Setting Up Accumulators

This topic provides an overview of user keys and discusses how to:

Track separate periods of employment.

Track NI category changes.

Set up accumulator periods.

This topic provides UK-specific information for setting up accumulators. For general information about setting up accumulators, refer to the PeopleSoft Global Payroll product documentation.

User keys enable you to track balances at various levels. This is important in the UK for tracking:

Separate periods of employment.

Changes of NI category.

All court order accumulators have the following user keys:

User Key 1: Court Order Reference Number

User Key 2: Order Type

User Key 3: Region

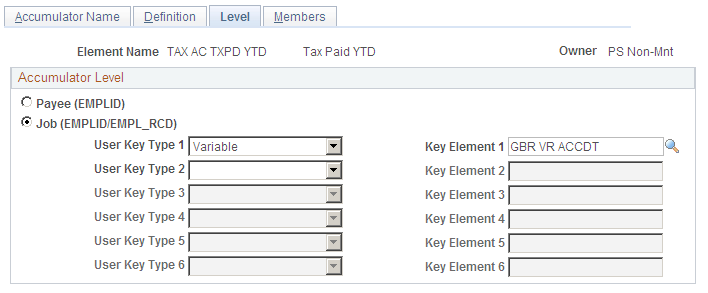

This example of the Accumulators - Level page () shows an accumulator defined with user keys:

This example illustrates an UK accumulator defined with user keys.

If an employee has a change of NI category code during the year, the Contributions Office expects to receive the amount of NI contributions for an employee for each category code.

To enable reporting on different category codes, the NI accumulators have User Key 2 defined as the value of the NI category code. This is captured in variable NI VR CATEGORY.

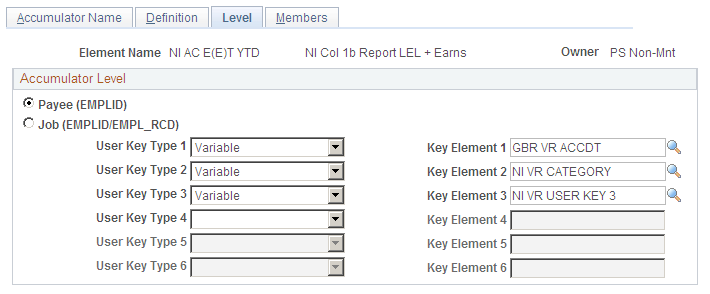

This example of the Accumulators - Level page () shows an accumulator defined with NI Category as a user key.

This example illustrates an UK accumulator defined with NI Category as a user key.

For the UK, statutory year to date accumulators:

Begin Option is Pay Entity Fiscal.

Pay Entity Fiscal year must be defined with a start date of April 6.

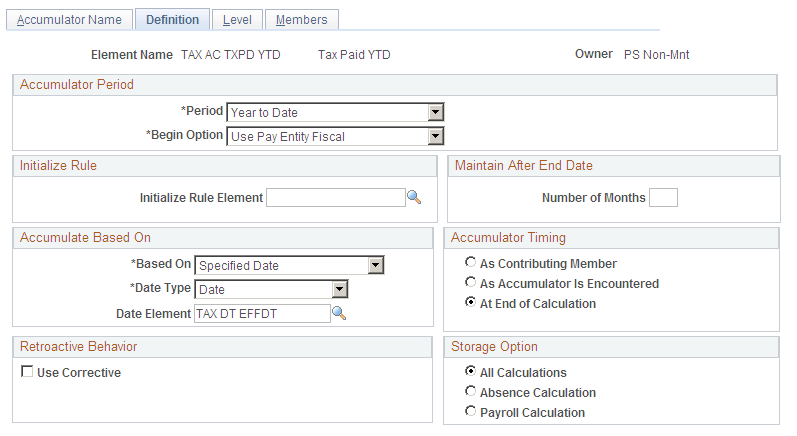

This example of the Accumulators - Definition page () shows an accumulator period setup:

This example illustrates an Accumulator Period setup.

Court Orders are not reported within statutory reports and therefore the fiscal YTD is not relevant. However to ensure that the Court Order balance can be calculated, accumulators are required to identify how much has been deducted to date. These accumulators use a Custom Period rather than Fiscal Year to Date.