Enrolling Employees in Pension Plans and Reviewing Benefits Information

This topic provides an overview of pension plan enrollment and discusses how to enroll employees and dependents in pension plans.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PENSION_PLAN1 |

Enroll employees and dependents in pension plans and enter salary and contribution amount information that can be used for payroll processing. |

|

|

BN_ENRL_SUMMARY |

View a summary of an employee's benefits participation in health, life, and accidental death and disability coverage. |

|

|

BN_DEDN_SUMMARY |

View a summary of an employee's benefit deductions, such as health, life, and accidental death and disability plans, regardless of the payroll system that the organization uses. |

|

|

DEPEND_BENEF_SUMM |

View employees' dependents or beneficiaries and the relationship between the employee and each person listed. |

Use the Pension Plans component to enroll employees in pension plans and assign beneficiaries to those plans. You can only enroll participants in the pension plans that are associated with their benefit program. The benefit plans available depend on the effective dates of both the program and the benefit plan. The system checks both dates against the enrollment effective date.

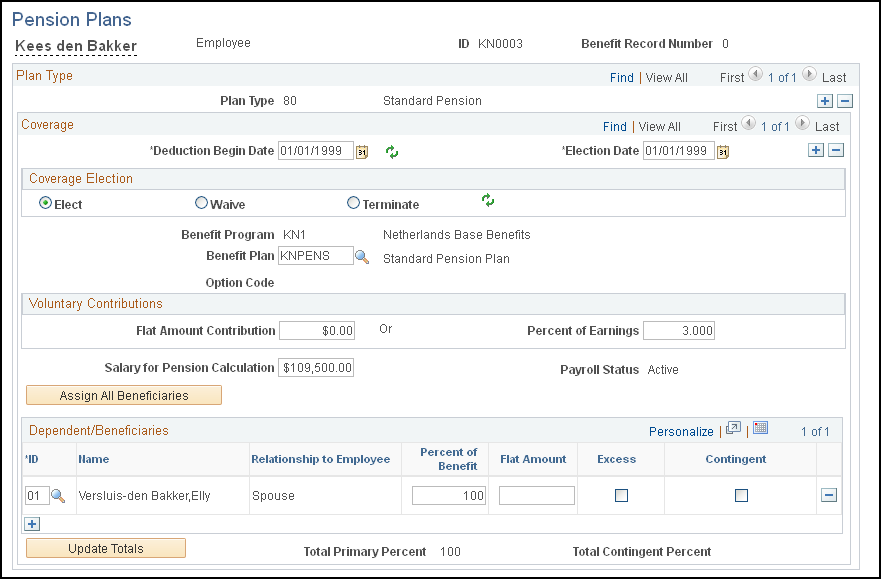

Use the Pension Plans page (PENSION_PLAN1) to enroll employees and dependents in pension plans and enter salary and contribution amount information that can be used for payroll processing.

Navigation:

This example illustrates the fields and controls on the Pension Plans page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Plan Type |

Select a plan type in which to enroll the employee. |

Coverage

Field or Control |

Description |

|---|---|

Deduction Begin Date |

Enter the date for employee contribution deductions to begin. |

Coverage Election and Election Date |

Define whether the employee is electing, waiving, or terminating coverage. By default, the Elect option is selected and today's date appears in the Election Date field. Elect: Select if the employee elects coverage, and enter the date that the election starts in the Election Date field. Waive: Select if the employee doesn't elect coverage, and enter the date that the waiver starts in the Election Date field. Terminate: Select if the employee is terminating coverage, and enter the coverage termination date in the Election Date field. |

Benefit Program |

Displays the benefit program in which the employee is enrolled. Use the Enroll in Benefits - Benefit Program page to verify or update the employee's enrollment. |

Benefit Plan |

Select the benefit plan. Only the pension plans that you associate with the employee's chosen benefit program as of the effective date are available. |

Option Code |

This field is not used by benefit programs in the Netherlands. |

Flat Amount Contribution or Percent of Earnings |

Enter an amount that the employee voluntarily contributes to the pension plan. This is an amount that is additional to the amount that you define on the Pension Plan table. |

Salary for Pension Calculation |

To calculate the pension by using a salary that is other than the employee pay rate, enter the salary in this field. |

Payroll Status |

Displays the employee's status from job data. |

Dependent/Beneficiaries

Field or Control |

Description |

|---|---|

Assign All Beneficiaries |

Click to view all beneficiaries that are currently entered into the system for this employee. |

ID |

Use to locate beneficiary information by individual. Select each beneficiary for the plan. |

Percent of Benefit and Flat Amount |

For each beneficiary, define the pension distribution benefit by percent or flat amount. The system calculates the total for all of the percentages that you enter, which cannot exceed 100. If you enter a flat amount and more than one beneficiary, select one of the beneficiaries to receive any excess funds (because the estimated benefit may vary over time). |

Excess |

Select to allocate excess benefit funds to this dependent or beneficiary. |

Contingent |

(Optional) Use this check box to indicate whether a beneficiary is primary or contingent (secondary to a primary beneficiary). If the beneficiary is contingent, select this check box. If you set up a primary beneficiary to receive 100 percent of the benefit and you want to set up a secondary beneficiary, first set up the secondary beneficiary with zero percent. |

Update Totals |

Click this button to update the values in the Total Primary Percent and Total Contingent Percent fields. |