Creating IR8A/IR8S Amendments

Amendment of IRAS submission is required when there is a change to the submitted amount or the field affecting the total amount of employment income. Amendment record also needs to be created when there is an error in employee ID number. You can modify the record before and after the actual submission to the IRAS.

Use the Create IR8A/IR8S Form page to modify the record before the actual submission to the IRAS. To create amendment record:

Run the Create IR8A/IR8S Tax Forms process using the Create IR8A/IR8S Form page to create the amended IR8A/8S data for the required year for the eligible employees.

Print the IR8A/IR8S amended forms.

Generate Amendment file.

Submit the Amended file to IRAS after successful validation.

Note: You need to select the form type as ‘Amendment’ before running the Create and Print processes.

To modify the record after the actual submission to the IRAS, use the IR8A/8S Amendment Data SGP page. Amendment data is also maintained using the same page.

Note: You can create multiple amendments for the same employee on different dates. System store the data and sum up the values of all the records with “Awaiting Issue” status for generating amendment file.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPSG_IR8A_AMD_DTLS |

Use to maintain the personal data of the employee for whom the amendment record is created. |

|

|

GPSG_IR8A_AMD_INCM |

Use to update the amendment data for earnings to be reported under IR8A. |

|

|

GPSG_IR8A_AMD_DEDS |

Use to update the amendment data for deduction and CPF related data to be reported under IR8A. |

|

|

GPSG_IR8S_AMD_DTLS |

Use to update the amendment data to be reported under IR8S. |

Note: The text fields and date fields cannot be amended using this amendment file submission. The details should be emailed to IRAS.

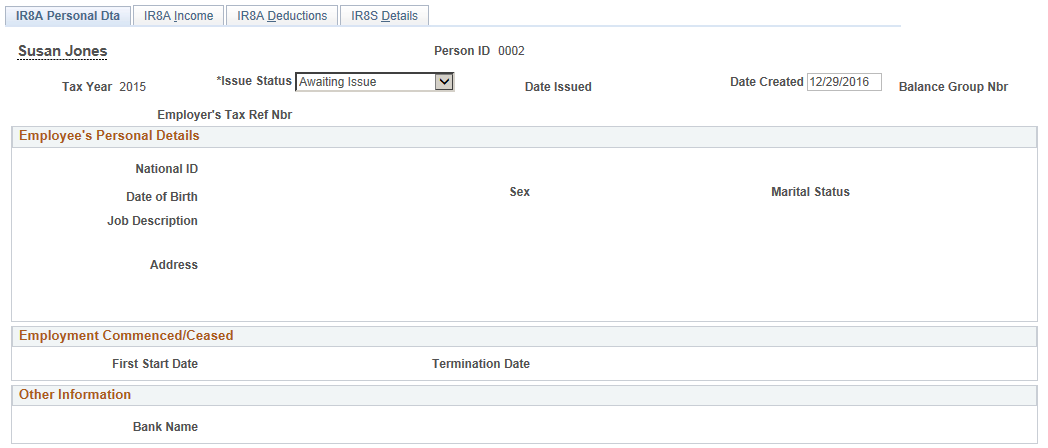

Use the IR8A Personal Data (GPSG_IR8A_AMD_DTLS) page to be view the personal details of the employee for whom the amendment record is created.

Navigation:

This example illustrates the fields and controls on the IR8A Personal Data page.

Field or Control |

Description |

|---|---|

Issue Status |

The status of the amendment data will be ‘Awaiting Issue’ until the generation of amendment file. After the amendment form is generated, the issue status will be changed to ‘Issued’ by the system. If you need to correct the history, change the record issue status manually (back to “Awaiting”) and regenerate the amendment file. |

Date Created |

Displays the date on which the amendment data is created. If you create amendment data again for the same employee on another date, system will sum up the values of all the records with “Awaiting Issue” status for generating amendment file |

