Reconciling PDR Data

The PDR reconciliation output compares the PDR data with Payroll Earnings and Deductions. The PDR Reconciliation process can be processed as soon as the payroll is identified and calculated, and the create PDR process is successful.

The Benefits of PDR Reconciliation are:

Reconcile the PDR data with payroll results.

Comply with auditing requirement of the organization for identifying the variances.

Reduce the verification time in identifying or analyzing the variance.

Identify any data issues in the PDR file

Prior to generate PDR Reconciliation Output, you must ensure the following:

Payroll calendar identified and processed.

PDR preparation process is successful.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PDR Reconciliation Page |

PNZ_RCN_RC |

To generate PDR reconciliation output which is used to compare the PDR data with Payroll Earnings and Deductions. |

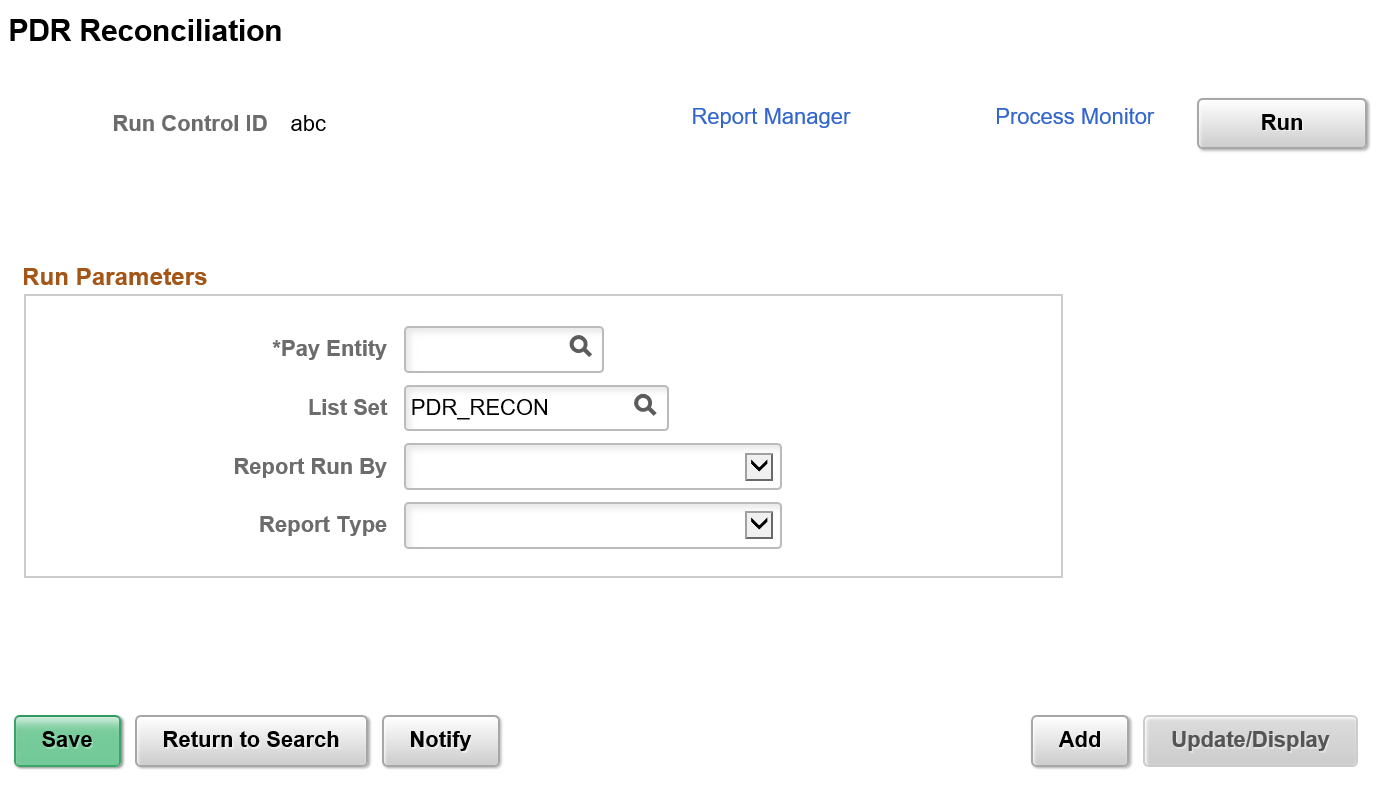

Use the PDR Reconciliation page to generate PDR reconciliation output which is used to compare the PDR data with Payroll Earnings and Deductions.

Navigation:

This example illustrates the PDR Reconciliation Page.

Field or Control |

Description |

|---|---|

Pay Entity |

The Pay Entity for which data is being compared. |

List Set |

This is a system delivered element where the gross earnings and statutory deductions are mapped. By default, the field displays the value PDR_RECON. |

Report Run by |

Specify whether you are generating a report based on Calendar Group or Payment Date. If you select Calendar Group, only those calendar that has been processed and PDR prepared are listed. If you select Payment Date, only those payment dates that has been processed and PDR prepared are listed. |

Report Type |

Type of report to be generated. Values available are:

|

Variance Only |

Select the check box to list only those employees having variance between Payroll and PDR in the reconciliation output. This filed is enabled only for the Report Type — Employee Detail. |