Setting Up Pension

This topic discusses how to set up the pension feature.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPGB_DEFPEN_SCHME |

Define a pension scheme and the corresponding contribution details. |

|

|

GPGB_QPNSH_DFLT |

Define the Qualifying Pension Scheme for a pay entity. |

|

|

GPGB_SET_EVNT |

Maintain events and the corresponding status for a pension applicant. |

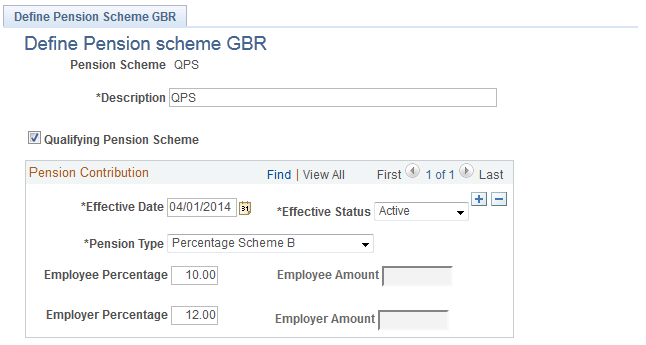

Use the Define Pension Scheme GBR page (GPGB_DEFPEN_SCHME) to define a pension scheme and the corresponding contribution details.

Navigation:

This example illustrates the fields and controls on the Define Pension Scheme GBR page.

The contribution details entered in the Pension Contribution grid is used to update payee data for the pension during the auto enrolment process.

Field or Control |

Description |

|---|---|

Pension Scheme |

Enter a pension scheme to identify it as either Qualifying Pension Scheme (QPS) or Non-Qualifying Pension Scheme (NQPS). |

Description |

Enter a description about the pension scheme. |

Qualifying Pension Scheme |

Select the check box to indicate that the pension scheme is a QPS. |

Pension Type |

Select one of the following pension types to define the format for contribution:

|

Effective Date |

Enter the date from which the pension scheme is effective. |

Effective Status |

Select the status of the pension scheme. |

Employee Percentage |

Enter the percentage of employee contribution for the pension. |

Employer Percentage |

Enter the percentage of employer contribution for the pension. |

Employee Amount |

Enter the amount of employee contribution for the pension. |

Employer Amount |

Enter the amount of employer contribution for the pension. |

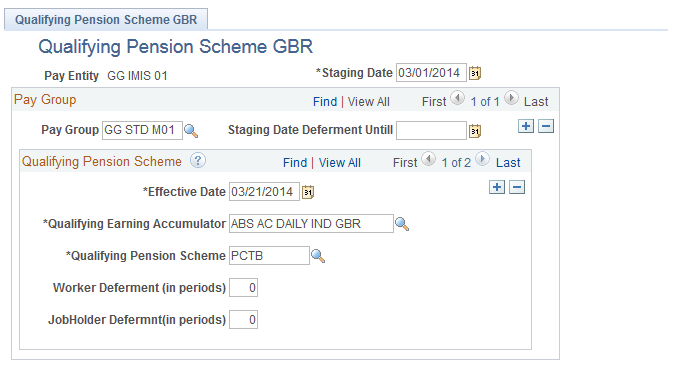

Use the Qualifying Pension Scheme GBR page (GPGB_QPNSH_DFLT) to define the Qualifying Pension Scheme for a pay entity.

Navigation:

This example illustrates the fields and controls on the Qualifying Pension Scheme GBR page.

