Integrating Global Payroll with General Ledger

To integrate Global Payroll with General Ledger, use the Chartfields (GP_GL_CHARTFLD), Element Groupings (GP_GL_GROUP), and Account Mapping (GP_GL_MAP) components.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_GL_CHARTFLD |

For a pay entity and business unit, select chartfields for allocating your costs to General Ledger accounts. |

|

|

GP_GL_GROUP |

For a pay entity and business unit, group similar earnings, deductions or accumulators so that they can be mapped to General Ledger accounts. Complete the ChartFields page first. |

|

|

GP_GL_MAP |

For a pay entity and business unit, map chartfields and grouping codes to a General Ledger account number. Define grouping codes first. |

|

|

GP_GL_DIST |

Override chartfield values at the Job level for an employee. Before using this page, you must define chartfield values on the ChartFields page. |

|

|

GP_PI_MNL_SEC |

Override the value of a chartfield for a particular instance of an element. |

See PeopleSoft General Ledger product documentation.

Integration points are interfaces between PeopleSoft applications. They enable the transfer of data from one database to another.

The Global Payroll and General Ledger interface uses integration points to retrieve account number and business unit information from General Ledger and to send payroll results to General Ledger.

Note: To research the technical details of an integration point that is used by PeopleSoft applications, see the Interactive Services Repository in the Implementation Guide topic of My Oracle Support.

Retrieving Account Data from General Ledger

When you set up the integration with General Ledger, Global Payroll must receive the following integration point messages:

ACCOUNT_CHARTFIELD_FULLSYNCH

BUS_UNIT_FS_FULLSYNC

BUS_UNIT_GL_FULLSYNC

JOURNAL_GEN_APPL_ID_FULLYSYNC

Later, as changes to account codes and business units are made in General Ledger, Global Payroll retrieves the changes by subscribing to the following integration point messages:

ACCOUNT_CHARTFIELD_SYNC

BUS_UNIT_FS_SYNC

BUS_UNIT_GL_SYNC

JOURNAL_GEN_APPL_ID_SYNC

Note: If you are using the standard chartfield configuration between PeopleSoft HCM and PeopleSoft FMS, you also need to run the import for those chartfields.

See PeopleTools: Integration Broker Testing Utilities and Tools product documentation.

Sending Payroll Results to General Ledger

The Global Payroll results integration point uses PeopleSoft Integration Broker to send payroll results to the Global Payroll Accounting Line Stage Record (GP_ACC_LINE_STG). The data is sent using the General Ledger Transaction Prep application engine process (GP_GL_PREP), and uses the Post Global Payroll to General Ledger batch rule (GP_POST_GL).

After Global Payroll sends the data, General Ledger can receive the data and incorporate it into its own data.

To set up Global Payroll for integration with General Ledger, you:

Synchronize Global Payroll and HR with your PeopleSoft Financials database.

To ensure that Global Payroll retrieves the correct account numbers and business units from the Financials database, activate and receive the following integration point messages: ACCOUNT_CHARTFIELD_FULLSYNCH, BUS_UNIT_FS_FULLSYNC, BUS_UNIT_GL_FULLSYNC, JOURNAL_GEN_APPL_ID_FULLYSYNC.

On the Business Unit Reference page, add a General Ledger Unit.

Indicate which system and variable elements can be used as chartfields:

For system elements, select the Use As Chart Field check box on the Source and Use page and select a prompt view. For variables, select the Use As Chart Field check box on the Variables - Definition page and select a prompt view.

On the <Element> Name page, select the Store check box.

Note: If you don't select the Store check box for an element, the GP_GL_PREP process won't store results for it in the Global Payroll Transaction Interface (GP_GL_DATA) record.

Include the chartfield elements in your payroll process list.

On the ChartFields page, select up to 21 chartfield elements that apply to a specific business unit and pay entity.

On the Element Groupings page, place earning, deduction, and segment accumulator elements into groups.

On the Account Mapping page, map the groups and chartfields to their corresponding General Ledger accounts.

The following diagram illustrates the General Ledger setup steps and batch process in Global Payroll.

Note: The Source and Use page, the Variable - Definition page, and the Element Name page are discussed previously in this product documentation.

