Entering Additional Report Parameters

The 2483 report requires additional parameters that are not stored in HR. Before you run the report, you must enter these parameters into the system.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TRN_2483_PARM |

Enter parameters that are required for the 2483 report. This page is dedicated to one company and one declaring year. |

|

|

TRN_2483_CPNY_COST |

Enter costs related to a civil year (2483 declaring year). These costs are dedicated to the 2483 report and are not included in the computation of other training processes. |

Use the Trn 2483 Parameters Setup (training 2483 parameters setup) page (TRN_2483_PARM) to enter parameters that are required for the 2483 report.

This page is dedicated to one company and one declaring year.

Navigation:

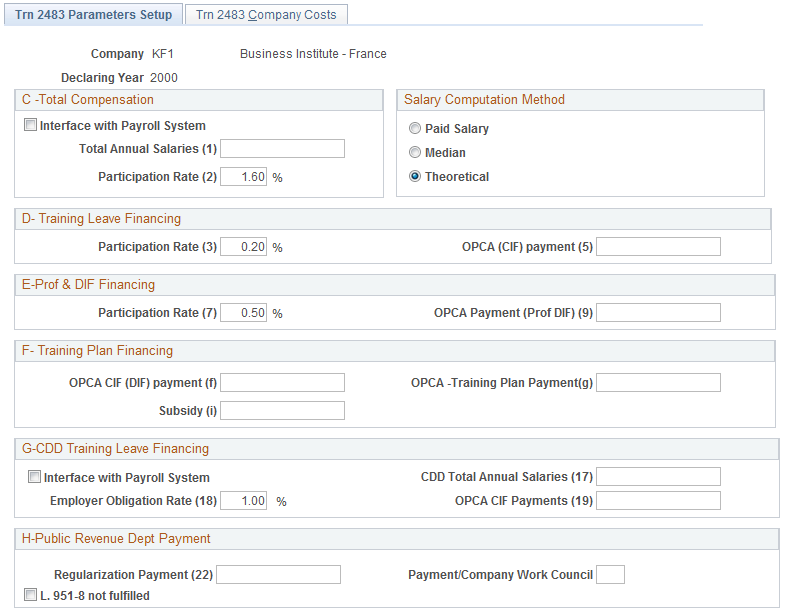

This example illustrates the fields and controls on the Trn 2483 Parameters Setup page. You can find definitions for the fields and controls later on this page.

Group C - Total Compensation

Field or Control |

Description |

|---|---|

Interface with Payroll System (reduction rate [10 employee mark]) |

Select if the amount of total compensation is to be calculated from the salaries the system retrieves from Global Payroll. Note: When Interface with Payroll System is selected, the field Total Salaries (1) is unavailable. |

Total Annual Salaries (1) |

Enter the total of the annual salaries for your organization. |

Participation Rate (2) |

Enter the rate applied to the Total Annual Salaries to calculate the amount that the company should spend on Trainings. This rate equals 1.6 by default. |

Salary Computation Method

These options are used to estimate the employee salary costs that are charged in the 2483 report.

Field or Control |

Description |

|---|---|

Paid Salary |

When you select this option, the Compute 2483 process prorates the employee's monthly salary for each session and then calculates the sum for all sessions. The system validates that the Paid Salary method is consistent with the salaries stored on the Update Salary Costs page, Period tab. All employees for the related company and related year should have the Calc. Flag field equal to Payroll or Manually. |

Median |

When you select this option, the Compute 2483 process divides the total training hours (the duration of all sessions) by total paid hours and multiplies the result by an employee's average annual salary. Salaries come from Global Payroll for France or are entered manually. The system verifies that the Median method is consistent with the salaries stored on the Update Salary Costs page, Period tab. All employees for the related company and related year should have the Calc. flag equal to Payroll, Job Code, or Manually. This option is the default. |

Theoretical |

The theoretical method is similar to the median method and should be selected when salaries have been entered manually or have been defined for each job code. When you select this option, the Compute 2483 process divides the total training hours (based on session duration) by total paid hours and multiplies the result by the employee's annual compensation. The system verifies that the Theoretical method is consistent with the salaries stored on the Update Salary Costs page, Period tab. All employees for the related company and related year should have the Calc. flag equal to Employee, Job Code, or Manually. |

Group D - Training Leave Financing

Field or Control |

Description |

|---|---|

Participation Rate (3) |

Enter the rate applied to the Total Annual Salaries to calculate the amount that the company should spend on Training Leaves (CIF in French). This rate equals 0.2 by default. |

OPACIF Payment (5) |

Enter the amount that is paid to a registered body for training leave for limited contract employees. |

Group E - Prof. & DIF Financing (Professionalization and Droit Individuel a la Formation [Individual Training Rights])

Field or Control |

Description |

|---|---|

Participation Rate (7) |

Enter the rate applied to the Total Annual Salaries to calculate the amount that the company should spend on professionalization periods and contracts, and DIF. This rate equals 0.5 by default. |

