Implementing Professional Tax Framework

Global Payroll for India PeopleSoft supports on implementing the Professional Tax framework by setting up the legislative deduction according to the State Government slabs, while processing payroll.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_BRACKET3 |

Define the brackets for professional tax calculations. The brackets are:

|

|

|

GP_VARIABLE |

Helps to trigger the professional tax calculation using the new professional tax setup. |

|

|

GPIN_PT_SETUP |

Define the key elements to calculate the professional tax for each state. |

|

|

PSXLATMAINT |

to maintain translate values. |

|

|

GPIN_PT_SETP_SLABS |

Define the salary range for calculating professional tax along with any other additional tax. |

|

|

GPIN_TDS_GEN |

Update the employee specific tax details. The PT VR ENABLE N PT variable is enabled to view the updated page. |

|

|

GPIN_PR_RC |

To generate the professional tax report |

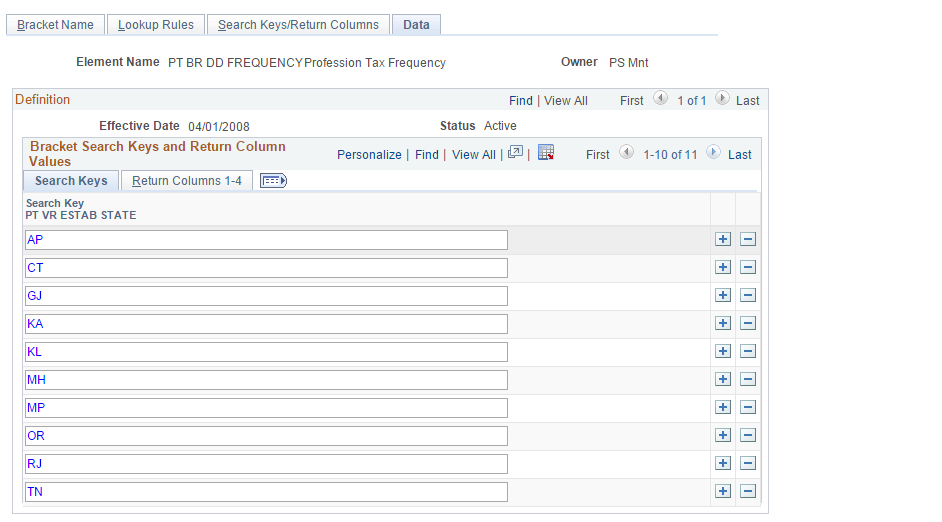

Use Brackets Pages to define the brackets for professional tax calculations. There are two brackets:

PT BR DD FREQUENCY

PT BR STATE RATES

The PT BR DD FREQUENCY bracket stores the deduction frequency data for each state codes.

Navigation:

.

This examples illustrate the fields and controls of the Search Keys tab in Brackets — Data page.

The fields represent the nine states which are supported by the system.

Field or Control |

Description |

|---|---|

AP |

Andhra Pradesh |

CT |

Chandigarh |

GJ |

Gujarat |

KA |

Karnataka |

KL |

Kerala |

MH |

Maharashtra |

MP |

Madhya Pradesh |

OR |

Odisha |

RJ |

Rajasthan |

TL |

Tamil Nadu |

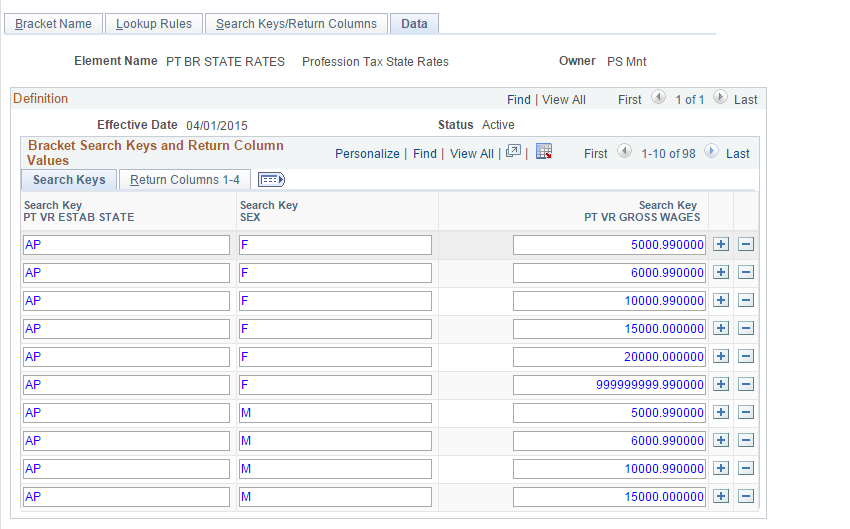

The PT BR STATE RATES stores the professional tax rates against the income slab for each state.