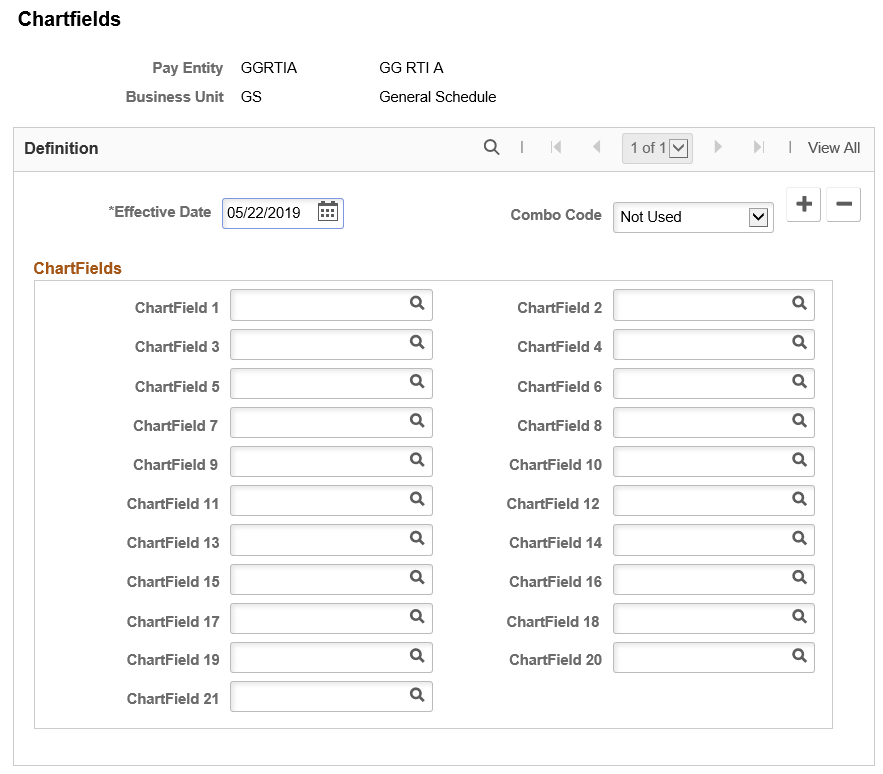

Use the ChartFields page (GP_GL_CHARTFLD) to for a pay entity and business unit, select chartfields for allocating your costs to General Ledger accounts.

Navigation:

This example illustrates the fields and controls on the ChartFields page.

Field or Control |

Description |

|---|---|

Combo Code |

Select an appropriate option against business unit or pay entity. Available options are:

|

Chart Fields

Select up to 21 chartfields for which you want Global Payroll to send values when you allocate costs to General Ledger accounts for this pay entity and business unit. You can select only from the system elements and variable elements that are designated as chartfields for the country of the pay entity that you selected to access this page.

Complete ChartField 1 through ChartField 21 in the order listed. You must list these fields in hierarchical order. Do not skip any fields.

Use the Element Groupings page (GP_GL_GROUP) to for a pay entity and business unit, group similar earnings, deductions or accumulators so that they can be mapped to General Ledger accounts.

Complete the ChartFields page first.

Navigation:

This example illustrates the fields and controls on the Element Groupings page.

A grouping code is an attribute of an earning, deduction, or accumulator element. Elements must be in groups before they can be processed by General Ledger.

Field or Control |

Description |

|---|---|

Grouping Code |

Enter a grouping code for the elements that you want included in the General Ledger transfer. Note: Instead of entering earnings individually, you can bundle them in one segment accumulator and create a grouping code for that accumulator. |

Earning, Deduction and Accumulator Elements

For each accumulator, deduction, or earning element to include in the group, select the entry type and element name.

Note: You can select accumulators only where Segment is defined as the accumulation period (on the Accumulator - Period page).

