Deducting Employee and Employer KiwiSaver Contributions

This section provides an overview of KiwiSaver calculations and retro pay and discusses how to enter employee KiwiSaver details.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPNZ_EE_KIW_DTL |

Enter employee KIWISaver contribution details when employees enroll in the KiwiSaver scheme, opt in, opt out, or elect a contribution holiday. |

KiwiSaver deductions are a fixed percentage of gross pay. To ensure that deductions are taken from retro pay, the system is configured to calculate deductions based on the delivered KIWI AC GROSS accumulator. This accumulator consists of just the NZL GROSS accumulator, which in turn has all regular earnings plus retro earnings.

Therefore, whenever there are retro changes to an employee's earnings, the deltas of the earnings are forwarded, and the KiwiSaver deductions are calculated on the combined gross (current gross + retro earnings).

The result of this configuration is that when a paycheck includes both regular pay and retro pay, there is only one KiwiSaver deduction, which is based on the combined gross. There are not separate KiwiSaver deductions for current earnings and retro earnings.

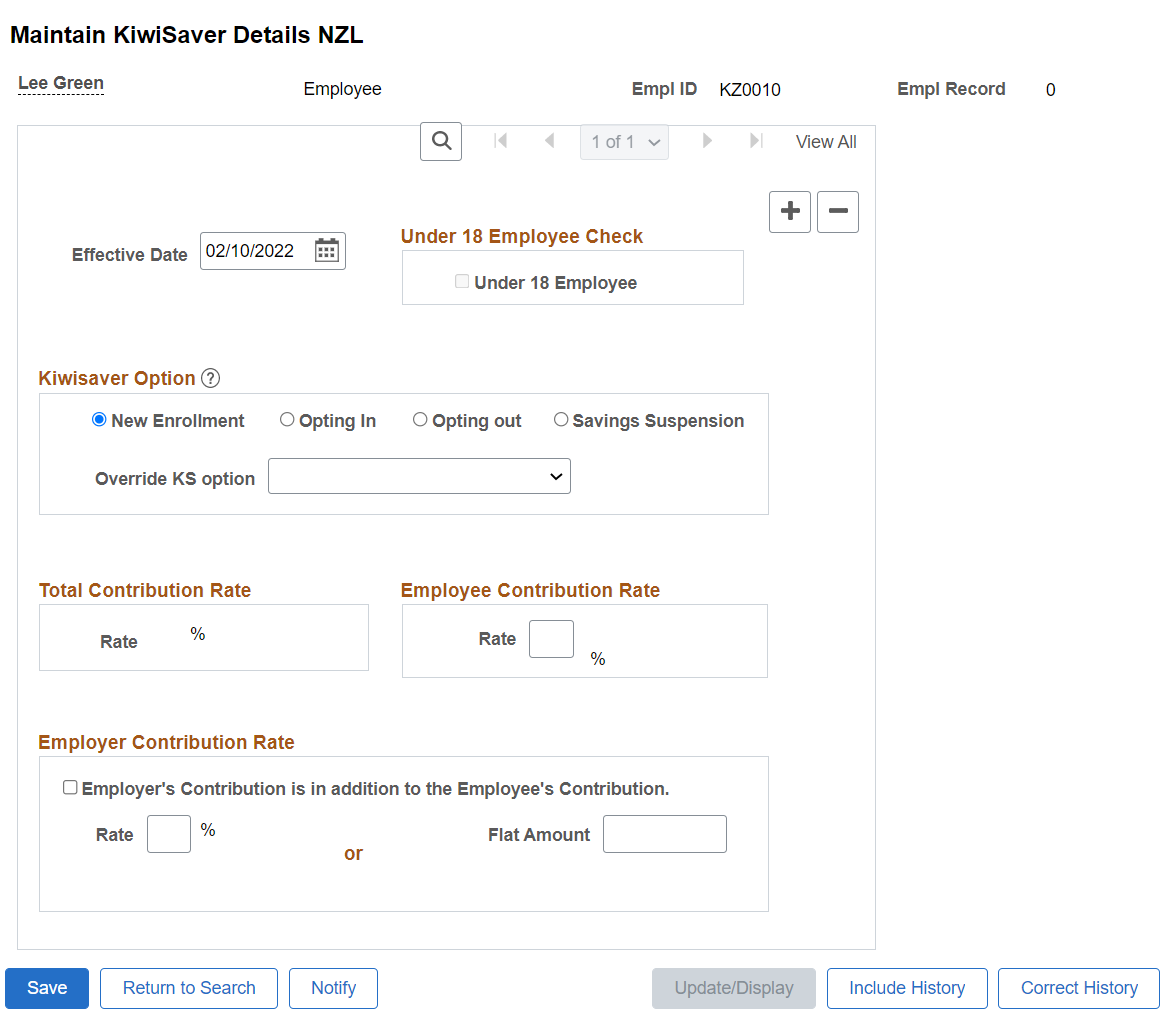

Use the Maintain KiwiSaver Details NZL page (GPNZ_EE_KIW_DTL) to enter employee KiwiSaver contribution details when employees enroll in the KiwiSaver scheme, opt in, opt out, or elect a contribution holiday.

