Entering Employee Tax Information

This topic discusses how to enter wage tax data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Tax Data |

EMPL_TAX_DATA_NL |

Enter data that determine an employee's wage tax. What you enter here affects the gross/net calculations that your payroll system makes. |

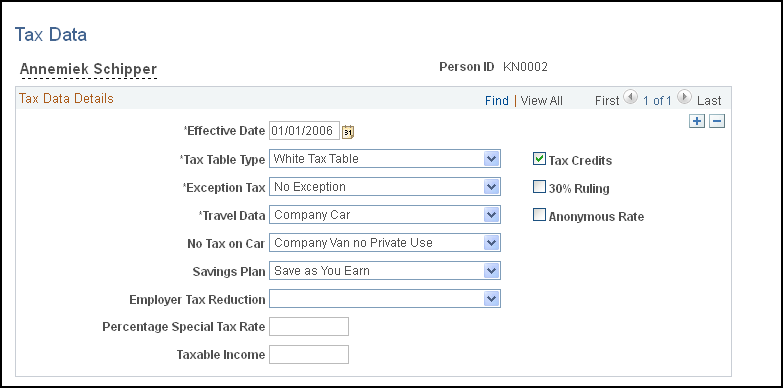

Use the Tax Data page (EMPL_TAX_DATA_NL) to enter data that determine an employee's wage tax.

What you enter here affects the gross/net calculations that your payroll system makes.

Navigation:

This example illustrates the fields and controls on the Tax Data page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax Credits |

Select if the employee is claiming a tax credit (heffingskorting), which reduces the amount of tax that is paid. In the new tax system, employers deal only with these tax credits. The general tax credit (algemene heffingskorting), the labor credit (arbeidskorting), and, if applicable, two old-age tax credits (ouderenkorting and aanvullende ouderenkorting). |

Exception tax |

Select any exceptions to the wage tax. |

30% Ruling (30 percent ruling) |

Select if the 30 percent ruling applies to the employee, whereby 30 percent of the income is tax-free. The 30 percent ruling applies to Dutch employees on international assignments and non-Dutch employees who are working in the Netherlands on an international assignment. |

Tax Table Type |

Select the tax table that is used to determine the level of the employee's wage tax: Green Tax Table, No Tax, or White Tax Table. |

Travel Data |

Select the value that describes the employee's travel conditions that impact taxes:

|

No Tax on Car |

Select one of these values if the employee has a company car or van but is exempt from the normal tax rules that apply to private use of company cars:

|

Savings Plan |

Select a savings plan if the employee contributes to a plan. There are two type of savings plan: Life Cycle Arrangement or Save As You Earn. |

Employer Tax Reduction |

If the employee is eligible for a tax deduction for education, select one of the these values to indicate which category:

|

Percentage Special Tax Rate |

Enter the percentage special tax rate for special tax cases. |

Anonymous Rate |

Select to indicate when an employee doesn't provide the documentation that is regarded as official proof of identity When this occurs, the highest tax rate is applied in order to discourage illegal immigration. |

Taxable Income |

Enter the employee's annual taxable income in euros (EUR). Enter a gross amount before tax deductions. |