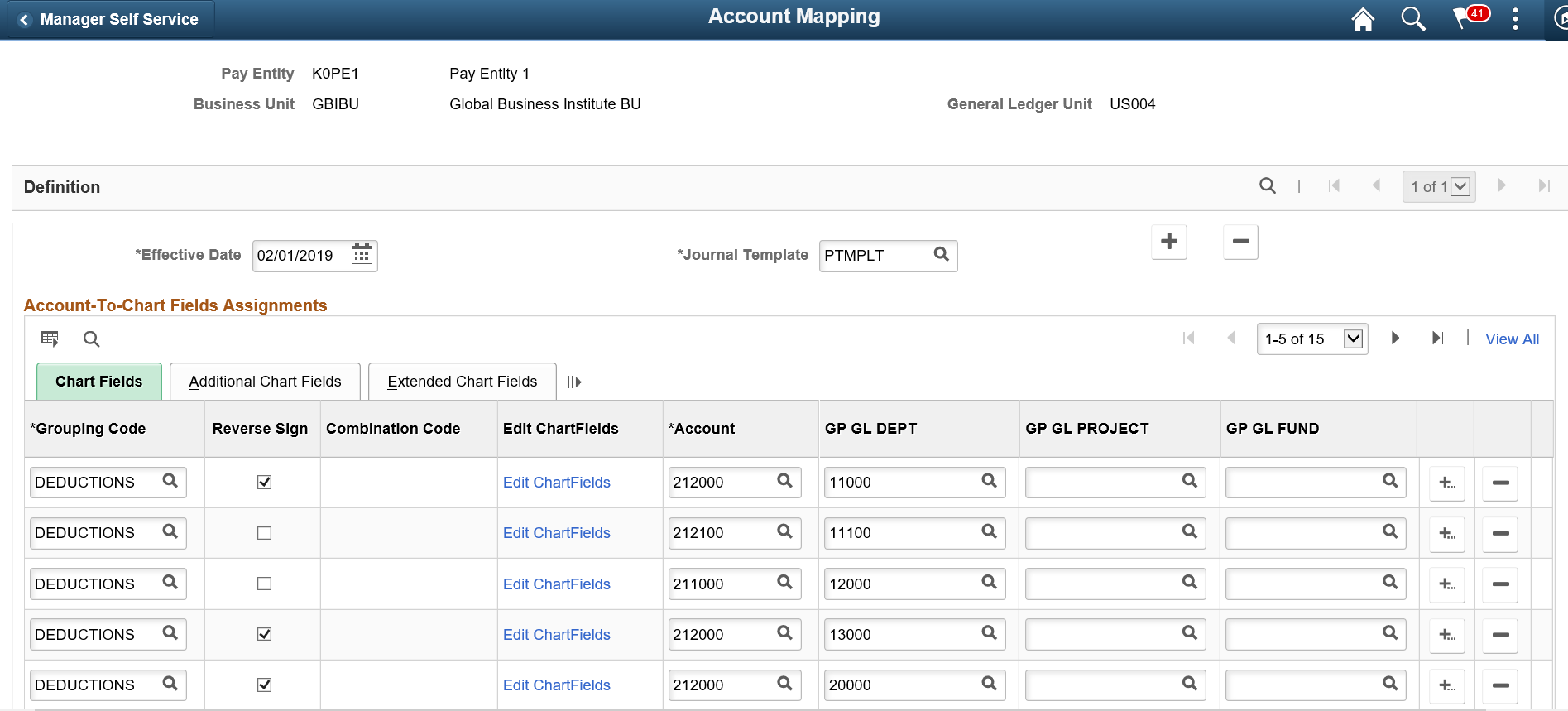

Use the Account Mapping page (GP_GL_MAP) to for a pay entity and business unit, map chartfields and grouping codes to a General Ledger account number.

Define grouping codes first.

Navigation:

This example illustrates the fields and controls on the Account Mapping page.

For an earning, deduction, or accumulator amount to be sent to General Ledger, you must map the combination of chartfield values that are associated with the amount to a General Ledger account.

