Setting Up Income Tax Liquidation Report Parameters

This topic lists the page used to set up income tax liquidation parameters.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Income Tax Liquidation ARG page |

GPAR_RC_TAX |

Create the Income tax liquidation report and the F-1357 flat file that should be delivered to the AFIP. |

Use the Income Tax Liquidation ARG page to execute the income tax liquidation process.

Navigation:

This example illustrates the fields and controls on the Income Tax Liquidation ARG Page.

|

Field or Control |

Description |

|---|---|

|

Application |

Select application as INCOME TAX LIQ in this field. |

|

Company |

The organization for which the report is to be generated. |

|

Date From and Date To |

Select the required date range for which the liquidation process is to be executed. |

|

Calendar Group ID |

Select the required Calendar Group ID. |

|

Calendar ID |

Select the required Calendar ID. |

|

Print Date |

Date that is to be printed on the report. |

|

Responsible Person Name |

Type the person’s name who signs the report. |

|

Generic Report ID |

Select the corresponding generic Report Id. |

|

Tax Liquidation |

Report with detailed information by employee. |

|

Tax Liquidation Summary |

Summary amounts of the selected criteria. |

|

F-1357 |

Select this checkbox if you want to generate the F-1357 text file. By selecting this checkbox, a new section F-1357 is displayed. |

|

File Sequence Number |

Displays the number of files that are considered as part of TXT file name. By default, it shows zero. |

|

Report Type |

Select the required file type. Possible values are:

|

|

Rectification Sequence Number |

Displays the rectification file sequence to be printed in the header of TXT file. By default, it shows zero. |

|

Selection Criteria |

Select ‘Options All Establishments & Payees’ or ‘Selected Employees’ as per requirements. |

To setup income tax liquidation report parameters, perform the following:

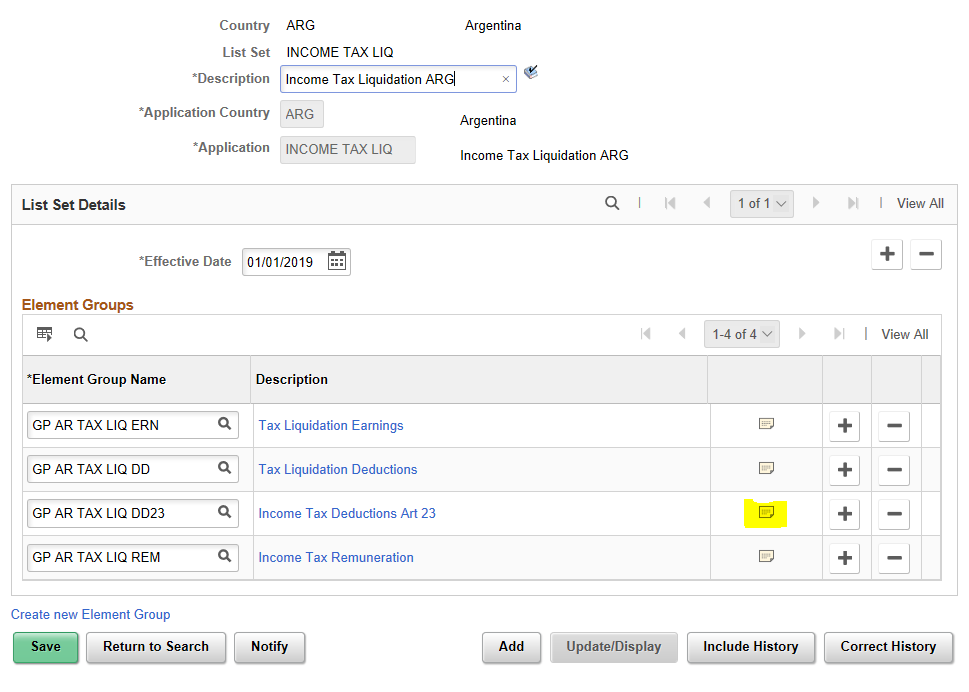

Update the following Element Groups with your corresponding Accumulators that will be used to extract the information for the TXT and PDF files.

GP AR TAX LIQ DD (Deductions)

GP AR TAX LIQ DD23 (Deductions Art 23)

GP AR TAX LIQ ERN (Earnings)

GP AR TAX LIQ REM (Remunerations)

Note: The accumulators must be annually (YTD), else the report will not show the yearly results.

Navigate to Define List Set page (Set up HRMS > Product Related > Global Payroll and Absence Management > Elements > Define List Set). Click the Element Group Details icon in the Element Groups block, to associate your Element List Members to the corresponding pre-defined string.

