Running the PTU (Profit Sharing) Process

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPMX_RC_PTU001 |

Run the PTU process. |

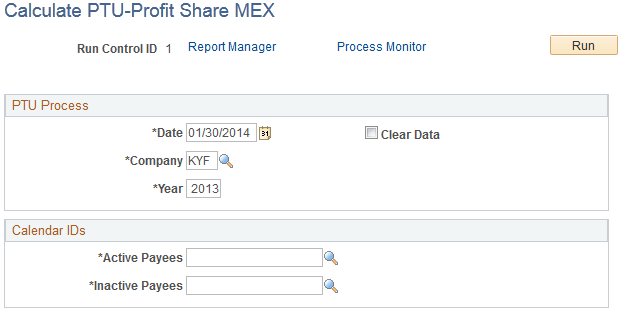

Use the Calculate PTU-Profit Share MEX page (GPMX_RC_PTU001) to run the PTU process.

Navigation:

This example illustrates the fields and controls on the Calculate PTU-Profit Share MEX page. You can find definitions for the fields and controls later on this page.

The PTU process generates two instances of positive input: one for the PTU IMP SAL element, and the other for the PTU IMP DIAS element. The PTU process also calculates the Day Factor and Salary Factor values that will be inserted in the PTU Setup page.

PTU Process

Enter the date, company, and year for which you want to run the process.

Field or Control |

Description |

|---|---|

Clear Data |

If you select this check box, the system will delete previously loaded data. If you deselect this check box, the PTU process will load new data into the Calendar IDs for active and inactive payees. |

Calendar IDs

Field or Control |

Description |

|---|---|

Active Payees |

Enter the calendar ID of the active payees to process. The electronic file transfer (EFT) for active payees will be as usual. |

Inactive Payees |

Enter the calendar ID of the inactive payees to process. The most common way to pay inactive payees is on an individual basis. Once the PTU process is executed, you can create a Period ID, Calendar ID, and Calendar Group ID to run the payroll process. |