Setting Up Fringe Matrix Codes

To set up encumbrance definitions, use the Encumbrance Salary Range Code (HP_ENCUMB_SAL_RANG) and Encumbrance Fringe Matrix Code (HP_ENCUMB_FRG_MAT) components.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

HP_SALARY_RANGE |

Define fringe encumbrance percentages and additional amounts based on salary ranges. |

|

|

HP_FRINGE_MATRIX |

Define an overall encumbrance fringe matrix code where you assign different salary range codes to different groups based on companies, pay groups, employee classifications, employee types, and full time/part status. You also establish an overall default salary range code and company-specific default salary range codes for employees who don't fall into any of the classifications that you create. |

Use the Encumbrance Salary Range Code page (HP_SALARY_RANGE) to define fringe encumbrance percentages and additional amounts based on salary ranges.

Navigation:

This example illustrates the fields and controls on the Encumbrance Salary Range Code page.

Field or Control |

Description |

|---|---|

Minimum Salary and Maximum Salary |

Use these fields to define salary ranges that have different encumbrance percentages or additional amounts. There must not be any gaps in the ranges you set up, nor can there be any overlap. For example, if the maximum salary for one range is 30,000.00 then the next higher range must have a minimum salary of 30,000.01. |

Encumbrance Percent |

Enter the percent of the encumbered salary to be encumbered. This percentage is applicable only to either tax encumbrances or deduction encumbrances that use this salary range code. |

Additional Encumbrance Amount |

Enter any additional amount to be encumbered above the encumbrance percent. This amount is applicable only to deduction encumbrances (and not tax encumbrances) that use this salary range. |

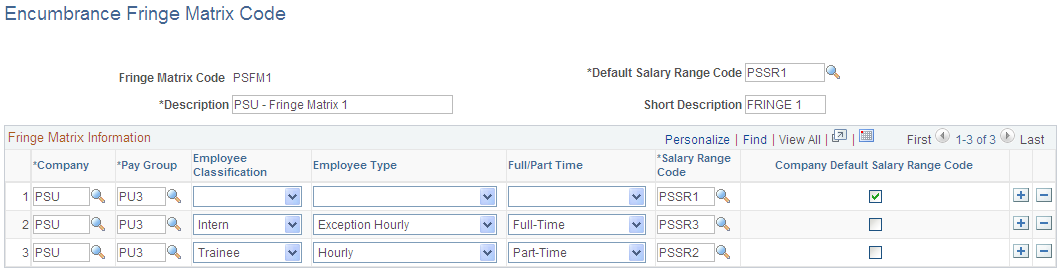

Use the Encumbrance Fringe Matrix Code page (HP_FRINGE_MATRIX) to define an overall encumbrance fringe matrix code where you assign different salary range codes to different groups based on companies, pay groups, employee classifications, employee types, and full time/part status.

You also establish an overall default salary range code and company-specific default salary range codes for employees who don't fall into any of the classifications that you create.

Navigation:

This example illustrates the fields and controls on the Encumbrance Fringe Matrix Code page.

Field or Control |

Description |

|---|---|

Default Salary Range Code |

Enter the overall default salary range code to use for employees who do not fall into any of the classifications that you define on this page. |

Company and Pay Group |

These fields are required for each row in the matrix. You do not have to create entries for all of your companies: companies that you do not specifically configure use the overall default salary range code. If all pay groups in the company use the same salary range code, create a row for any one pay group, then select the Company Default Salary Range Code check box. If some pay groups use a salary range code other than the company default, create additional rows for those pay groups. |

Employee Classification, Employee Type, and Full/Part Time |

To assign salary range codes at a more granular level than company and pay group, you can create additional rows in the matrix and assign salary range codes based on the employee classification, employee type, and full/part time status. |

Salary Range Code |

Enter the salary range code to use for the specified company, pay group, employee classification, employee type, and full/part time status. |

Company Default Salary Range Code |

Select this check box to use the salary range code as the default for employees who do not fall into any of the more granular classifications that you defined for a specific company. |