Field or Control |

Description |

|---|---|

General Ledger Unit |

Displays the General Ledger unit that corresponds to the selected business unit (as defined on the Business Unit page in HR). |

Journal Template |

Select the journal template for this pay entity and business unit. Journal templates are defined in General Ledger. To send information to General Ledger, you should use the GLOBAL_PAY template. |

Chart Fields

Field or Control |

Description |

|---|---|

Grouping Code |

Select the code to map to the General Ledger account. |

Reverse Sign |

Select to post the transaction with the reverse sign. Typically, you use the reverse sign for net pay and deductions (so that the system records those transactions as credits rather than debits) and leave the sign untouched for earnings. |

Account |

Select the General Ledger account number to which the chartfields and grouping codes will map. |

Edit ChartFields |

Select the Edit ChartFields link to enter combination code. Note: The Edit ChartFields link is displayed only when the value selected in Combo Code in ChartField is either Optional or Required. |

<Element Name 1>, <Element Name 2>, and <Element Name 3> |

A field (column) appears for each chartfield that you selected on the ChartFields page. The column names match the prompt views that are identified on the Source and Use pages. Select the chartfield values to map to the General Ledger account. You can associate different sets of chartfield values with the same grouping code and General Ledger account combination. Note: Because variables are effective-dated, it's possible for the prompt table for a chartfield to contain a variable that is no longer designated as a chartfield or is currently inactive. You must manually remove invalid variables or substitute valid variables for invalid variables; there is no automatic updating to the mapping fields. Variables are listed after system elements in the prompt tables. If you associated multiple accounts with the same grouping code, you must enter distinct chartfields for each account. |