Navigation:

This example illustrates the fields and controls on Maintain KiwiSaver Details NZL page.

Field or Control |

Description |

|---|---|

Under 18 Employee |

Indicates that the employee is under the age of 18. |

Kiwisaver Option

Indicate the reason you are entering or updating Kiwisaver details for the employee.

Note: It is your responsibility to verify that employees meets all IRD requirements for enrolling, opting in, opting out, or taking a contribution holiday. The system displays certain warning messages regarding these requirements, but does not verify employee eligibility or prevent you from saving.

Field or Control |

Description |

|---|---|

New Enrollment |

Select this option if the employee is a new hire and satisfies required criteria for automatic enrollment in the KiwiSaver scheme. The effective date for new enrollment should be the employee's hire date. |

Opt In |

Select this option when an employee who has not been contributing begins to contribute. Select this option if an employee does not satisfy the automatic enrollment criteria and hence has to be enrolled manually, or if an employee is reenrolling after a contribution holiday. |

Opt Out |

Select this option when an employee who has been contributing stops contributions. Note: The effective date of opting out should fall between the dates defined in the Employee file. |

Savings Suspension |

Select this option when an employee who has been contributing takes a contribution holiday (temporarily stops contributing). A savings suspension row is eventually followed by an opt in row. |

Opt Out Reason |

Select the opt out reason. Available options are:

Note: To enable this field, you need to select the Opting Out radio button and the effective date of Opt Out should be greater than 56 days from Hire or Re-hire date. |

|

Override KS Option |

Select the required value to override the KiwiSaver status for an employee at payee level. Available options are:

This value is applicable only for the PDR Employee file and will not be used for payroll calculation. |

Total Contribution Rate

Field or Control |

Description |

|---|---|

Rate |

Displays the sum of the employee contribution rate and any percentage-based employer contribution rate. |

Employee Contribution Rate

Field or Control |

Description |

|---|---|

Rate |

Employees can choose a contribution rate of either 2%, 4%, or 8%. |

Employer Contribution Rate

Field or Control |

Description |

|---|---|

Employer's Contribution is in addition to the Employee's Contribution |

Select this check box if the employer contribution is in addition to the contribution percentage that the employee chose, or deselect it to indicate that the employer contribution is being used to reduce the amount of the employee contribution. Selecting this check box does not reduce the employee's contribution. Instead, it indicates that the amount entered as the employee contribution rate has already been reduced by the amount of the employer contribution. The system uses this information when validating that the employee contribution meets required minimums. For example, if an employee signs up for a 4% contribution, and the employer is going to share the cost by contributing 2% (so that the employee only ends up contributing 2%), enter an employee contribution rate of 2%, an employer contribution rate of 2%, and deselect this check box. |

Rate or Flat Amount |

Enter the employer's contribution as either a percent of salary or as a flat amount. |

Process to Calculate the Correct Rate of Employer Superannuation Contribution Tax

To correctly process the rate of Employer Superannuation Contribution Tax (ESCT) in payroll calculation, the administrator must manually override the contribution rates.

For employees hired in the previous financial year, the administrator must override the variable TAX VR FIRST CAL to the value 1.00 before running the payroll for April (i.e, the first month of the new financial year).

For employees hired in the current financial year, the administrator must override the variable TAX VR SSCWT HIRRT to the required percentage of ESCWT deduction for the calendar in which the employee was hired. The same percent will be used to calculate the ESCWT amount.

For the rest of the already existing employees in the current financial year, the administrator must override two variables at payee level, namely: TAX VR SSCWT OVRRT and TAX VR SSCWT ALTRT.

Both the variables hold the value of Superannuation Contributions Withholding Tax (SSCWT) used for calculating SSCWT. TAX VR SSCWT OVRRT rate must equal the rate held in the variable TAX VR SSCWT ALTRT for to be used in tax calculation. Both the variables are used in the formula TAX FM SS FLAT RT and if required, must be entered against the employee at any of the specified override levels.