Setting Up Calendars and Calendar Groups

This topic discusses how to set up calendars and calendar groups.

This topic provides UK-specific information for setting up calendars and calendar groups. For general information about setting up calendars, refer to the PeopleSoft Global Payroll product documentation.

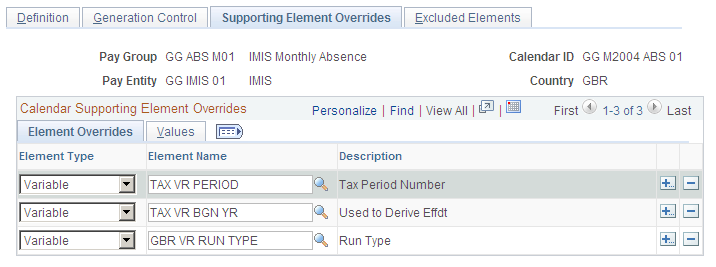

For UK payroll, calendars must have these overrides:

TAX VR PERIOD defines the tax period.

TAX VR BGN YR defines the year at the start of the tax year.

GBR VR RUN TYPE is REG for payroll or ABS for absence processing.

Note: You can set the GBR VR RUN TYPE to other values for supplementary or expenses processing.

See Defining Processing Elements for Supplementary Runs.

Here is an example of calendar overrides for the UK (select Set Up HCM, Product Related, Global Payroll and Absence Mgmt, Framework, Calendars, Calendars):

This example illustrates the fields and controls on the Supporting Element Overrides page.

The formula TAX FM EFFDT uses the TAX VR PERIOD and TAX VR BGN YR variables (and the frequency system element PRD FREQ NAME) to determine the tax effective date (TAX DT EFFDT). This is a key date that is used in the statutory tax and NI calculations.

The Tax Effective Date is required to ensure that payroll and statutory reporting are accurate. The year-to-date accumulators for tax and National Insurance are based on the date derived from TAX FM EFFDT. The TAX DT EFFDT date is derived from these variables that are populated by the TAX FM EFFDT formula:

TAX VR EFF DAY

TAX VR EFF MTH

TAX VR ADD YR

Note: An additional supporting element override may be required in the last period of the tax year to ensure that directors' NI is calculated on a cumulative basis in the final period. To indicate that a calendar is the last period of the tax year, add the variable TAX VR LAST PERIOD to the Supporting Element Override page and assign it the value Y. Directors' NI is explained in the Entering Statutory Tax and National Insurance Details topic.

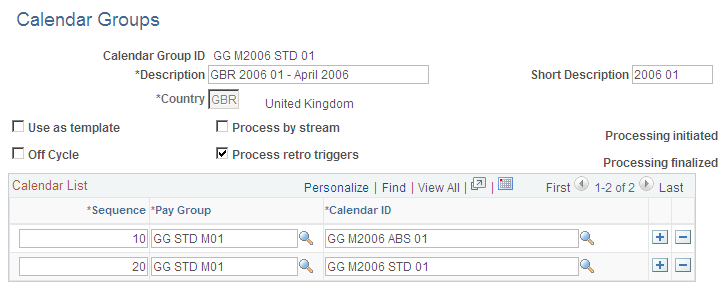

If you are setting up a calendar group to process both absence and payroll, set up two calendars, one for payroll and one for absence. When you define the absence calendar use the Target Calendar field on the Definition page to identify the payroll calendar in which the processed absence is paid.

This means that you must define the payroll calendar before you can define the absence calendar. Here is an example of a calendar group for the U.K (select Set Up HCM, Product Related, Global Payroll and Absence Mgmt, Framework, Calendars, Calendar Groups):

This example illustrates the fields and controls on the Calendar Group page.

The PeopleSoft Global Payroll product documentation explains how to set up calendar groups.