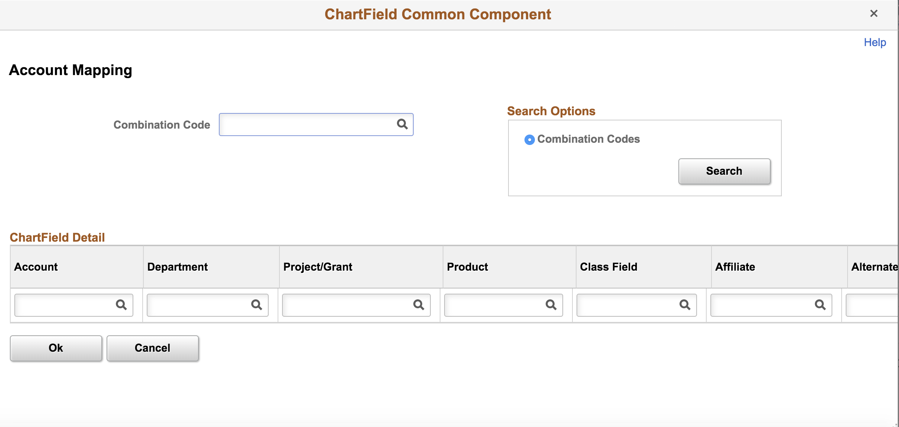

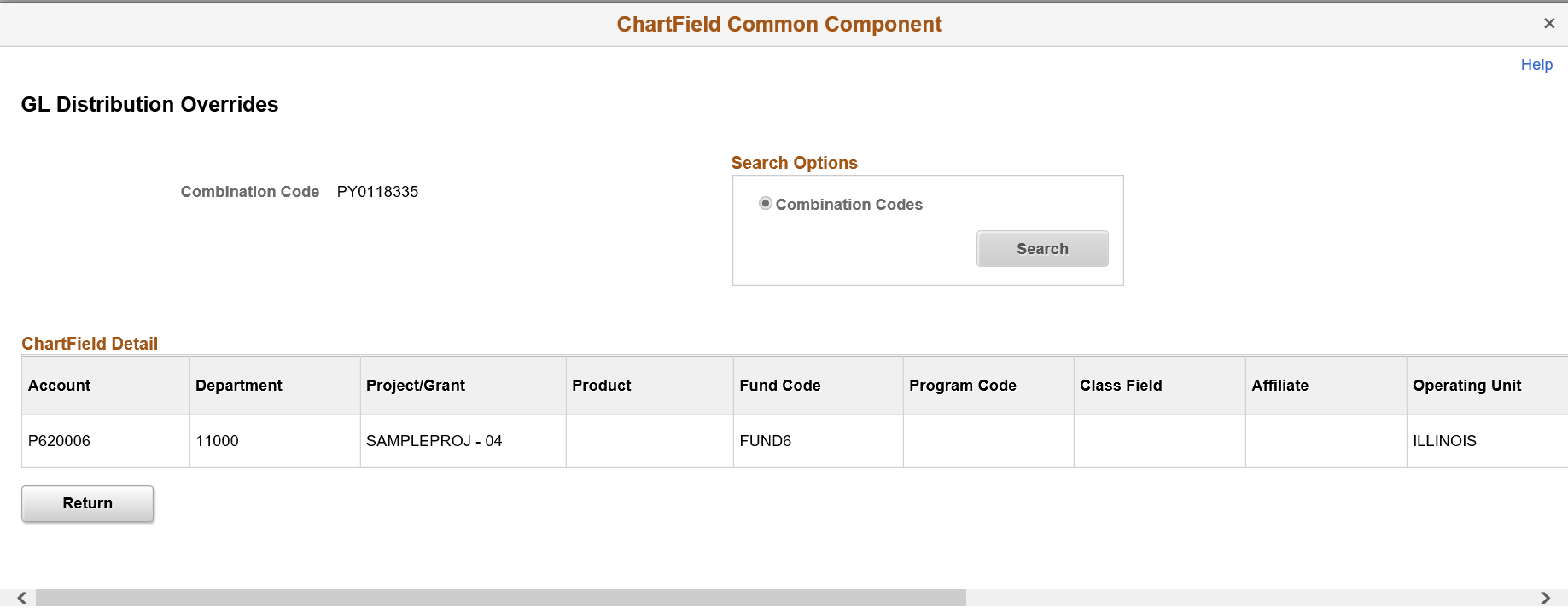

ChartField Common Component Modal Window

Use the Edit ChartFields modal window to enter combination codes. This is selected against valid combination code with Pay Entity and Business Unit.

For details, see Entering and Maintaining Valid ChartField Combinations

This example illustrates the ChartField Common Component modal window.

Setting Up Default Accounts

When an amount is associated with a combination of chartfield values that is not mapped to a General Ledger account, the system cannot send the amount to General Ledger. Setting up a default account is appropriate in some cases.

Let's say that you've set up the following information and that you have payees who work in departments A, B, C, and D:

|

Account |

Grouping Code |

ChartField (DEPTID) |

|---|---|---|

|

1 |

Earnings |

DEPT A |

|

2 |

Earnings |

DEPT B |

|

3 |

Deductions |

|

|

4 |

Deductions |

DEPT A |

|

5 |

Deductions |

DEPT B |

Because account 3 does not have a chartfield value assigned at the DEPTID level, it serves as the default for deductions that can't be charged to DEPT A or DEPT B. Deductions for payees who work in departments C and D are charged to account 3.

This default feature enables you to use a single row to assign numerous departments to the same account. However, because (in this example) no similar default account is set up for earnings, the earnings for payees in departments C and D are not charged to any account.

When mapping to accounts, be sure to set up either a default account or specific accounts for all earning, deduction, and accumulator elements that will be transferred to General Ledger accounts.

See PeopleSoft General Ledger product documentation.

