Assigning Loans

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPMX_LOAN |

Define loan assignment information and a repayment schedule for payee. |

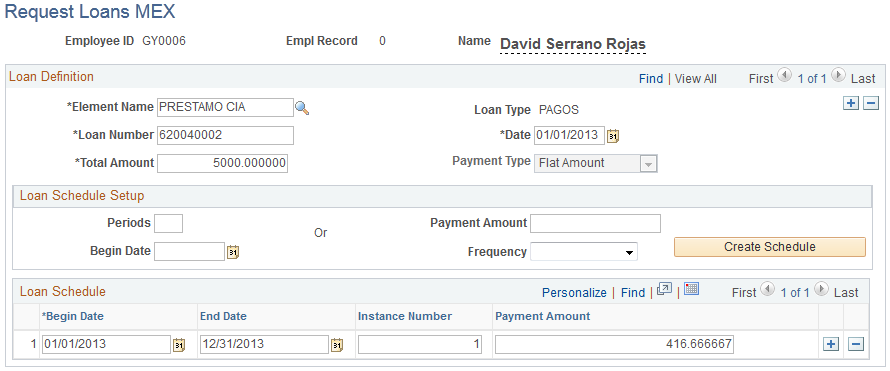

Use the Request Loans MEX page (GPMX_LOAN) to define loan assignment information and a repayment schedule for payee.

Navigation:

This example illustrates the fields and controls on the Request Loans MEX page. You can find definitions for the fields and controls later on this page.

Note: PeopleSoft Global Payroll for Mexico delivers the DIVIDE PRESTAMO driver accumulator that enables you to assign multiple loan deductions to an employee and process them for the same payroll calendar run by tracking their balances individually.

Loan Definition

Field or Control |

Description |

|---|---|

Element Name |

Select the element name that corresponds to the loan. |

Loan Type |

Displays the loan type. The system considers only deductions with a category of "PR" (loans), which are defined in the Category field on the Deduction Name page. Four types of loans have been defined in Customer Fields on the Deduction Name page: CRED INFONAV − for INFONAVIT loans PRESTAMO CIA − for company loans PRES FONACOT − for FONACOT loans FALTANTE CAJ − for cashier loans |

Loan Number |

Enter the loan number. |

Date |

Enter the date on which the loan was given. |

Total Amount |

Enter the total amount of the loan. |

Payment Type |

Select the payment type: Amount, Percentage or x Minimum. ThePayment Type field applies only to INFONAVIT loans and refers to the type of loan that was originally granted. If an Amount loan was granted, then a flat amount will be discounted each period from the employee's payslip. If a Percentage loan was granted, you must enter the percentage that is to be discounted in theInfonavit % field. If ax Minimum loan was granted, you must enter the number of minimum wages that is to be discounted on thex Min Wages field. Note: Depending on the value you select in the Payment Type field, different fields appear in theLoan Schedule group box. |

Loan Details

In this grid you can record all the INFONAVIT Loans Action Types used by the SUA Loans Report.

Field or Control |

Description |

|---|---|

Date |

Enter the date that the loan action type comes into effect for the INFONAVIT loan. |

Action Type |

Select the action type of the INFONAVIT loan. The system displays all of the possible loan action types used by the SUA Loans reports. |

Loan Schedule Setup

Field or Control |

Description |

|---|---|

Periods |

If the loan will be repaid over a period of time, you'll specify the number of periods here. If you don't know the fixed amount of a loan payment, but you know the number of periods required to discount the total amount, then you can generate your loan schedule based on the number of periods. In other words, you will define either the Periods field or theAmount field, but not both. |

Amount |

If the loan is a fixed amount (for a one-time repayment), enter the amount here. If you don't know the total number of periods required to discount the total amount, but you know the discount to take off each period, then you can generate your loan schedule based on the number of periods to determine the payment amount each period. |

Begin Date |

Enter the date on which the loan repayment begins. The begin date must be after the loan date. |

Frequency |

Specify the frequency of the loan repayment. Values are Biweekly, Monthly, Semimonthly, and Weekly. |

Create Schedule |

If you selected a Company Loan (PRESTAMO CIA) or a FONACOT Loan (PRES FONACOT), click the Create Schedule button. When you clickCreate Schedule, the loan schedule is automatically created in one row indicating Begin Date, End Date and Payment Amount. |

Loan Schedule

Field or Control |

Description |

|---|---|

Begin Date/End Date |

Enter the begin and end dates for the period of time on which the payment amount is valid. |

Instance Number |

The system automatically populates this field, establishing the sequence based on the payee and loan type. This enables you to assign more than one loan of the same type to a payee. |

Payment Amount |

If you selected Amount in thePayment Type field, thePayment Amount field appears. Enter the flat amount that is to be deducted from an employee's payslip. |

x Min Wages (times minimum wages) |

If you selected X Minimum in thePayment Type field, thex Min Wages field appears. Enter the number of minimum wages that will be the payment for each period. |

Infonavit % (percentage) |

If you selected Percentage in thePayment Type field, theInfonavit % field appears. Enter the percentage that is to be deducted from an employee's payslip. Typically, this is 20%, 25%, or 30%. If the loan was granted before January 30, 1998, the system looks up the value on the INFONAVIT Loans Percentage page and retrieves the corresponding discount. Otherwise, it will discount the percentage entered. For example, let's say that an employee has a loan granted on January 1, 1997 with a 20% discount, an SDI of 100, and a minimum daily salary of 42.15 MXN. The number of times the minimum wage that the employee's salary is will be calculated as 100/42.15 = 2.3724792. When the system is processing the loan data, it looks up the value entered on the INFONAVIT Loans Percentage page and sees that the number of times the minimum wage of 2.37 for a loan at 20% has a discount of 15.70%. |