Federal Tax Calculation

This topic discusses how to:

Calculate federal tax.

Calculate FWT.

Calculate OASDI.

Calculate Medicare tax.

Calculate FUTA.

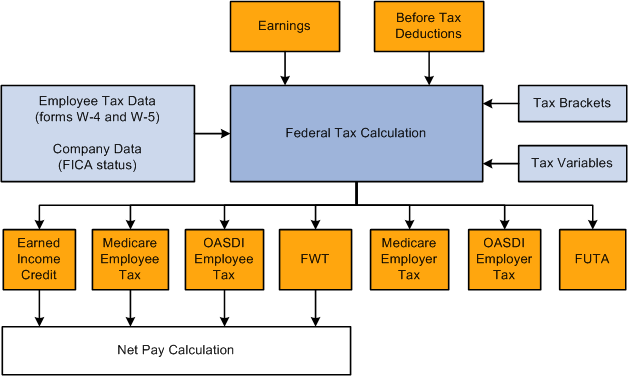

This diagram illustrates the flow of federal tax calculation:

This diagram illustrates the flow of federal tax calculation.

This diagram presents an overall view of the calculation of federal income tax. It shows how the system uses employee data, company data, earnings, deductions, and supporting elements to calculate the various federal taxes and credits for payees and employers. The system then uses the taxes and credits calculated for payees to calculate net pay.

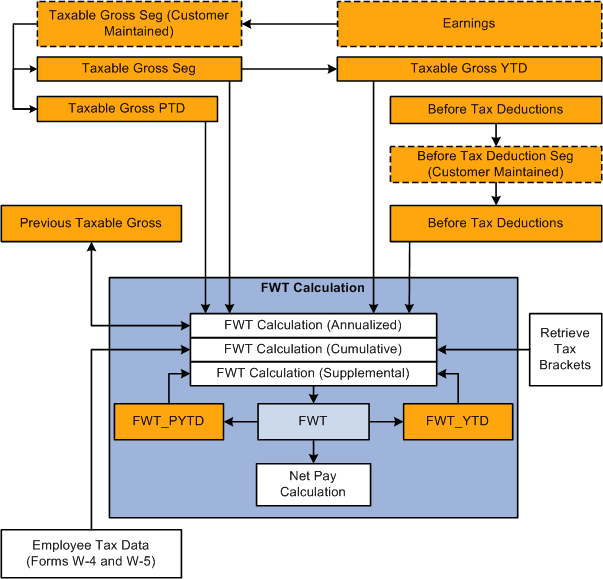

This diagram illustrates the flow of FWT calculation:

This diagram illustrates the flow of FWT calculation.

The system calculates FWT as a deduction (FWT) using the formula TAX FM FWT. The system includes this deduction in net pay calculation.

The calculation has three phases, based on tax method:

Annualized

Cumulative

Supplemental (aggregate/percent)

The calculations are based on the bracket TAX BR FWT RATES, which contains the tax rates and set of variables that store key values such as exemption allowances and supplemental wage rate.

Note: The default tax method is annualized. You can override the method that the system uses to calculate FWT.

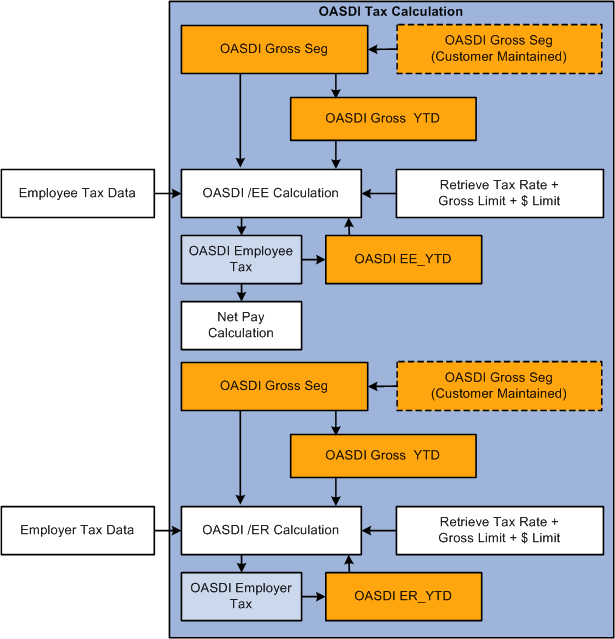

This diagram illustrates the flow of the OASDI calculation:

This diagram illustrates the flow of the OASDI calculation.

