Setting Up to Create IRD Data

To set up to create IRD data, use the Pay Entity IRD Details NZL (GPNZ_IRD_DTL) component.

This section discusses how to enter pay entity information for IRD reporting.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPNZ_PYENT_DET |

Store information about the pay entity that is needed for reporting to the IRD. |

Use the Pay Entity IRD Details NZL page (GPNZ_PYENT_DET) to store information about the pay entity that is needed for reporting to the IRD.

Navigation:

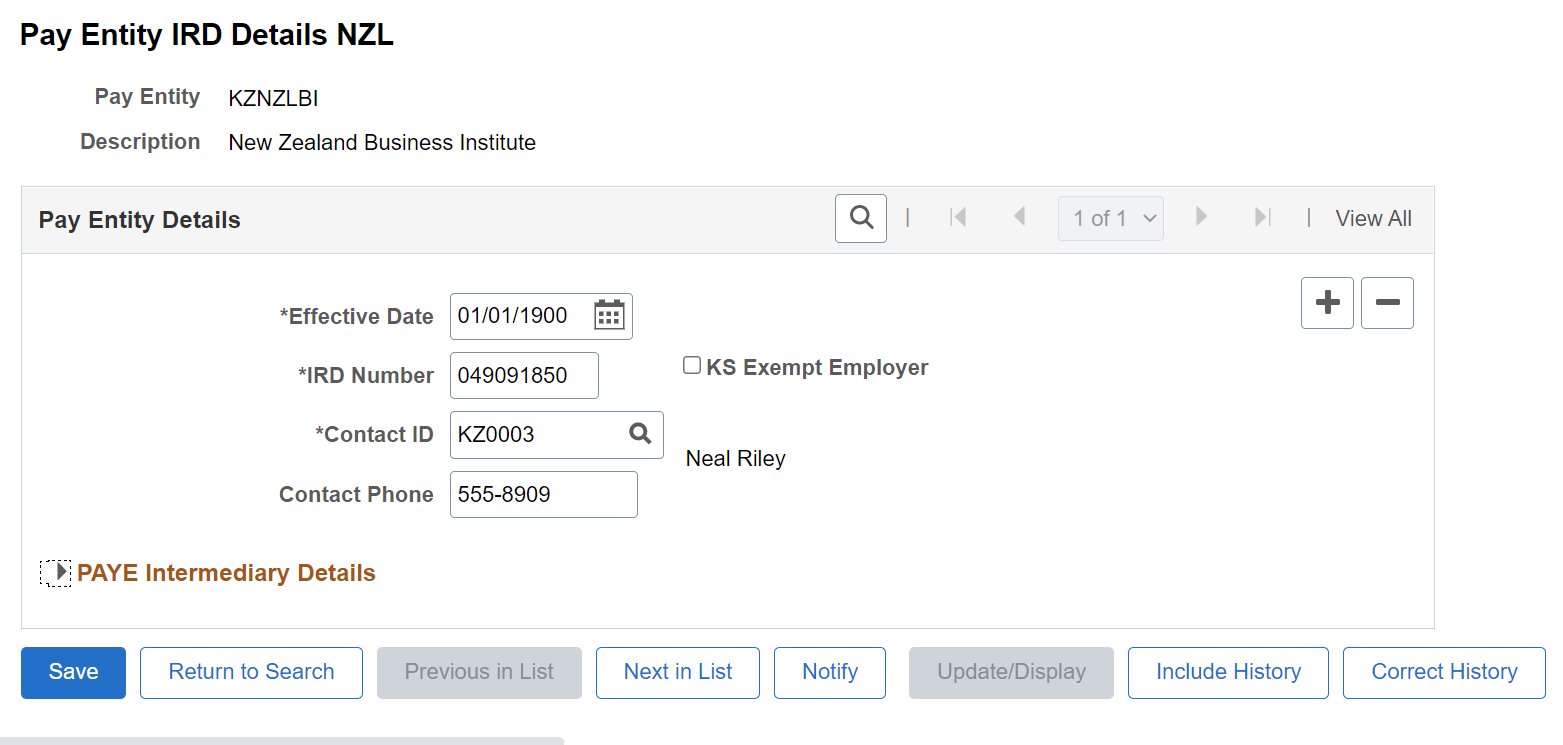

This example illustrates the fields and controls on the Pay Entity IRD Details NZL page.

Field or Control |

Description |

|---|---|

IRD Number |

Enter the number that the IRD allocates for the pay entity. Your entry is validated in the same way as employee IRD numbers are. |

Contact ID |

This is the employee in the organization that the IRD should contact as required. |

|

KS Exempt Employer |

Select the checkbox to set the KiwiSaver Exempt option at employer level so that it applies to all the employees across that Pay Entity. Exempt Employer does not have to enroll employees in KiwiSaver. |