Entering Taxable Deductions

This topic discusses how to enter income tax deductions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAR_INC_TAX_DED |

Enter taxable deductions for employee income tax calculation during a fiscal year. |

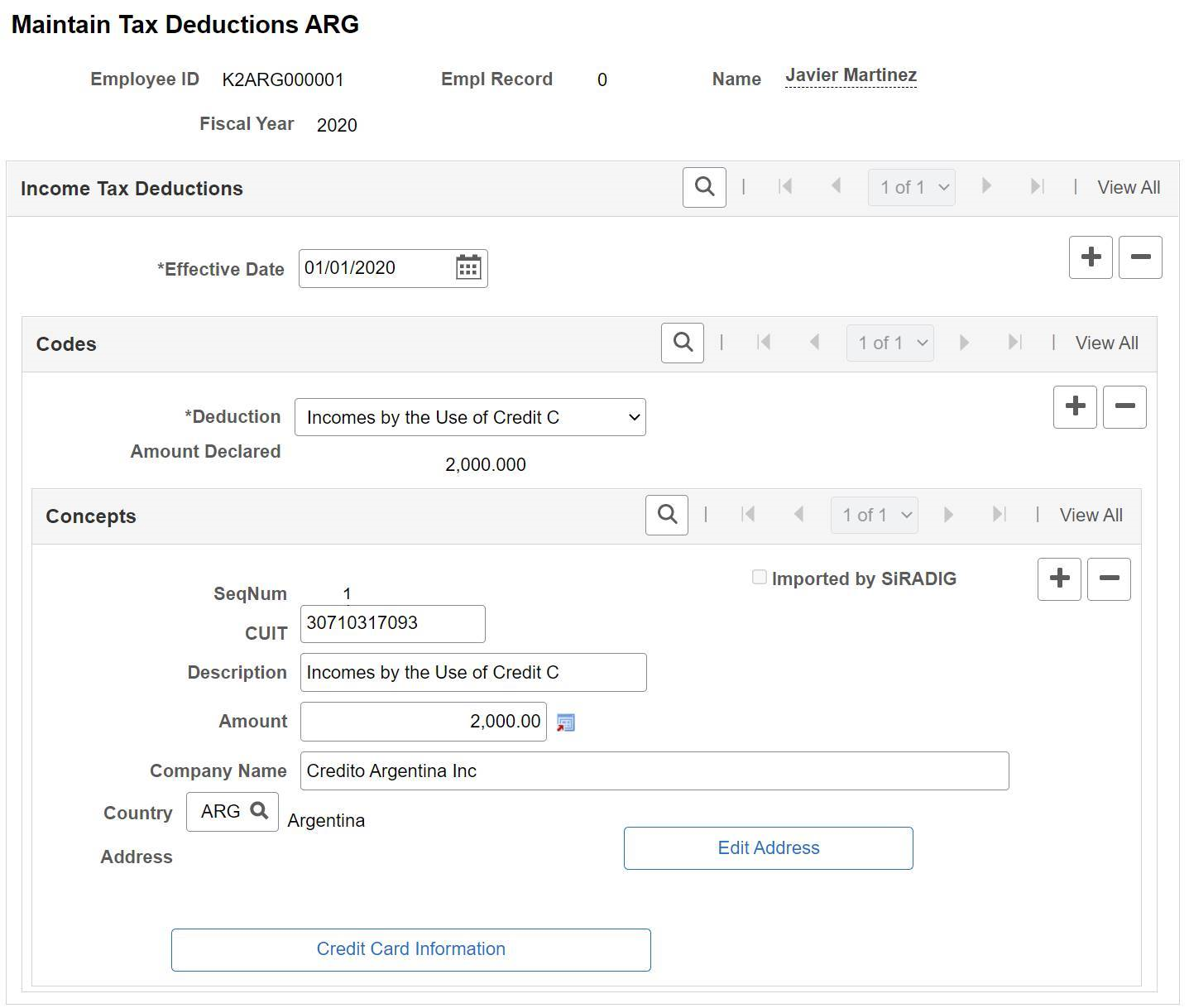

Use the Maintain Tax Deductions ARG page (GPAR_INC_TAX_DED) to enter taxable deductions for employee income tax calculation during a fiscal year.

Navigation:

This example illustrates the fields and controls on the Maintain Tax Deductions ARG page. You can find definitions for the fields and controls later on this page.

Note: To add Tax Deductions for the Fiscal Years 2020 and 2021, you need to add the Deduction in the corresponding Fiscal Year plus the effective date of the Payroll you are running.

Field or Control |

Description |

|---|---|

Effective Date |

Enter the date the declaration takes effect. Note: The Payroll calculation considers only the latest effective date within a single fiscal year. The last effective date replaces any previous dates. |

Deduction |

Select the deduction element. The values are obtained from the entries on the Income Tax Elements ARG page. |

Amount Declared |

Displays the total of any amounts associated with the deduction. |

CUIT (Código único de Identificación Tributaria) |

Enter the Unique Tax Identification Code corresponding to the declared deduction. |

Description |

Enter the name of the declared deduction. |

Amount |

Enter the deduction amount. |

|

Company Name |

Enter the company name. |

Country |

Select the country where the transaction occurred. |

Address |

Displays the address of the company that generated the deduction. |

|

Credit Card Information |

Click this button to enter the information related to the credit card used when you spent money for the entered amount. This button is displayed automatically when Incomes by the Use of Credit C Deduction type is selected. |