Note: The bracket PT BR DD Frequency supports Annual and Monthly PT ( Professional Tax) deduction. For states Tamilnadu and Kerala, where the PT needs to deducted in semi annual basis, use separate formula PT FM SA D along with PT FM SA GC to calculate the month of PT deductions.

Navigation:

.

This example illustrates the fields and controls of the Return Columns tab in Brackets — Data page

Field or Control |

Description |

|---|---|

Return ColumnPT BR DD FREQUENCY |

Represents the first alphabet of the state codes. |

Return ColumnPT BR MONTH1 |

Enter the variable that represents the first month in which the professional tax is getting deducted. |

Return ColumnPT BR MONTH2 |

Enter the variable that represents the second month in which the professional tax is getting deducted. For example, if PT BR MONTH1 is 9 and PT BR MONTH2 is 3, then the first tax deduction happens in the September and the second deduction happens in March. |

The PT BR STATE RATES stores the professional tax rates against the income slab (lower limit and upper limit) for each state.

Navigation:

.

This example illustrates the fields and controls of the Return Columns tab in Bracket — Data (PT BR STATE RATES) page

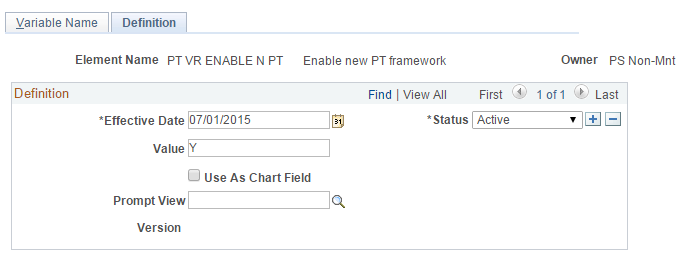

Use Variables — Definition page (GP_VARIABLE) to trigger the professional tax calculation using the new professional tax setup.

Navigation:

.

This example illustrates the fields and controls of the Variables — Definition page.

Field or Control |

Description |

|---|---|

Effective Date |

Enter the date from which the variable defined be effective. |

Note: The professional tax calculations can be done even in the mid of the year. The switching will not be having any impact on the accumulators since the same accumulator is going to be maintained and the system will calculate the PT irrespective of the switch.

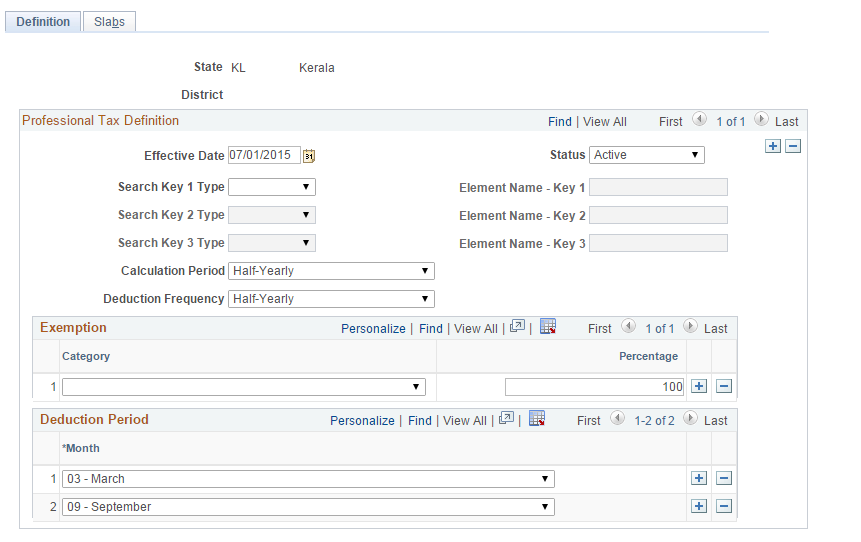

Use Professional Tax Details IND — Definition Page (GPIN_PT_SETUP) to create the key elements to calculate the professional tax .