Field or Control |

Description |

|---|---|

Pay Entity |

Indicates the pay entity to which the qualifying pension scheme will be mapped. |

Staging Date |

Enter the staging date defined for the employer. |

Staging Date Deferment Untill |

Enter an alternate staging date if the current staging date needs to be deferred. |

Effective Date |

Enter a base date to calculate the end date of worker/job holder deferment. |

Qualifying Earning Accumulator |

Enter the earning accumulator to be used by the auto enrolment batch process to validate against the qualifying earning thresholds. |

Qualifying Pension Scheme |

Enter the pension scheme to be mapped to the pay entity. |

Worker Deferment (in periods) |

This field is applicable for new employees in the organization. Enter a period value for the system to apply worker deferment (if available) for employees for whom either no event has been triggered or postponement has been triggered. |

JobHolder Defermnt (in periods) |

This field is applicable for the current employees in the organization. Enter a period value for the system to apply job holder deferment (if available) for employees for whom no event for postponement has been triggered. Note: The number of periods entered in the Worker Deferment (in periods) or JobHolder Defermnt (in periods) fields are used for the automatic enrolment batch process. For example, if worker deferment period is entered as ‘1’ for a monthly pay group then an employee is the worker deferred by 1 month from his hire date. Similarly, If a job holder deferment period is entered as ‘1’ for a weekly pay group then an employee is the job holder deferred by 1 week from his first eligibility date. |

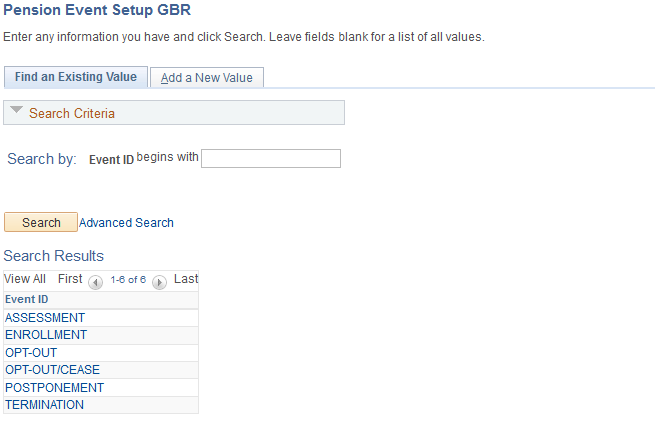

Use the Pension Event Setup GBR page (GPGB_SET_EVNT) to maintain events and the corresponding status for a pension applicant.

Navigation:

This example illustrates the fields and controls on the Pension Event Setup GBR search page.

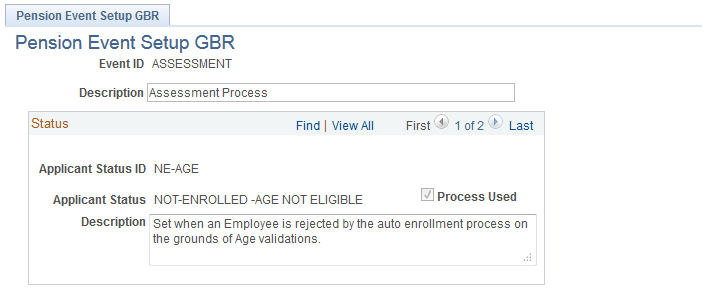

This example illustrates the fields and controls on the Pension Event Setup GBR page.

Whenever the auto enrolment process is run, the process updates the event and status corresponding to the process run date in the events table. The setup for the updates is defined in the Pension Event Setup GBR page.

The following table lists setup data available by default in the system. You can define your own events, statuses, and description but you need to ensure that the statuses are added to the automatic enrolment process.

|

Event ID |

Applicant Status |

Description |

|---|---|---|

|

ASSESSMENT |

NOT-ENROLLED -AGE NOT ELIGIBLE |

Set when an Employee is rejected by the auto enrollment process on the grounds of Age validations. |

|

ASSESSMENT |

NOT-ENROLLED -EARNING NOT ELIGIBLE |

Set when an Employee is rejected by the auto enrollment process on the grounds of Earning validations. |

|

ENROLLMENT |

AUTO ENROLLED |

Set when an Employee is auto enrolled. Conditions are as follows: 1. Age is 22 or older but less than State Pension Age 2. Earnings reach or exceed Automatic Enrollment Threshold. |

