Defining Income Tax Elements

This topic discusses how to enter income tax default value definitions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAR_ITAXES_PARM |

Enter elements, labels and properties for Income Tax-related elements. |

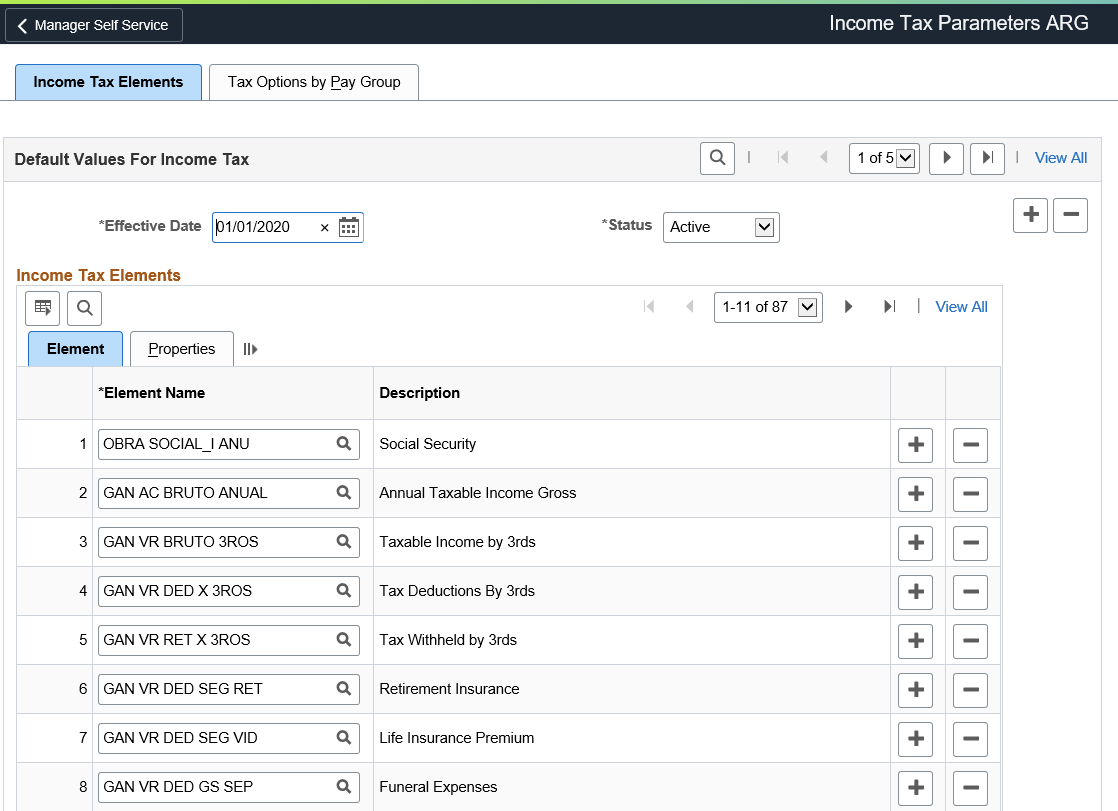

Use the Income Tax Parameters ARG page (GPAR_ITAXES_PARM) to enter elements, labels and properties for Income Tax-related elements.

Navigation:

This example illustrates the fields and controls on the Income Tax Parameters ARG page: Element tab. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Description |

