Deriving Employee Tax Scales

To review the delivered tax scale data, use the Tax Scale Table (GPMY_TAX_SCALE_TBL) component.

This section discusses how to derive employee tax scales.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPMY_TAX_SCALE |

Define a tax scale that can change over time. Identify tax scale basis (that is, marital status, number of dependents, and spouse's employment status). |

|

|

GPMY_TAX_RANGE |

Define the range of wages for each tax scale and the applicable tax amount for each range. |

|

|

GP_BRACKET3 |

View the delivered Malaysian tax schedule that the system uses if you select the formula method. |

|

|

GPMY_TAX_SETUP |

Define the tax declaration setup for each data entry page |

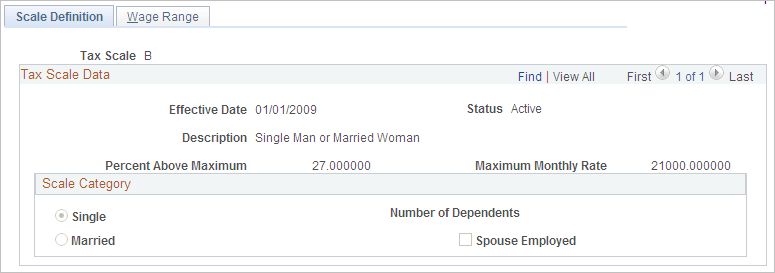

Use the Scale Definition page (GPMY_TAX_SCALE) to define a tax scale that can change over time.

Identify tax scale basis (that is, marital status, number of dependents, and spouse's employment status).

Navigation:

This example illustrates the fields and controls on the Scale Definition page. You can find definitions for the fields and controls later on this page.

Use the Tax Scale Table to view the delivered Malaysian Tax Schedule that the system uses if you select the tax scale method.

Field or Control |

Description |

|---|---|

Maximum Monthly Rate |

Displays the maximum rate for the tax scale. |

Percent Above Maximum |

Displays the percent that applies when the wages that are applicable to the scale exceed the maximum monthly rate. |

Scale Category

Field or Control |

Description |

|---|---|

Single/Married |

Indicates whether the scale is applicable to single or married employees. |

Number of Dependents |

Displays the number of dependents for the tax scale. |

Spouse Employed |

Indicates whether the employee's spouse is employed. |

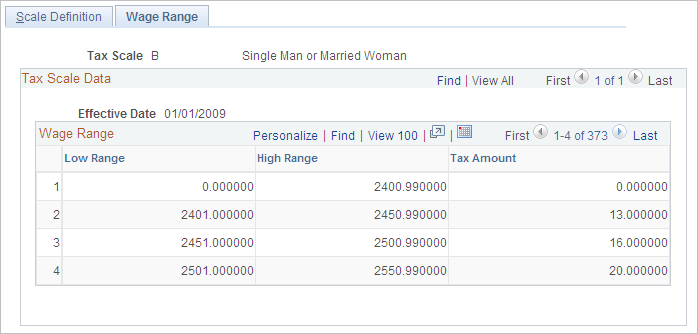

Use the Wage Range page (GPMY_TAX_RANGE) to define the range of wages for each tax scale and the applicable tax amount for each range.

Navigation:

This example illustrates the fields and controls on the Wage Range page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Low Range |

Displays the minimum taxable wages for the specified tax amount. This amount must be less than the high range. |

High Range |

Displays the maximum taxable wages for the specified tax amount. This amount must be greater than the low range and cannot overlap another range. |

Tax Amount |

Displays the amount of tax to be withheld from a payee based on the payee's taxable wages. |

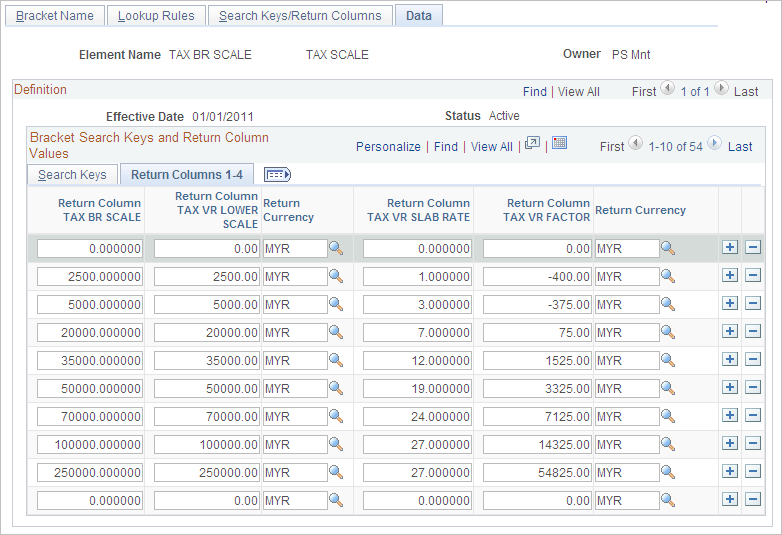

Use the Brackets - Data page (GP_BRACKET3) to view the delivered Malaysian tax schedule that the system uses if you select the formula method.

Navigation:

Search for and select the TAX BR SCALE element.

Select the Data page and display all columns.

This example illustrates the fields and controls on the Brackets - Data page. You can find definitions for the fields and controls later on this page.

Use the TAX BR SCALE bracket to view the delivered tax data that the system uses if you select the tax formula method. This data is used by the formula TAX FM FINAL CALC.

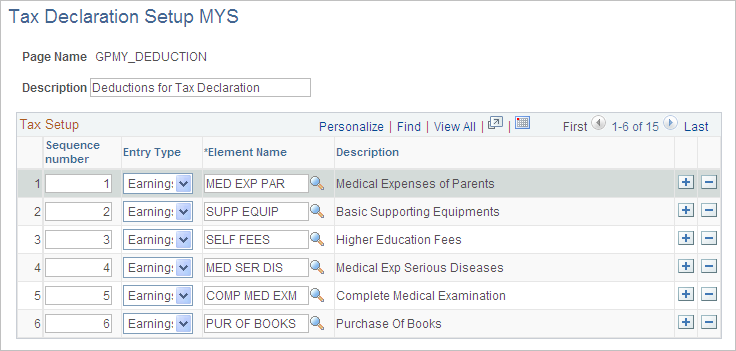

Use the Tax Declaration Setup MYS page (GPMY_TAX_SETUP) to .

Navigation:

This example illustrates the fields and controls on the Tax Declaration Setup MYS page. You can find definitions for the fields and controls later on this page.

Define the tax declaration setup for each data entry page. For example, the elements that you define for the Deductions page (GPMY_DEDUCTION) are the elements that you can select when entering payee tax information on the Rebates page.

Field or Control |

Description |

|---|---|

Sequence Number |

Enter a sequence number to indicate the sequence of elements for the page. |

Entry Type |

Select the element's entry type. |

Element Name |

Select the element name. Only elements with the selected entry type appear as choices. The corresponding description appears when you select the element name. |