Setting Up Frequently Used Supporting Element Overrides

To define frequently used supporting element overrides in Mexico, use the Earn/Ded SOVRs MEX (GPMX_ERNDED_SOVR) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPMX_ERNDED_SOVR |

Set up SOVRs at the earnings and deduction level for variables used in key calculations. |

Global Payroll for Mexico enables you to define the most frequently used supporting element overrides (SOVRs) for earnings and deductions on the Earn/Dedn SOVRs MEX page. This includes the following:

Supporting elements used to specify a tax method.

Supporting elements used to select earnings and deductions for inclusion in the Minimum Wage Salary Level report (report GPMXAA01).

Supporting elements used to associate earnings and deductions with a termination version.

Before you can run a payroll, a Minimum Wage Salary Level report, or a termination process, you must:

Enter basic information on the Earn/Dedn SOVRs MEX page about which earnings and deductions to include in each tax method and each row of the Minimum Wage Salary Level report.

Specify which earnings and deductions to include in each termination version.

Understanding Element Overrides

The information that you enter on the Earn/Dedn SOVRs MEX page is inserted as a supporting element override for these variables at the earnings and deduction level:

|

Type of Override |

Variable |

|---|---|

|

Tax Method |

FD VR METODO ISR |

|

Salary Level Group |

AA VR NIVEL SAL |

|

Termination Versions |

Variables LF VR VER FINIQ 01 through LF VR VER FINIQ 10 |

Use the Earn/Dedn SOVRs MEX (Earnings/Deductions SOVRs MEX) page (GPMX_ERNDED_SOVR) to set up SOVRs at the earnings and deduction level for variables used in key calculations.

Navigation:

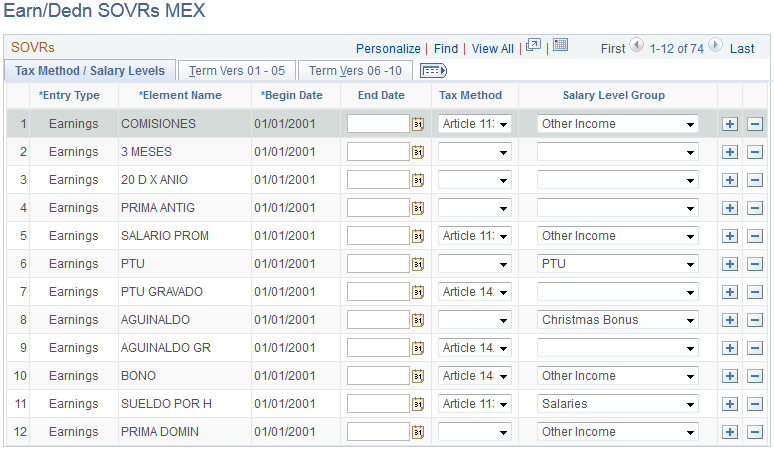

This example illustrates the fields and controls on the Earn/Dedn SOVRs MEX page. You can find definitions for the fields and controls later on this page.

Tax Method/Salary Levels Tab

Field or Control |

Description |

|---|---|

Entry Type |

For a Minimum Wage Salary Level report: Define the type of element to include in the report. You can include only earnings or deductions. For tax method selection: Define the type of element to which you want to apply a tax method using the Tax Method field. You can include only earnings or deductions. |

Element Name |

For a Salary Level report: Enter the name of the earnings or deductions element to include in the Minimum Wage Salary Levels report (report GPMXAA01). For tax method selection: Enter the name of the earnings or deductions to which you want to apply a tax method using the Tax Method field. |

Begin Date |

Enter the begin date of the supporting element override. |

End Date |

Enter the end date of the supporting element override. |

Tax Method |

Define the tax method to apply to each earnings and deduction identified in the Entry Type andElement Name fields. |

Salary Level Group |

For a Minimum Wage Salary Level report, specify the salary level group in which you want to include the earnings or deductions identified in the Element Name field. |

Term Vers 01-05 and Term Vers 06-10 Tabs

Field or Control |

Description |

|---|---|

Term Vers 01-10 (termination versions 1-10) |

This field is used to associate earnings and deductions with termination versions. For each earnings or deduction that you identify in the Entry Type andElement Name fields, specify the termination versions (the grouping of termination actions and reasons) for which the earnings and deductions can be paid. Select up to 10 different termination versions for each earnings and deduction. Note: To associate a termination version with an earnings or deduction, the termination version must already be defined on the Termination Version and Termination Action Reason pages, and the earnings or deduction must be linked to one of the delivered variables LF VR VER FINIQ 01 through LF VR VER FINIQ 10 on the Supporting Elements Override page. (LF VR VER FINIQ 01 through LF VR VER FINIQ 10 are delivered variables representing termination versions.) |