Entering Payee Supplied Tax Information

This section discusses how to enter payee tax details.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPNZ_EE_TAX_DETAIL |

Enter tax information as supplied by the payee. |

Use the Maintain Tax Data NZL page (GPNZ_EE_TAX_DETAIL) to enter tax information as supplied by the payee.

Navigation:

This example illustrates the fields and controls on the Maintain Tax Data NZL page. You can find definitions for the fields and controls later on this page.

Payee tax details are keyed by pay entity and balance group number, allowing payees with concurrent jobs to have different tax details for each job. This page, on which you enter payee tax information, is designed to be similar to the IRD forms — IR 330, 23 and 331 — that the payee supplies.

Field or Control |

Description |

|---|---|

IRD Number |

The system validates the entry. If the payee does not provide a valid IRD number, you need to set the Tax Code field to ND (no declaration) for employees, and to WT ND (withholding tax, no declaration) for contractors. The system does not enforce this tax code selection but does provide a warning message. |

Pay Entity |

You can select only pay entities that you select for the pay group that you specify on the payee's Job Data - Payroll page |

Tax Code |

The translate values for this field are effective-dated because even if codes are no longer active they are needed for history purposes. The system warns if:

|

Balance Group Nbr |

This field enables you to record different tax details for different, concurrent jobs. Balance group numbers identify the accumulator that the system stores tax balances in. You can select only balance group IDs that you set up on the payee's Job Data - Payroll page. |

Nature of Payment |

The code that you enter here ensures that the system applies the correct withholding tax rate. You only enter a Nature of Payment Code if:

|

IR23 - Special Tax Code: Tax Override Types

This group box appears only when you select STC in the Tax Code is field. Select one of the following types of tax overrides and enter any required details for the selected option.

Field or Control |

Description |

|---|---|

None |

This is the default tax override type. |

PAYE Tax Code (pay as you earn tax code) |

If you select this option, select a PAYE Tax Code override. The translate values for this field are a subset of the tax codes that you select in the Tax Code field. You don't have to use this field to set an override; you can just change the tax code. In either case, you need a new effective date. |

PAYE Tax Rate (pay as you earn tax rate) |

If you select this option, enter the applicable PAYE tax deduction rate. The rate can be zero. |

Withholding Tax Rate |

If you select this option, enter the applicable withholding (special) tax deduction rate. The rate can be zero. |

IR23 - Special Tax Code: Additional Options

This group box appears only when you select STC in the Tax Code is field. Use the group box to specify tax overrides.

Field or Control |

Description |

|---|---|

Student Loan |

Select the check box and enter an override rate. It can be zero. The check box and the override rate are not affected by the tax code or tax override type. The same applies to the Earner Premium field. |

Certificate Number |

The system does not use the values that are in this field, nor the value that is in the Expiry Date field; they are for information only. You cannot enter a certificate number and expiry date if the tax override type is none. |

STC or Special Tax Code is used when an employee asks employer to make tax or student loan deductions from salary or wages at unusual rates. It may be necessary for these employees to provide either or both of the following certificates:

A special tax code certificate informing the employer what tax deductions to make.

A special deduction rate certificate authorising the employer to deduct a different rate of student loan repayments.

With the certificate, employers may:

Deduct no tax at all.

Deduct tax at a special rate.

Deduct ACC earners' levy only.

Deduct no student loan repayments.

Make PAYE deductions at a specific rate.

Deduct student loan repayments at a lower rate than the usual.

Note: Tax deductions are determined by employers using special tax code certificates. Employers can deduct student loan repayments at a different rate with a special deduction rate certificate. In some cases, the certificate may include both a special tax code and a special deduction rate for the employee's student loan.

The STC tax scales could be treated either as primary or secondary income according to legislation. In PeopleSoft you can define the primary and secondary incomes based on a variable TAX VR SL STC.

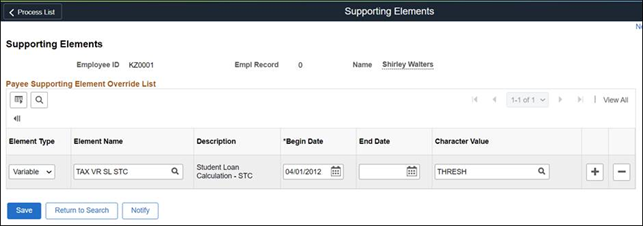

To calculate student loans, SLCIR, and SLBOR for STC tax scales, you need to enter the value "THRESH" in the Character Value field for primary income in the create override level for each employee as shown:

Primary Income

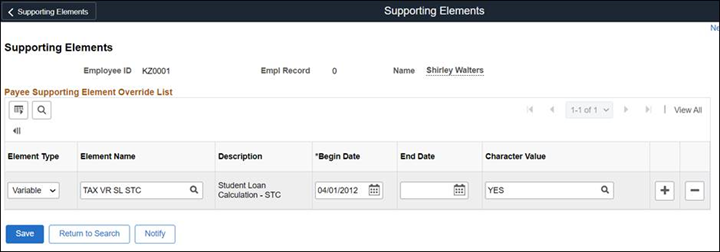

To calculate student loans, SLCIR, and SLBOR for STC tax scales, you need to enter the value "Yes" in the Character Value field for secondary income in the create override level for each employee as shown:

Secondary Income

IR331 - Withholding Tax Exempt

This group box appears only when you select WT or WT ND in the Tax Code is field.

Field or Control |

Description |

|---|---|

Exempt |

Select if the employee is exempt from withholding. You can only add a certificate number and expiry date if you have selected this check box. |

Certificate Number |

The system does not use the values in this field nor the value in the Expiry Date field: they are for information only. |

Note: There is no field to indicate if the payee is an employee or a contractor as this status is indicated by the tax code. You can indicate that a payee is a contractor in the Employee Class field on the payee's Job record.

Extra Emolument

Tax rate options are: Normal EE Rate (normal employee rate), Use Tax Rate 17.5%, Use Tax Rate 30%, and Use Tax Rate 33%.

When a value other than Normal EE Rate is selected, the formula that calculates the extra emolument tax (TAX FM XE TAX ) uses the higher of the selected rate and the employee’s normal rate.