Using Batch Positive Input

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPMX_PI_BATCH |

Load batch positive input or delete previously loaded batch positive input. |

You can use Batch Positive Input Application Engine process (GPMX_PI_BTCH) to reduce time-consuming data entry in Global Payroll for Mexico by loading data into the system in batch from a flat file. You can use the process for loading earnings, deductions, and supporting element overrides. You can also use the process to delete previously loaded data according to the batch code that you specify.

To use this functionality, you must create a flat file which contains the data that you want to load. This text file can be in plain text or csv format but must follow a specific layout for batch positive input processing, as described later in this section. When you run the Batch Positive Input process it reads the information from the flat file and loads the data into the positive input records. You can then access this data through the Positive Input page in the core application.

For example, you could enter and trigger bonuses for all of your employees using batch positive input, or you could trigger mass deductions. Suppose that an employer has an agreement with a cell phone company to provide half the employee population with a 50 percent discount rate on calls. Instead of entering each of the monthly cell phone invoices (deductions) for each employee, the cell phone company could generate a flat file with a layout that loads this invoice information using a batch process.

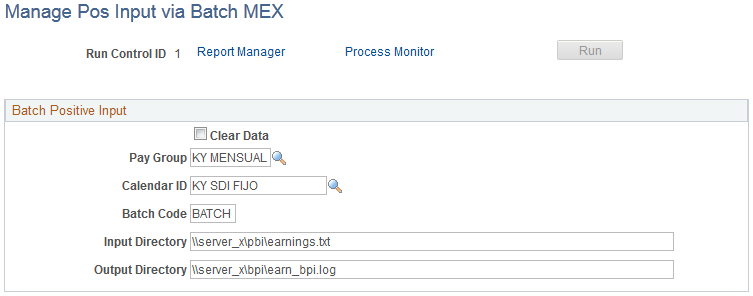

Use the Manage Pos Input via Batch MEX page (GPMX_PI_BATCH) to load batch positive input or delete previously loaded batch positive input.

Navigation:

This example illustrates the fields and controls on the Manage Pos Input via Batch MEX page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Clear Data |

If you select this check box, the system will delete previously loaded data. If you deselect this check box, the batch process will load new data into the Positive Input tables for payroll purposes. |

Pay Group |

Enter the pay group for which you want to load batch positive input. |

Calendar ID |

Enter the calendar ID for the pay group that you identified in the Pay Group field. |

Batch Code |

Enter the batch code ID that identifies all of the transactions contained in the flat file. This field enables you to delete information loaded by mistake, because it serves as the identifier of that information. |

Input Directory |

Specify the location of the flat file containing the batch positive input (flat file directory). |

Output Directory |

If the batch process finds errors, it generates a log file containing the errors. Use this field to specify where the system should place the error log (error log directory). |

Note: You do not need to specify input and output directories when deleting values because the process determines the data to delete according to the batch code that you specify.

Flat File Layout for Batch Positive Input

When you create flat files for the batch positive input process, reproduce this file definition for earnings and deductions:

|

Field |

Initial Position |

Length |

Default Value |

|---|---|---|---|

|

EMPLID |

1 |

11 |

Not applicable. |

|

EMPL_RCD |

12 |

3 |

Not applicable. |

|

PIN_NM |

15 |

18 |

Not applicable. |

|

GP_UNIT |

33 |

20 |

Not applicable. |

|

GP_AMT |

53 |

20 |

Not applicable. |

|

GP_RATE |

73 |

20 |

Not applicable. |

|

GP_PCT |

93 |

11 |

Not applicable. |

|

PC_BASE |

104 |

20 |

Not applicable. |

|

DEPTID |

124 |

10 |

Not applicable. |

|

JOBCODE |

134 |

6 |

Not applicable. |

When you create flat files for the batch positive input process, reproduce this file definition for supporting elements:

|

Field |

Initial Position |

Length |

Default Value |

|---|---|---|---|

|

EMPLID |

1 |

11 |

Not applicable. |

|

EMPL_RCD |

13 |

3 |

Not applicable. |

|

PIN_NM |

16 |

18 |

Not applicable. |

|

PIN_NM (SOVR) |

34 |

18 |

Not applicable. |

|

SOVR_VAL_CHAR |

52 |

25 |

Not applicable. |

|

SOVR_VAL_NUM |

77 |

18 |

Not applicable. |

|

SOVR_VAL_DT |

95 |

10 |

Not applicable. |

Here's an example of a flat file for earnings and deductions:

|

Field |

Example |

|---|---|

|

EMPLID |

KY003 |

|

EMPL_RCD |

0 |

|

PIN_NM |

COMISIONES |

|

GP_UNIT |

12.58 |

|

GP_AMT |

11.36 |

|

GP_RATE |

10 |

|

GP_PCT |

1.3 |

|

GP_BASE |

25.36 |

|

DEPTID |

43000 |

|

JOBCODE |

550000 |

Note: This flat file definition applies to both earnings and deductions that you load using batch positive input.

Here is an example of a flat file for a supporting element override:

|

Field |

Example |

|---|---|

|

EMPLID |

KY004 |

|

EMPL_RCD |

0 |

|

PIN_NM |

COMISIONES |

|

PIN_NM (SOVR) |

FD VR METODO ISR |

|

SOVR_VAL_CHAR |

142 |

|

SOVR_VAL_NUM |

(blank) |

|

SOVR_VAL_DT |

(blank) |