OPCA Payment (Prof. DIF) (9) |

Enter the amount that is paid to a registered body for professionalization periods and contracts, and DIF. |

Group F - Training Plan Financing

Field or Control |

Description |

|---|---|

OPCA CIF (DIF) payment (f) |

Enter the amount that is paid to a registered body for training leaves (which are also DIF). |

OPCA -Training Plan Payment (g) |

Enter the amount that is paid to a registered body for trainings defined in the training plan. |

Subsidy (i) |

Enter the amount of subsidy granted for training purposes. The subsidy should be granted by government bodies (received by the company) during the declaring year. |

Group G - CDD Training Leave Financing

Field or Control |

Description |

|---|---|

Interface with Payroll System |

Select if the amount of CDD Training Leave Financing is to be retrieved from Global Payroll. |

CDD Total Annual Salaries (17) |

Enter the total salaries for all limited contract employees. |

Employer Obligation Rate (18) |

Enter a percentage rate. This rate equals 1 by default. It is applied to the CDD Total Annual Salaries to calculate the amount that the company should spend on trainings for CDD. |

OPCA CIF Payments (19) |

Enter the amount that is paid to a registered body for training leave for limited contract employees. |

Group H - Public Revenue Dept Payment

Field or Control |

Description |

|---|---|

Regularization Payment (22) |

If your organization hasn't spent the required training amounts declared in previous 2483 reports (because the corresponding trainings were supposed to cover several years), you must make a regularization payment to the French authorities. Enter the amount of the payment. |

Payment/Company Work Council |

Enter the number of attached documents for the declaration report. |

L. 951-8 not fulfilled |

Select this option when you know that this law does not apply. |

Use the Trn 2483 Company Costs (training 2483 company costs) page (TRN_2483_CPNY_COST) to enter costs related to a civil year (2483 declaring year).

These costs are dedicated to the 2483 report and are not included in the computation of other training processes.

Navigation:

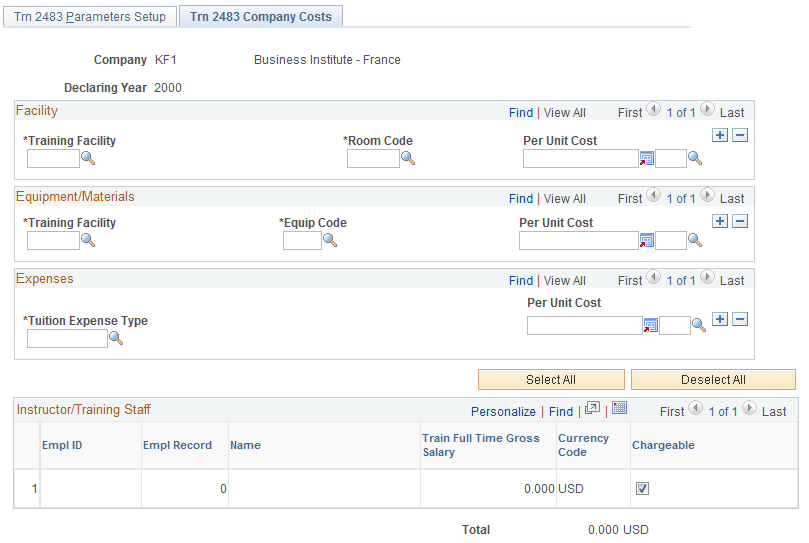

This example illustrates the fields and controls on the Trn 2483 Company Costs page. You can find definitions for the fields and controls later on this page.

Note: Most training costs are processed through the Compute Student Cost process and are then available at the employee level. These costs (available in the Maintain Student Cost pages) are used to calculate most financial indicators of the 2483 report. However, certain company costs such as facility, equipment and materials expenses go directly on the 2483 report without any conversion or calculation. Use this page to charge these costs to the declaring company no matter what the length of the training session or number of students. Be sure to set Cost Unit Type on the Cost Unit page to Company.

See Understanding Training Costs.

Facility

Field or Control |

Description |

|---|---|

Training Facility |

Enter the training facility where training was provided. |

Room Code |

Enter the room code where training occurred. Each room in a training facility must have a unique room code. |

Equipment/Materials

Field or Control |

Description |

|---|---|

Training Facility |

Enter the training facility where training equipment and materials will be used. |

Equip Code (equipment code) |

Enter the equipment code of equipment and materials used for training. |

Expenses

Field or Control |

Description |

|---|---|

Tuition Expense Type |

Define miscellaneous expenses that are associated with a training session. |

Instructor/Training Staff

Field or Control |

Description |

|---|---|

Chargeable |

Instructor/Training Staff salaries are retrieved automatically and the check box is selected by default. You may deselect this check box for rows that you do not wish to be included in the 2483 report. This group box links to the Trainees Salary Costs page. Employees that appear in this section (those defined as Full Time Instructor and training staff employees that are fully dedicated to the training department) are chargeable. To confirm that their annual total compensation appears on the 2483 report, select the Chargeable check box. Click the Select All button to set all employees to chargeable at once. |