The system calculates OASDI employee tax as a deduction (OASDI EE) using the formula TAX FM OAS EE. The system includes this deduction in the net pay calculation. The calculations are based on a set of variables that store key values such as gross limits, tax rates, and payment limits for OASDI. Year-to-date OASDI tax for a payee is stored in the OASDI EE YTDA accumulator. The system then refers to this accumulator to enforce the yearly OASDI limit during calculation.

The system calculates OASDI employer tax as a deduction (OASDI ER) using the formula TAX FM OAS ER. Because this deduction applies only to employers, the system does not include it in net pay calculation. The system stores year-to-date OASDI employer tax in an accumulator (OASDI ER YTDA), just as it does for year-to-date OASDI employee tax. Likewise, the system uses the accumulator to enforce yearly limits on OASDI employer tax.

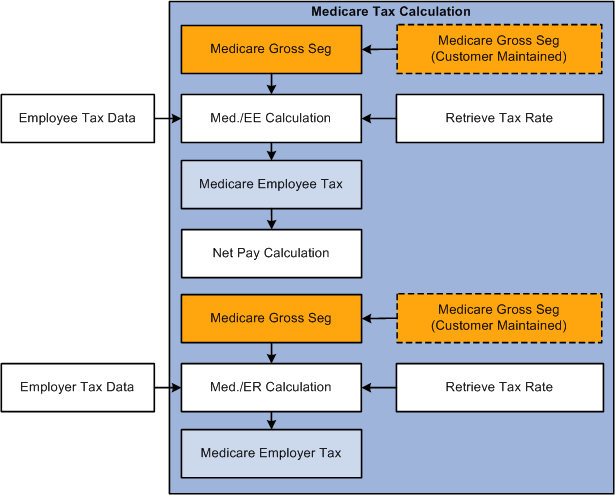

This diagram illustrates the flow of Medicare tax calculation:

This diagram illustrates the flow of Medicare tax calculation.

The system calculates Medicare employee tax as a deduction (MEDICARE EE) using the formula TAX FM MED EE. The system includes this deduction in net pay calculation. The calculations are based on a variable that stores the tax rate for Medicare.

The system calculates Medicare employer tax as a deduction (MEDICARE ER) using the formula TAX FM MED ER. Because this deduction applies only to employers, the system does not include it in net pay calculation.

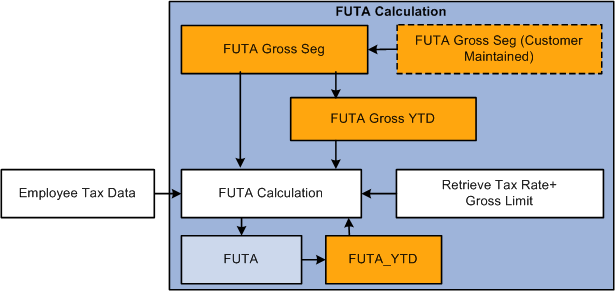

This diagram illustrates the flow of FUTA calculation:

This diagram illustrates the flow of FUTA calculation.

The system calculates FUTA as a deduction (FUTA) using the formula TAX FM FUT. The system includes this deduction in net pay calculation. The calculations are based on a variable that stores the tax rate for FUTA.

Year-to-date FUTA for a payee is stored in the FUTA_YTDA accumulator. The system then refers to this accumulator to enforce the yearly FUTA limit during calculation.