Setting Up Leave Transfer Programs

To set up leave transfer programs, use the Leave Denial Codes USF (GVT_DENIAL_CD_TBL), Leave Program Type Table (GVT_LV_XFR_TYP_TBL), Leave Bank Details (GVT_LV_BANKMEM_SEC), and Emergency Leave Transfer Details (GVT_LV_DON_TGT_SEC) components.

To set up leave transfer programs, you must define the programs and the earnings codes and accrual classes used for processing.

These topics discuss how to set up leave transfer programs.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GVT_DENIAL_CD_TBL |

Set up denial reasons and specify the text to be printed in denial notifications. |

|

|

GVT_LV_XFR_TYP_TBL |

Set up leave transfer programs, specify the program type, and indicate limits on donations and balances. |

|

|

Leave Bank Details Page |

GVT_LV_BANKMEM_SEC |

Enter Leave Bank board members. |

|

Emergency Leave Transfer Details Page |

GVT_LV_DON_TGT_SEC |

Enter the number of donation hours targeted. |

|

GVT_LV_CLS_RULES |

Define your organization's rules for enrolling or terminating an employee from an earnings (leave) accrual class. |

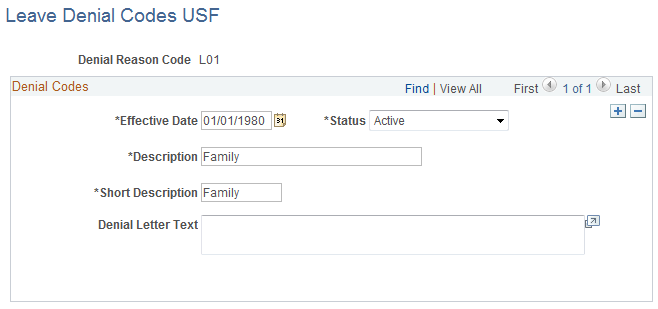

Use the Leave Denial Codes USF page (GVT_DENIAL_CD_TBL) to set up denial reasons and specify the text to be printed in denial notifications.

Navigation:

This example illustrates the fields and controls on the Leave Denial Codes USF page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Denial Letter Text |

Enter details of the reason for denial that you want to be printed on the Leave Denial Notifications report (FGPY031). |

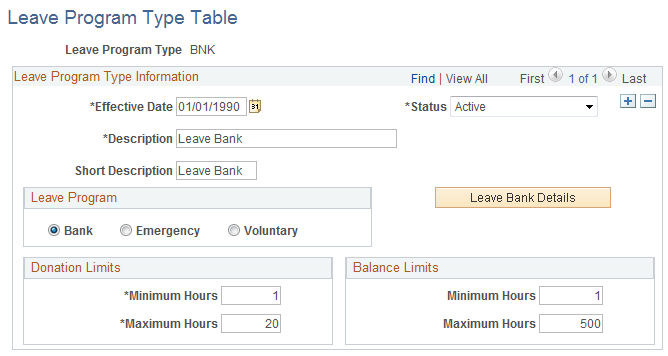

Use the Leave Program Type Table page (GVT_LV_XFR_TYP_TBL) to set up leave transfer programs, specify the program type, and indicate limits on donations and balances.

Navigation:

This example illustrates the fields and controls on the Leave Program Type Table page. You can find definitions for the fields and controls later on this page.

Leave Program Type Information

Field or Control |

Description |

|---|---|

Leave Program Type |

Define your leave program codes. |

Leave Program |

Select the type of leave transfer program (Bank, Emergency, Voluntary) to associate with this Leave Program Type code. |

Donation Limits and Balance Limits |

Enter the Minimum Hours and Maximum Hours allowable for donations and balances. |

Leave Bank Details |

Click to access the Leave Bank Details page and enter the Leave Bank board members and indicate those who are labor representatives. If you select Bank in the Leave Program group box, the system adds the Leave Bank Details button to the page when you save. |

Emergency Leave Transfer Dtl (emergency leave transfer details) |

Click to access the Emergency Leave Transfer Details page and record the number of donation target hours. If the Leave Program Type is Emergency, the system adds the Emergency Leave Transfer Details button to the page when you save. |

Set up three unique earnings codes for three distinct purposes:

For donors to donate leave to transfer programs.

For recipients to receive (accrue) leave from transfer programs.

For recipients to use leave accrued from transfer programs.