|

ENROLLMENT |

ENROLLED AS ELIGIBLE JOB HOLDER |

Set when Employee will be enrolled on check of an Opt-In flag in Pension Payee data. Conditions are as follows: 1. Age is 22 or older but less than State Pension Age 2. Earnings reach or exceed Automatic Enrollment Threshold. |

|

ENROLLMENT |

ENROLLED AS ENTITLED WORKER |

Set when Entitled Workers will be enrolled on check of an Opt-In flag in Pension Payee data Conditions are as follows: 1. Age is 16 or over but under 75 with earnings equal to and lesser than lower threshold for qualifying earnings. |

|

ENROLLMENT |

ENROLLED AS NON ELIGIBLE JOB HOLDER |

Set when Employee will be enrolled on check of an Opt-In flag in Pension Payee data. Conditions are as follows: 1. Age is 16 or over but under 75 with earnings above the lower threshold for qualifying earnings but less than or equal to the automatic enrollment threshold (Or) 2. Age is 16 or over but under 22 with earnings above the automatic enrollment threshold. (Or) 3. Age is State Pension Age or over but under 75 with earnings above the automatic enrollment threshold. |

|

ENROLLMENT |

SEIZED ENROLLED |

Set when Employee will be enrolled on check of an Opt-In flag in Pension Payee data Conditions are as follows: 1. Age is 16 or over but under 75 with earnings equal to and lesser than lower threshold for qualifying earnings. |

|

ENROLLMENT |

VOLUNTARY ENROLLED |

Set when Employee will be enrolled on check of an Opt-In flag in Pension Payee data. Conditions are as follows: 1. Age is 16 or over but under 75 with earnings above the lower threshold for qualifying earnings but less than or equal to the automatic enrollment threshold (Or) 2. Age is 16 or over but under 22 with earnings above the automatic enrollment threshold. (Or) 3. Age is State Pension Age or over but under 75 with earnings above the automatic enrollment threshold. |

|

OPT-OUT |

OPTED OUT FOR SEIZED MEMBERSHIP |

Set when an applicant has opted from the pension scheme and the applicant was enrolled under Status\Reason as Enrolled\ Seized Enrollment |

|

OPT-OUT |

OPTED OUT WITH REFUND |

Set when an Employee has opted out before the opt-out date defined from the pension scheme and the applicant was enrolled under Status\Reason as Enrolled\Auto Enrollment or Enrolled\ Voluntary Enrollment. |

|

OPT-OUT |

OPTED OUT WITHOUT REFUND |

Set when an Employee has opted out after the opt-out date defined from the pension scheme and the applicant was enrolled under Status\Reason as Enrolled\Auto Enrollment or Enrolled\ Voluntary Enrollment. |

|

OPT-OUT/CEASE |

CEASED |

Set when Employee is Ceased from an Active Membership. Refunds are not processed. |

|

OPT-OUT/CEASE |

OPTED-OUT |

Set when Employee is opted out of an Active Membership. Refunds are processed. |

|

POSTPONEMENT |

JOBHOLDER DEFERMENT |

Set when an Job Holder Deferment is applied. |

|

POSTPONEMENT |

STAGING DATE DEFERMENT |

Set when an Staging Date Deferment is applied. |

|

POSTPONEMENT |

WORKER DEFERMENT |

Set when an Worker Deferment is applied. |

|

TERMINATION |

TERMINATION |

Set when an employee is terminated. |

Note: For the values mentioned in the above table, the Process Used check box in the Pension Event Setup GBR page is selected. The check box appears in display-only mode. The auto enrolment process sets these events and statuses in the Pension Schemes and Pension Events grids in the Auto Pension Enrollment GBR page. However, the Payroll Administrator can add more events or statuses. Refer Auto Pension Enrollment GBR Page and Assign Scheme GBR Page.