deduction if the employee contributes to the ZVW health insurance, or No Ded (no deduction) if the employee isn't required to contribute to ZVW health insurance. |

ZVW Code |

Select the ZVW code that applies to the employee. This code is used in the Wage Declaration. |

Vendor |

If the employee is required to participate in a national health service scheme, select the vendor from the list. Leave this field blank if the law doesn't require the employee to participate in a national health service scheme. |

Registration Nbr (registration number) |

If the employee is required to participate in a national health service scheme, enter the employee's association member registration number. Leave this field blank if the law doesn't require the employee to participate in a national health service scheme. |

Reducement Unemployment |

Select this check box if, at the time of hire, the employee was classified as long-term unemployed. |

Disability Insurance |

If you select the Reducement Unemployment check box, select Deduction or No Ded to indicate whether the employee has deductions for premium disability insurance (WAO). |

Premium Health Law |

Select Deduction or No Ded to indicate whether the employee has deductions for premium health care (ZFW). This field is only available if you do not select the Reducement Unemployment check box. Note: As of January 1, 2006, the ZVW health insurance replaced the ZFW health insurance. Do not use this field from this date. |

Unemployment Tax |

Select Deduction or No Ded to indicate whether the employee has deductions for premium unemployment insurance (WW). This field is only available if you do not select the Reducement Unemployment check box. |