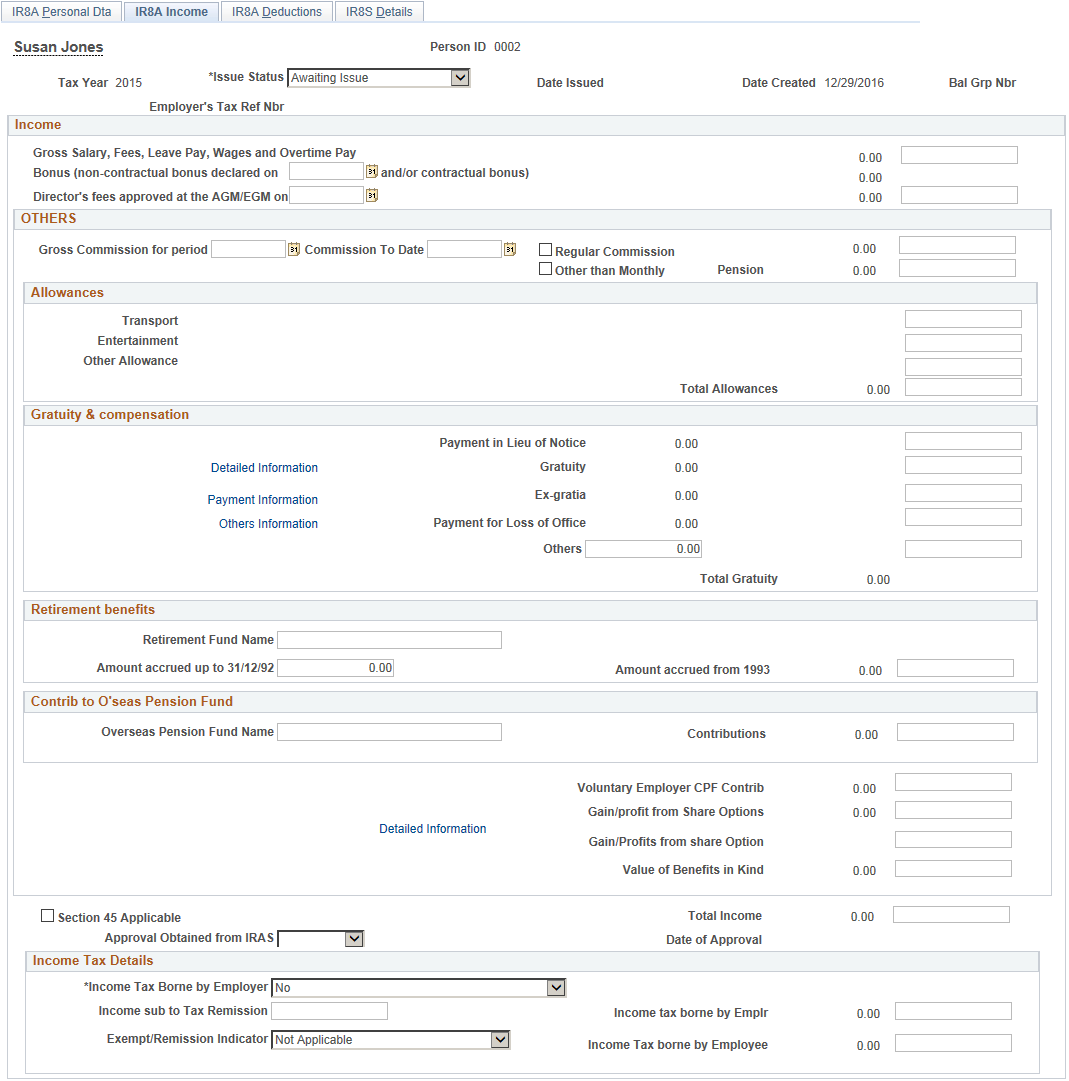

Use the IR8A Income (GPSG_IR8A_AMD_INCM) Page to update the amendment data for earnings to be reported under IR8A.

Navigation:

This example illustrates the fields and controls on the IR8A Income page.

Income

Field or Control |

Description |

|---|---|

Gross Salary, Fees, LeavePay, Wages and Overtime Pay |

Enter the updates on Gross Salary, Fees, LeavePay, Wages and Overtime Pay |

Bonus (non contractual/contractual bonus declared on |

Enter a date within the same year as the original date for updating bonus related amendment. |

Director’s fees approved at the AGM/EGM on |

The date on which the payment of director's fees is approved. Enter a date within the same year as the original date. |

Others

Field or Control |

Description |

|---|---|

Regular Commission |

If this checkbox is left blank in the original submission, this information can be overwritten in the amendment submission. But, if the indicator was selected previously, this cannot be amended in the submitted record. The details should be emailed to IRAS. |

Other than Monthly |

If this checkbox is left blank in the original submission, this information can be overwritten in the amendment submission. But, if the indicator was selected previously, this cannot be amended in the submitted record. The details should be emailed to IRAS. |

Allowances

Use Allowances section to enter the changes on transport, entertainment and other allowances.