The Global Payroll for India supports professional tax for nine states. There are certain details required to calculate professional tax such as deduction frequency, income range and exemption category for those nine states.

Navigation:

.

This example illustrates the fields and controls of the Professional Tax Details IND — Definition Page

Field or Control |

Description |

|---|---|

Effective Date |

Specify date from which the tax details becomes effective. When there is a change in the tax slabs or any new exemption, add a new effective dated row. |

Search Key |

Refers to different type of employees, classification within employee group which is in turn used in defining the professional tax slabs for each type of employees. For example, in Maharashtra professional tax rates for male and female employees are different. Use the search key to configure such classifications. |

Element Name |

Corresponds to the respective Search key defined. For each category (combination of Search key and Element Name), you can define different gross wages or tax rates as applicable. |

Calculation Period |

Define the frequency of employee’s income based on which the professional tax is calculated. This varies between states and cane be Monthly, Quarterly, Half-yearly and Yearly |

Deduction Frequency |

Define the frequency with which the system deducts the professional tax from employee’s salary. Varies between states and can be Monthly, Quarterly, Half-yearly and Yearly. |

Category |

Configure the exemption category and percentage of exemption in the new set-up page. |

Note: Deduction Period is applicable when the deduction frequency is not Monthly. When the deduction frequency is half-yearly the deduction period grid enables to select the months in which the professional tax deduction has to be done from the employee. The number of rows in the grid must match with the deduction frequency selected except for monthly selection.

Navigation:

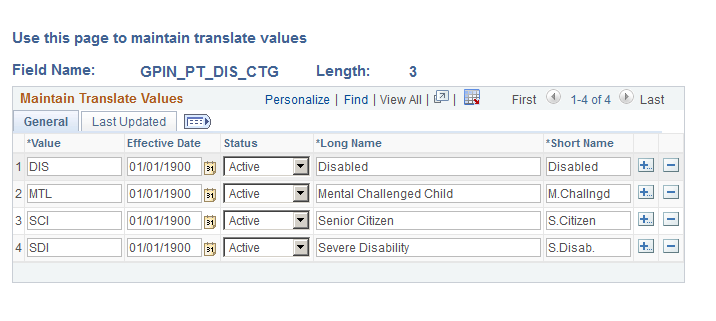

Use Translate Values Page (PSXLATMAINT) to add a new value under the exemption category and to maintain the translate values.

.

This example illustrates the fields and controls of the Translate Values Page.

Navigation:

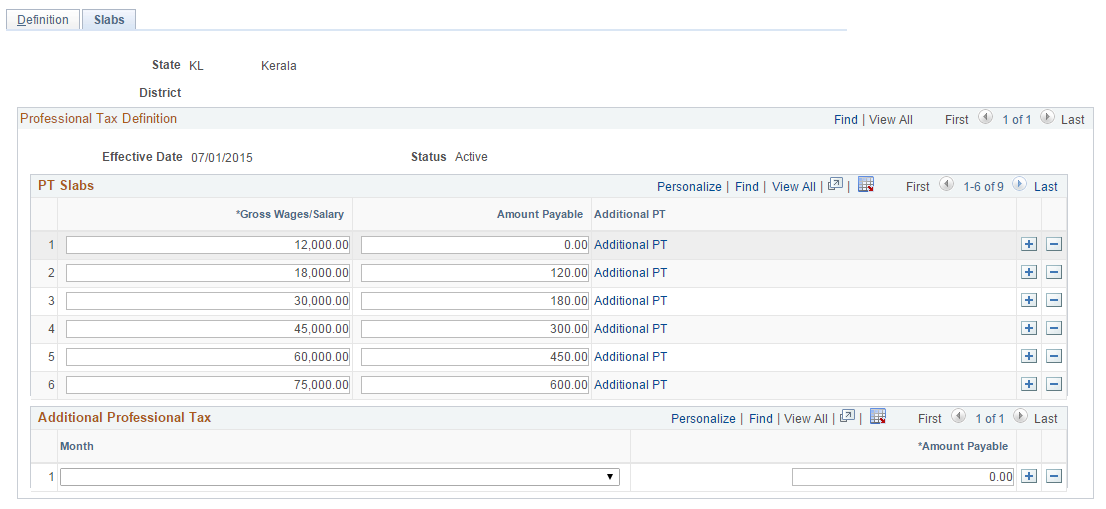

Use Professional Tax Details IND — Definition Page (GPIN_PT_SETP_SLABS) to define the salary range for calculating professional tax along with any other additional tax.