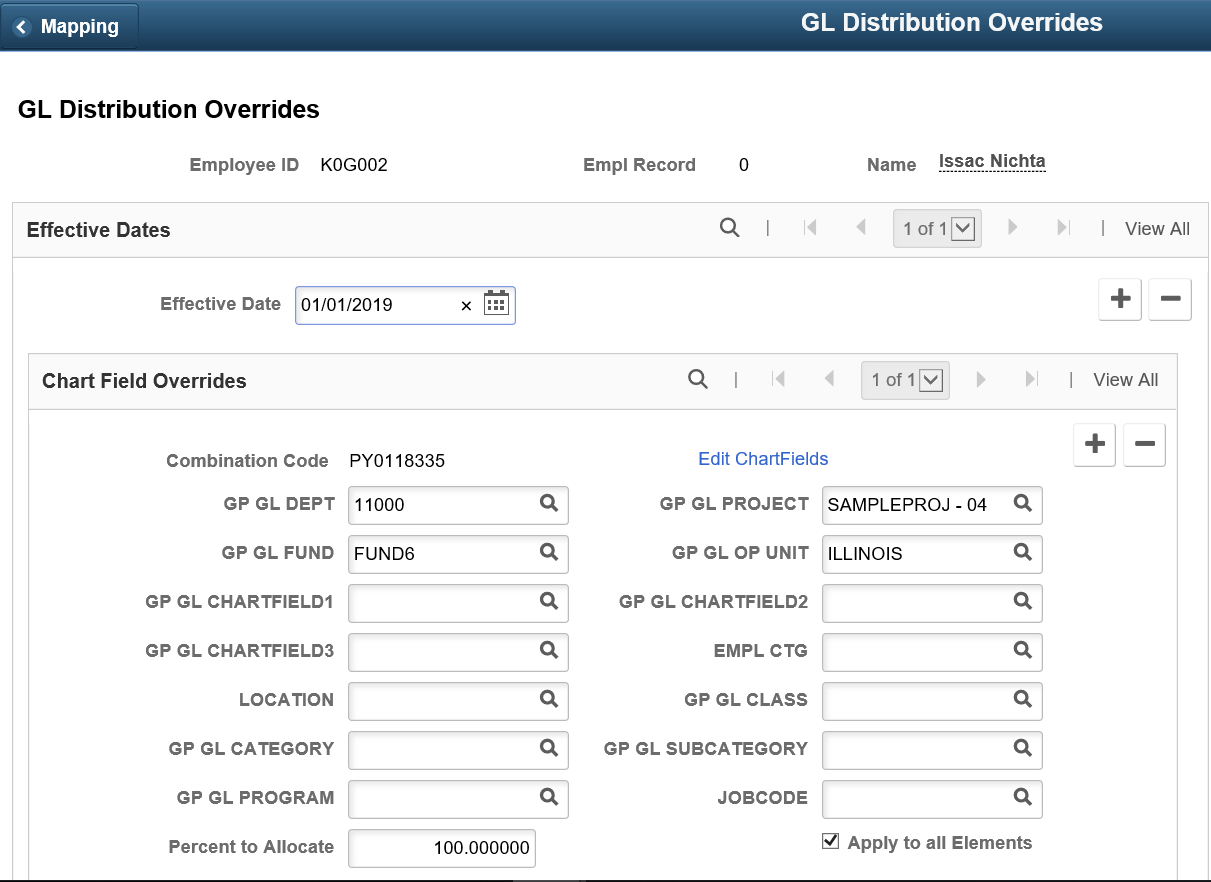

Use the GL Distribution Overrides page (GP_GL_DIST) to override chartfield values at the Job level for an employee.

Before using this page, you must define chartfield values on the ChartFields page.

Navigation:

This example illustrates the fields and controls on the GL Distribution Overrides page.

The data that you enter on this page overrides the values on the respective chartfields on the Job record or other source record.

Click Edit ChartFields link to enter combination code . This displays the ChartField Common Component modal window.

Note: The Edit ChartFields link is displayed only when the value selected in Combo Code in ChartField is either Optional or Required.

This example illustrates the ChartField Common Component modal window.

You can enter the required combination code. This is selected against valid Combination code with Pay Entity and Business Unit.

For details, see Entering and Maintaining Valid ChartField Combinations

Chart Field Overrides

Chart values 1−21 are enabled based on how many chartfields are defined for the pay entity and the business unit that the payee belongs to in this job. Field names match the prompt views that you selected for the chartfield elements.

Enter the chartfield values to use for the selected payee's job.

Field or Control |

Description |

|---|---|

Apply to all Elements |

Select to assign the same set of chartfield override values to all of the payee's earnings, deductions, and segment accumulators for this job. |

Overrides by Element

Designate the earning, deduction, and segment accumulators for which you want to override chartfield values. You can also specify the percentage of the earning, deduction, or accumulator amount that you want to take on the override values.

For example, an earning element named OVERTIME has a value of 1000. If you specify 25 percent to allocate for the OVERTIME element, the system associates the chartfield override values that you entered in the Chart Field Overrides group box with an earning amount of 250. You must then associate the default chartfield values with the remaining 75 percent.

Field or Control |

Description |

|---|---|

Percent to Allocate |

Specify the percentage of the payee's earnings, deductions, and segment accumulators to allocate to the selected chartfield values. For example, if a payee splits time between departments A and B, and you want to charge the cost to two departments:

|

Note: Do not allocate more than 100 percent to the same element.

Use the Positive Input - Details page (GP_PI_MNL_SEC) to override the value of a chartfield for a particular instance of an element.

Navigation:

Click Details on the Main Components tab of the Positive Input page.

Click Details on the Element Overrides tab of the Positive Input By Calendar page.