Gratuity and Compensation

Use Gratuity and Compensation section to enter gratuity related changes.

Field or Control |

Description |

|---|---|

Detailed Information |

Use this link to view more information on gratuity compensation. |

Payment Information |

Use this link to view the reason and basis of payment for loss at office. |

Other Information |

Use this link to view additional details on reason of payment. |

Note: Text fields cannot be amended using the amendment file submissions.

Retirement Benefits

Use this section to enter the changes on retirement benefits.

Contribution to Overseas Pension Fund

Use this section to enter the changes on overseas pension fund contributions.

Field or Control |

Description |

|---|---|

Detailed Information |

Use this link to view more information on gratuity compensation. |

Section 45 Applicable |

Select this check box if section 45 is applicable for the employee. Note: If this checkbox is left blank in the original submission, this information can be overwritten in the amendment submission. But, if it was selected previously, this cannot be amended in the submitted record. The details should be emailed to IRAS. |

Approval Obtained from IRAS |

Select from the following list:

Note: If the field was left blank in the original submission, this information can be overwritten in the amendment submission. But, if it was selected previously, this cannot be amended in the submitted record. The details should be emailed to IRAS. |

Income Tax Details

Use this section to enter the changes on income tax details.

Field or Control |

Description |

|---|---|

Income Tax Borne by the Employer |

Select from the following options:

Note: If the field is left blank in the original submission, this information can be overwritten using the amendment submission. But, if it was selected previously, this cannot be amended in the submitted record. The details should be emailed to IRAS. |

Exempt/Remission Indicator |

Select from the following options:

By default, Not Applicable is selected. Note: If this field is left blank in the original submission, this information can be overwritten using the amendment submission. But, if it was selected previously, this cannot be amended in the submitted record. The details should be emailed to IRAS |

Approval Obtained from IRAS |

Select from the following list:

Note: If this field is left blank in the original submission, this information can be overwritten using the amendment submission. But, if it was selected previously, this cannot be amended in the submitted record. The details should be emailed to IRAS. |

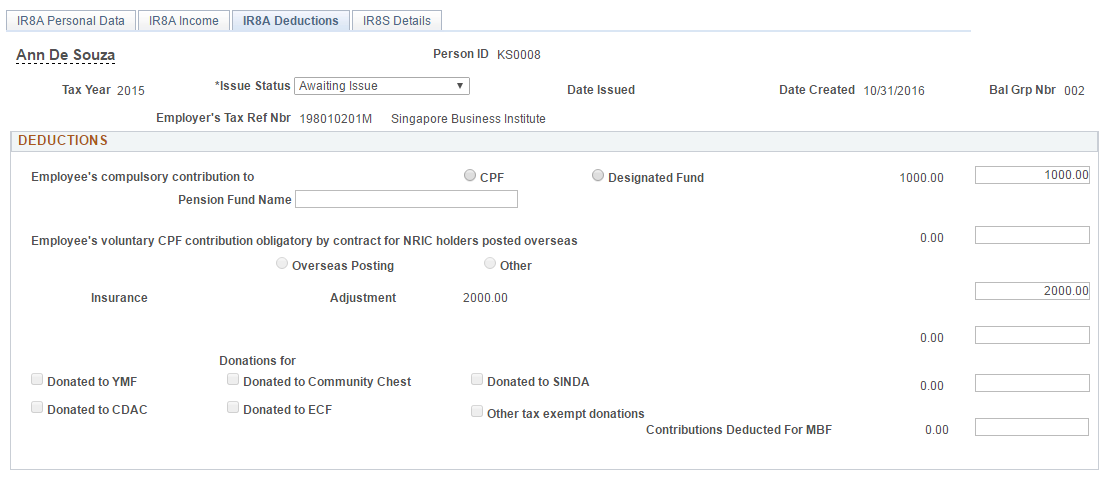

Use the IR8A Deductions Page to update the amendment data for deduction and CPF related data to be reported under IR8A

Navigation:

This example illustrates the fields and controls on the IR8A Deductions page.

