Managing Garnishments

These topics provide an overview of garnishments in Global Payroll for Argentina and discuss how to enter employee garnishment data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAR_GARNISHMENT |

Assign garnishments and enter garnishment details. Garnishment balances and values are updated by the payroll process. |

|

|

Garnishment Payment Details Page |

GPAR_GARNISHMENT_SEC |

View a history of garnishment payment details. |

Garnishment is a legal requirement in Argentina. PeopleSoft Global Payroll for Argentina delivers two types of garnishment:

Litis Expenses

Writ of Garnishment

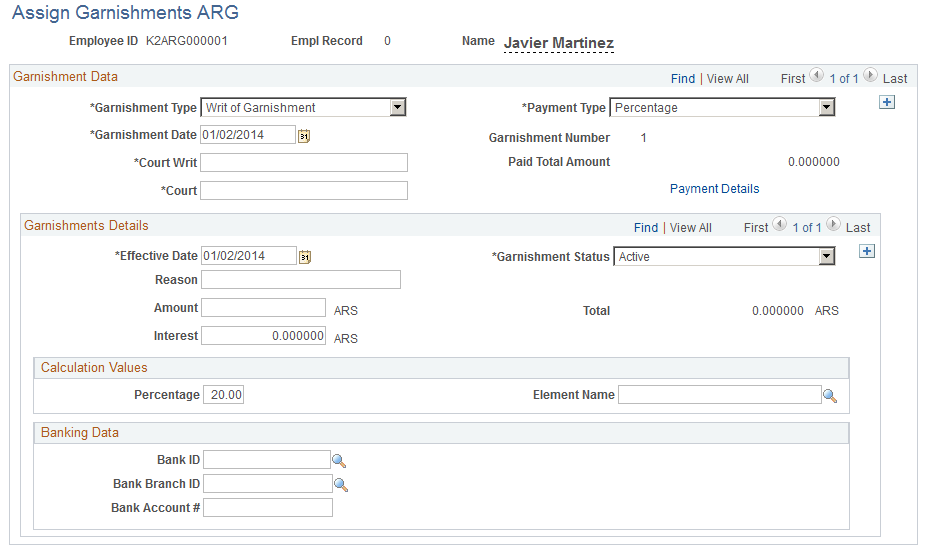

Use the Assign Garnishments ARG page (GPAR_GARNISHMENT) to assign garnishments and enter garnishment details.

Garnishment balances and values are updated by the payroll process.

Navigation:

This example illustrates the fields and controls on the Assign Garnishments ARG page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Garnishment Type |

Select the type of garnishment. Valid values are Litis Expenses and Writ of Garnishment. |

Payment Type |

Select the payment type. Valid values are: Percentage, Fixed Amount, and Percentage and Fixed Amount. |

Garnishment Date |

Enter the date of reception of the court writ. |

Garnishment Number |

Displays a number for each garnishment entered for an employee. |

Court Writ |

Enter the Court Writ of the garnishment. |

Paid Total Amount |

Displays the total amount paid for the garnishment. |

Court |

Enter the garnishment corresponding court. |

Payment Details |

Click to access the Garnishment Payment Details page. This page enables you to view a history of garnishment payment details. |

Garnishment Status |

Select the garnishment corresponding status. Valid values are: Active and Canceled |

Reason |

Enter an explanation for the garnishment status. Note: A garnishment's status can be modified only when the balance is equal to zero. |

Amount |

Enter the original garnishment amount. This is required for a Writ of Garnishment. |

Total |

Displays the garnishment total, which is the value of the Amount field plus the value of the Interest field. |

Interest |

Enter the interest specified by the court writ. |

Percentage |

Enter the percentage of the earnings accumulator element that the system deducts. Note: The maximum deduction amount cannot exceed 20 percent of the deductible gross amount when the garnishment is a Writ of Garnishment. |

Element Name |

Select the base accumulator element used to determine the corresponding percentage amount. |

Fixed Amount |

Enter the fixed amount to be deducted. |

Bank ID |

Enter the bank code specified in the court writ. |

Bank Branch ID |

Enter the bank branch code specified in the court writ. |

Bank Account # (Bank Account Number) |

Enter the bank account specified by the court writ. |