|---|---|

|

Element Name |

Specify the element that stores the amounts deducted from an employee's pay. |

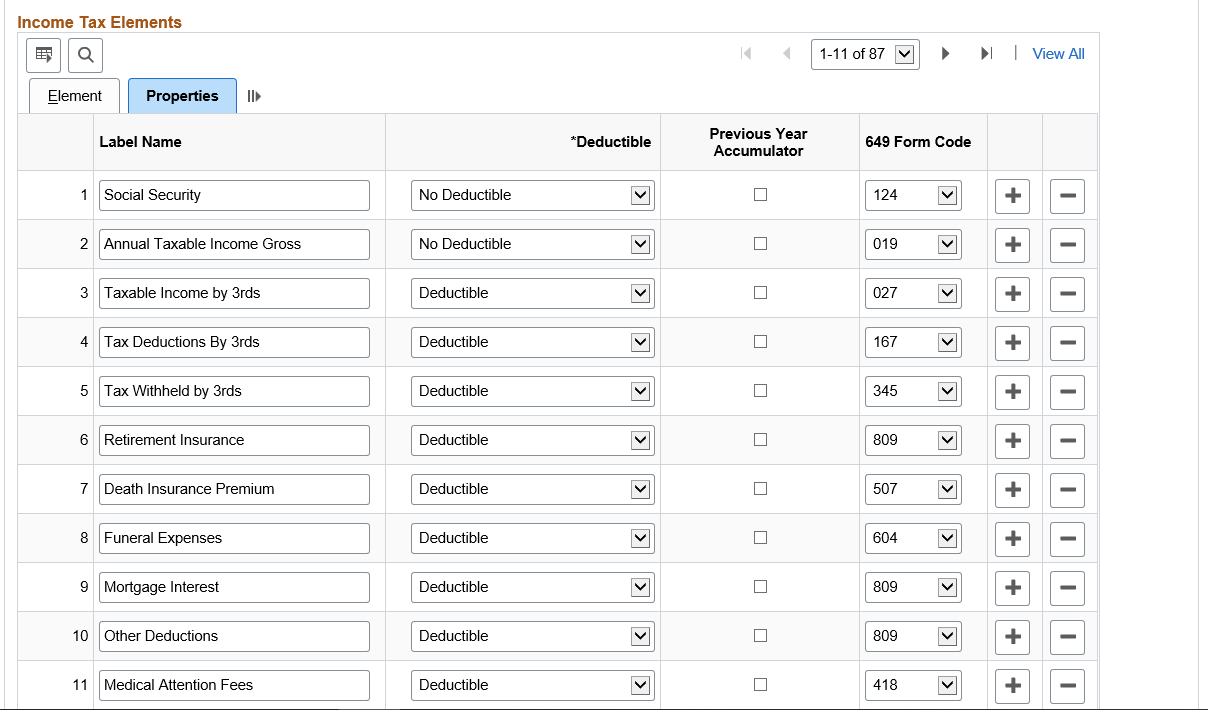

This example illustrates the fields and controls on the Income Tax Parameters ARG page: Properties tab. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Description |

|---|---|

|

Label Name |

Enter a description for the element. This name is displayed on the Maintain Income Tax ARG page. |

|

Deductible |

Select to specify that an element is deductible from the taxable base. |

|

Previous Year Accumulator |

Select to specify the elements that track previous fiscal year accumulators. |

|

649 Form Code |

Select the code that specifies the field where the element is printed on the Form 649 report. |

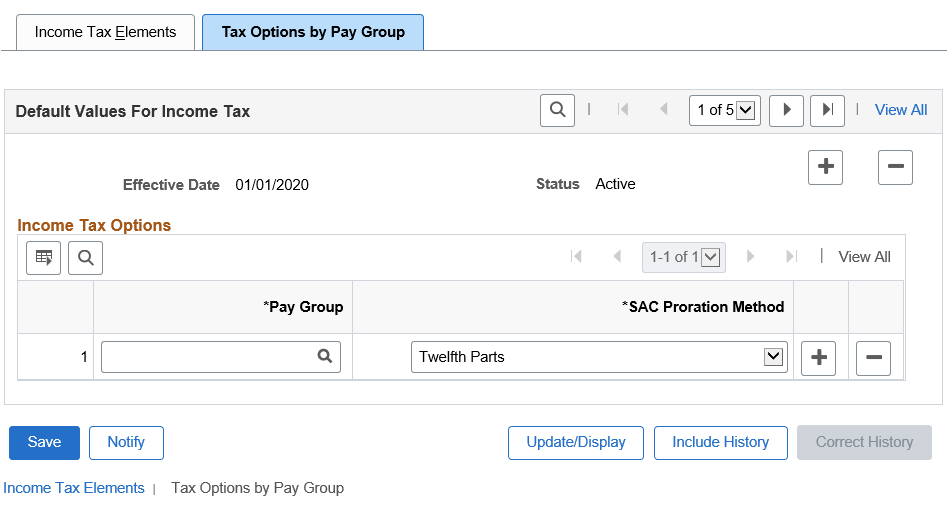

Use the Income Tax Parameters ARG: Tax Options by Pay Group tab to indicate how the tax for SAC (Christmas Bonus) will be calculated taken the Twelfth Parts of the real paid amount.

This example illustrates the fields and controls on the Income Tax Parameters ARG page: Tax Options by Pay Group tab. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Description |

|---|---|

|

Pay Group |

Enter the Pay Groups that will take the real paid amounts for SAC instead of monthly Twelfth Parts. |

|

SAC Proration Method |

Select the required proration method. Available options are:

|