Field or Control |

Description |

|---|---|

Employee's compulsory contribution to and Fund Name |

Select the CPF option if the employee has CPF contributions, and the Fund Name field displays C.P.F. When the employee has no CPF contribution, the Designated Fund option is available for selection. Note: If a checkbox is left blank in the original submission, this information can be overwritten in the amendment submission. But, if it was selected previously, this cannot be amended in the submitted record. The details should be emailed to IRAS |

Employee's voluntary CPF contribution obligatory by contract for NRIC holders posted overseas |

This total includes year-to-date contributions of all voluntary CPF (employee voluntary contributions) that are obligatory by contract of employment in respect of NRIC holders who are posted overseas. It includes the values from the accumulators for the category IR8A employee voluntary CPF when the employee has a value of Y set for the variable IRS VR OVERSEAS on the Payee Supporting Elements record (GP_PAYEE_SOVR). Note: If a checkbox is left blank in the original submission, this information can be overwritten in the amendment submission. But, if it was selected previously, this cannot be amended in the submitted record. The details should be emailed to IRAS |

Donations For Donated to YMF, Donated to Community Chest, SINDA, CDAC, ECF, and Other tax exempt donations |

The total donations that are deducted through salaries includes year-to-date deductions for all of the following deduction elements; MBMF, SINDA, SHARE (also known as Community Chest), CDAC and ECF. If the check box is selected for these deductions, this indicates that deductions were taken during the year. It includes the values from the accumulators for the categories IR8A MBMF, IR8A Community Chest donations, IR8A SINDA, IR8A CDAC, IR8A ECF and IR8A other tax exempt donation. Note: If a checkbox is left blank in the original submission, this information can be overwritten in the amendment submission. But, if it was selected previously, this cannot be amended in the submitted record. The details should be emailed to IRAS |

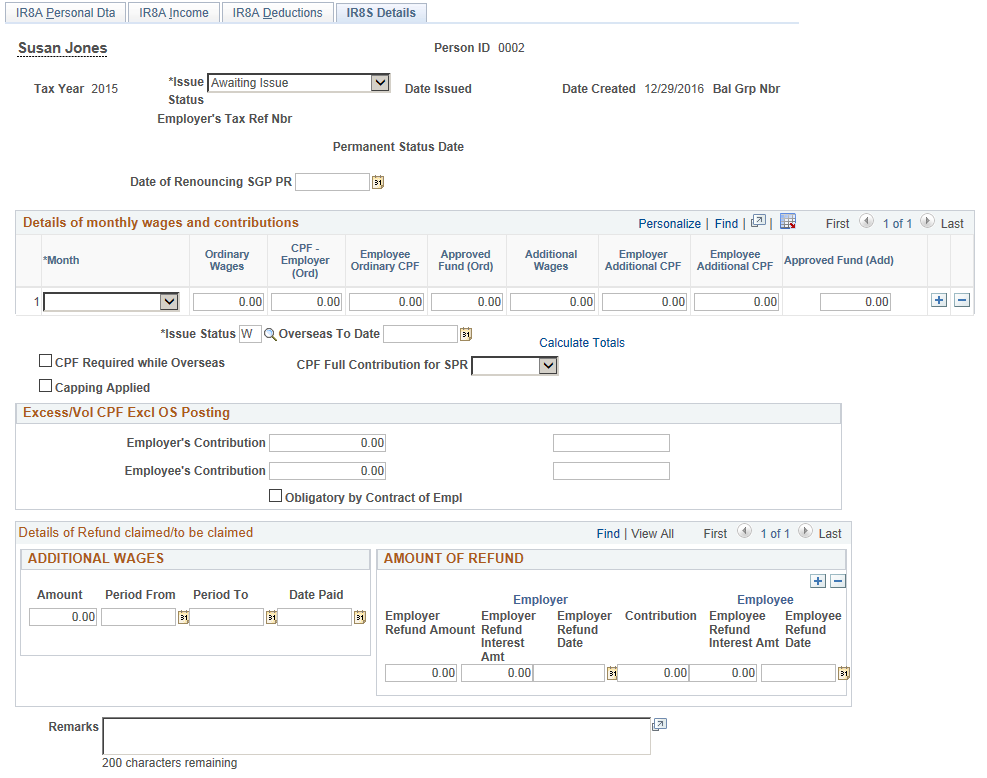

Use the IR8S Details Page to maintain and update the amendment data for earnings, deduction and CPF related data to be reported under IR8S.

Navigation:

This example illustrates the IR8S Details page

Note: When you amend amount fields in IR8S that affect amount in IR8A (If the changes to the amount fields affect the amount for the field “Excess contribution to CPF made by employer” )an amendment record should be submitted for both the IR8A and the IR8S forms.