.

This example illustrates the fields and controls of the Professional Tax Details IND — Slabs Page.

PT Slabs defines the state specific professional tax.

Field or Control |

Description |

|---|---|

Gross wages/ Salary |

Defines upper limit of Income slab for the respective search keys. The amount is in sync with the calculation period in definition tab. If Income frequency is yearly, gross salary must be an annual income. |

Amount Payable |

Amount of Professional tax to be deducted for the corresponding income range. |

Additional PT |

Corresponds to any additional professional tax to be deducted for the respective gross salary range. |

Note: The Additional Professional Tax grid is different from the Additional PT link under PT Slabs grid. Some states have additional deduction of professional tax in any specific month, then you can select the month on which the Additional PT has to be deducted and the applicable amount. This deduction happens only for such category of employee in that specific month irrespective of income ranges.

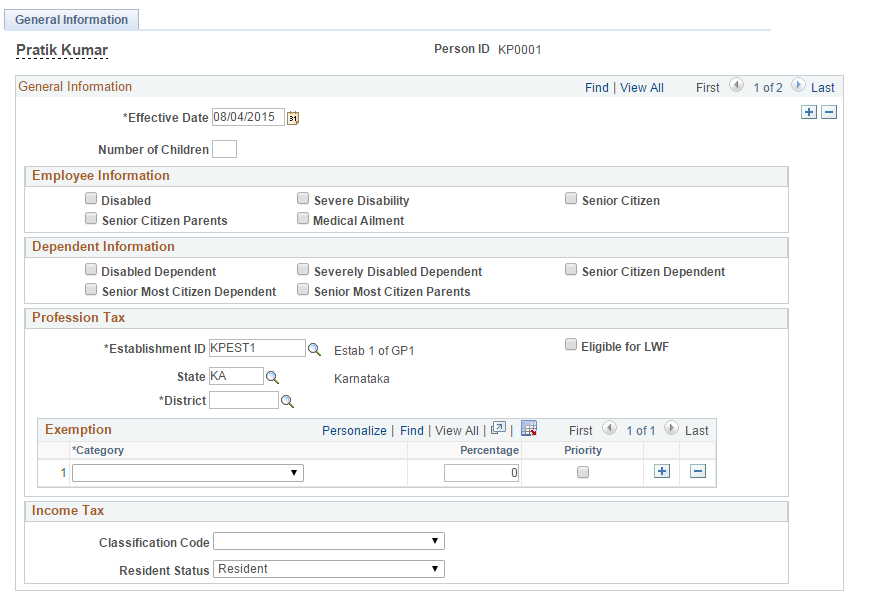

Use Specify Tax Details IND page (GPIN_TDS_GEN) to update the employee specific tax details.

.

This example illustrates the fields and controls of the Specify Tax Details IND page.

Note: By adding a new row for an existing employee, you can add the Exemption filed under the Professional Tax grid. The effective date and the related data are populated according to the variable defined for each state.

Field or Control |

Description |

|---|---|

District |

Define the district code accordingly, if needed. |

Category |

Displays the exemption category updated in the definition page for the respective state or district selected for the employee. |

Percentage |

Specify the percentage of deduction. This varies between each category of exemption. |

Priority |

Select to define which is the priority for the exemption among selected categories. For an employee having more than one exemption category, this check box is applicable where percentage of exemption differs between each category of exemption. |

Note: : The exemption percentage can override the percentage mentioned in the PT definition page based on the employee’s eligibility.

Use Professional Tax Report IND page (GPIN_PR_RC) to generate reports for professional tax..

.

This example illustrates the fields and controls of the Professional Tax Report IND page.