Processing Final Payments

To define final payments, use the Final Payment USA (GPUS_FPMT) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPUS_FPMT |

Enter details about what elements to pay when a payee is terminated. |

|

|

GPUS_FPMT_PYE |

Assign a final payment definition to a payee. |

Final payment processing enables you to control which earnings and deductions are processed in a payee's termination pay run, and to settle outstanding balances that need to be collected from, or refunded to, a payee in the final payment.

To process a final payment for a payee:

Create a final payment definition on the Final Payment Definition page.

A final payment definition specifies:

Which earnings and deductions not to process. (By default, all pay elements are processed in the final pay run.)

Instructions for collecting outstanding goal balances for deductions.

Instructions for refunding deduction balances, such as for Employee Stock Purchase Plan (ESPP) deductions.

Assign the final payment definition to the payee on the Maintain Termination Data page.

Process the payee in either an on-cycle or off-cycle calendar.

Note: You may need to create more than one final payment definition, depending on business requirements.

Note: The processing of a final payment does not depend on whether the payee's JOB record has a termination row. A final payment can be created for someone who is still active in the system.

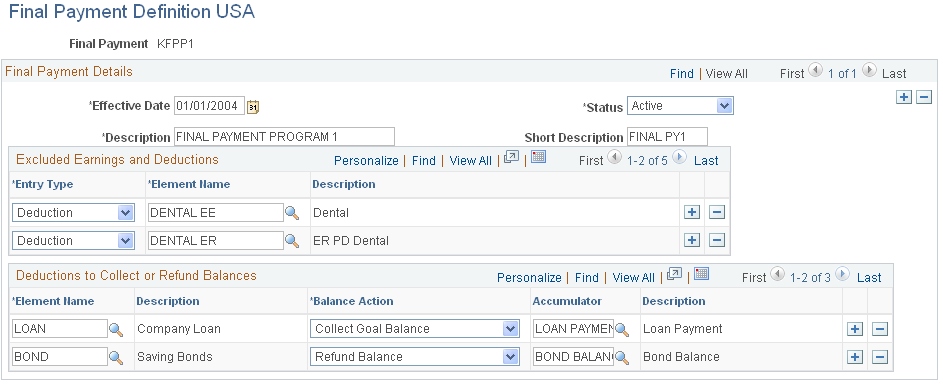

Use the Final Payment Definition USA page (GPUS_FPMT) to enter details about what elements to pay when a payee is terminated.

Navigation:

This example illustrates the fields and controls on the Final Payment Definition USA page.

Excluded Earnings and Deductions

In this group box, indicate which earnings and deductions not to process.

Field or Control |

Description |

|---|---|

Entry Type |

Specify the type of element to exclude from the payroll process. Valid values are Earnings and Deduction. |

Element Name |

Enter the name of the element to exclude from the payroll process. |

Note: If an element is listed in this group box and positive input exists, positive input takes priority.

Deductions to Collect or Refund Balances

In this group box, identify the deductions that have goal balances that you want to collect or refund.

Field or Control |

Description |

|---|---|

Element Name |

Enter the name of the deduction element with the balance to collect or refund. Note: Any deduction can be entered, whether it has a goal balance or not. If a deduction is entered with no goal balance, then no special processing will occur for that element. If an element is entered and positive input exists, positive input takes priority. |

Balance Action |

Select the balance action. Valid values are:

|

Accumulator |

Specify the accumulator that holds the balance to collect or refund. |

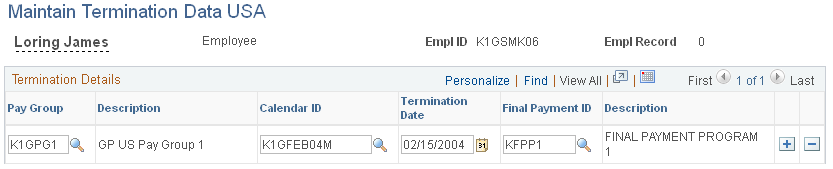

Use the Maintain Termination Data USA page (GPUS_FPMT_PYE) to assign a final payment definition to a payee.

Navigation:

This example illustrates the fields and controls on the Maintain Termination Data USA page.

Field or Control |

Description |

|---|---|

Pay Group |

Identify the pay group containing the payee to whom to are assigning the final payment definition. |

Calendar ID |

Identify the calendar you are using to process the final payment. |

Termination Date |

Enter the termination date (final payment date). Note: This component does not update the payee's JOB record with termination data. The termination must be defined separately in the JOB record. |

Final Payment ID |

Identify the final payment definition to assign to the payee. Final payment definitions are created on the Final Payment Definition page. |

Note: You can also assign final payment definitions at the pay entity, pay group, and calendar levels using supporting element overrides. To do this, define the value of the variable that stores the final payment definition - FNL PAY DEFN - at one of these levels.