Leave Earning Type

PeopleSoft provides five Leave Earning Type codes as translate values. Associate these types with earnings codes that you set up for processing leave transfers. The type code you select defines the function of the earnings code within the leave bank and transfer program. The following table summarizes the processing that is triggered by these codes.

|

Leave Earn Type |

Leave Bank and Transfer Process |

Earning Accrual Process |

|---|---|---|

|

Donate to Bank |

Updates the donor's Additional Pay page with the hours contributed to a Leave Bank Program. Use the Leave Bank Application/Donate page to enter requests. Updates Leave Bank Ledger inquiry page with hours contributed. |

Donor's Annual:

|

|

Donate to Emergency |

Updates the donor's Additional Pay page with the hours contributed to an Emergency Leave Transfer Program (ELTP). Use the Leave Bank Application/Donate page to enter requests. Updates the Leave Bank Ledger with hours contributed. |

Donor's Annual:

|

|

Donate to Recipient |

Updates the donor's Additional Pay page with the hours contributed in the Voluntary Leave Transfer Program (VLTP). Use the Donor Contribution page to enter requests. Updates the Track Leave Donation page. |

Donor's Annual:

|

|

Received from Bank |

Updates the recipient's Additional Pay page with the hours received from the Bank or ELTP. Use the Create Leave Recipient App page to enter requests. Updates Leave Bank Ledgers with hours withdrawn. |

Leave Program Recipient: Increase Balance YTD |

|

Received from Donor |

Updates the recipient's Additional Pay page with the hours received through the VLTP. Use the Create Leave Recipient App page to enter requests. |

Leave Program Recipient: Increase Balance YTD |

Setting Up Earnings Codes for Donors and Recipient Accruals

Use the Earnings Table component to set up earnings codes for donors and recipient accruals. You must use the specified values for the following fields:

General page: In the Payment Type field, select Hours Only. Leave transfer earnings codes process hours only; there are no earnings or deductions associated.

Taxes page: There are no taxes taken. In the Earning Allocation group box, select Maintain Earnings Balances.

Federal Additional Earnings page: In the Leave Bank and Transfer Type group box, select the appropriate Leave Earnings Type.

Calculation Page: The Multiplication Factor must be 0.0000 to ensure no earnings.

Setting Up an Earnings Code for Recipients to Use Transferred Leave

Use the Earnings Table component to set up earnings codes for recipients to use transferred leave. You must use the specified values for the following fields:

General page: In the Payment Type field, select Hours Only.

Taxes page: The earnings are fully taxable. In the Earning Allocation group box, select Add to Gross, Maintain Earnings Balances, and Hours Only.

Calculation Page: The Multiplication Factor must be 1.0000 to ensure the earning is paid at the regular hourly rate.

Set up earning accrual classes for the following purposes:

Leave program recipient.

Once an employee is approved as a recipient in either a Bank, ELTP, or VLTP, they must be enrolled into an Earning Accrual Class to track hours received and used during their program participation.

Deferred Annual/Sick Leave.

When an employee is participating in either an Agency Bank or VLTP, they must terminate their enrollment from regular annual and sick leave plans and enroll into the deferred annual and sick earning accrual classes. The deferred programs will track service hours and entitlement to a defined maximum accrual. For example, full time employees may accrue to the maximum of 40 hours.

Employees participating in an ELTP are not subject to the accrual limit and do not need to be enrolled into the deferred programs.

Annual Leave.

All donated hours are taken from the employee's annual leave accrual class. Update each of your annual accrual classes with the three donor earning codes defined with Donate to Bank, Donate to Emergency, and Donate to Recipient leave earning types.

Setting Up Earnings Accrual Classes for Leave Program Recipients

Use the Earnings Accruals component to set up earnings accrual classes for leave program recipients. You must use the specified values for the following fields:

Class page: In the Leave Type field, select Leave Program.

Balance page: The values you enter depend upon the purpose of the earnings code you're adding to the class.

For earnings codes used to accrue recipient leave transfer, select Add to Hours Earned.

For earnings codes used when recipients use transferred leave, select Add to Service Hours and Add to Hours Taken.

Setting Up Earnings Accrual Classes for Deferred Annual/Sick

Use the Earnings Accruals component to create a deferred earning accrual class for every annual and sick accrual class that has a different accrual maximum during an employee participation in the leave bank or transfer programs.

Deferred accrual classes need to mirror the accrual classes that they are replacing; the only difference in the two classes is the leave type and accrual ceiling.

For example, the Deferred Annual Accrual Class mirrors the Annual Accrual Class by having the same accrual calculation, carryover, expiration/termination, accrual rates, and balance earning codes. The only difference in the two classes is the Leave Type and Accrual Ceiling. In this example, enter the following information:

Class page: In the Leave Type field, select Deferred Annual.

Ceiling/Carryover page: Set up the accrual ceiling as desired for the deferred accrual class.

Setting Up Annual Accrual Classes for Leave Transfer Processing

All donated hours to bank and transfer programs are withdrawn from the employee's Annual Leave Accrual Class. You must update all your Annual Accrual Class Balance tables with the three earning codes you set up with the leave earnings types of Donate to Bank, Donate to Emergency, and Donate to Recipient.

Use the Leave Class Rules USF page (GVT_LV_CLS_RULES) to define your organization's rules for enrolling or terminating an employee from an earnings (leave) accrual class.

You can define leave class rules to enroll an approved recipient automatically into the accrual class that you create to track leave program activity. Use this page to define the automatic enrollment rule for each leave program type you set up.

Navigation:

Select Leave Program Status as the Leave Class Rules Criteria Type.

Select the appropriate Leave Program Type.