Define List Set page

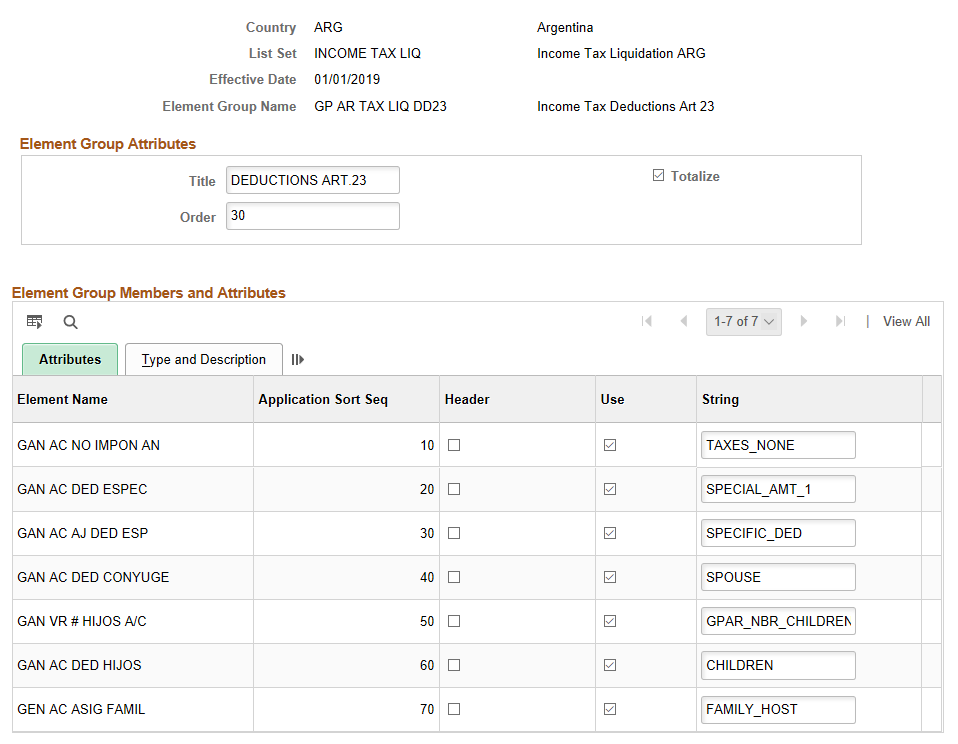

Associate Element List Members to the corresponding string as shown in the example.

Element Groups page

Note: You are not allowed to modify the predefined strings.

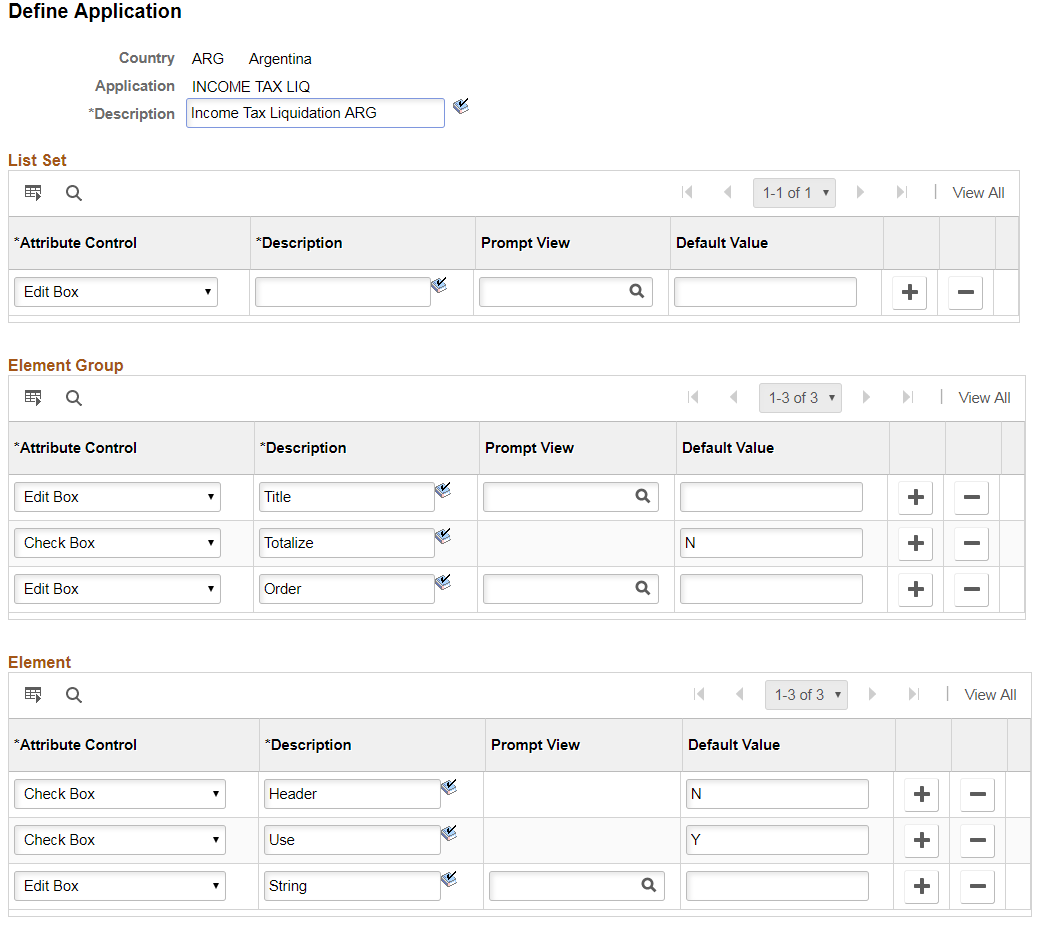

Validate that the INCOME TAX LIQ Application exists, if not, you need to add it through the Define Application page as shown (Set up HRMS > Product Related > Global Payroll and Absence Management > Elements > Define Application).

Note: This Application is predefined and only used to validate those already exist in the system.

Define Application page