Setting Up for Social Insurance Processing

This section lists a prerequisite and discusses how to set up social insurance premium and view standard remuneration grades.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPJP_SC_STD_REMUN |

View the values and grades on the Monthly Standard Remuneration table. |

|

|

GPJP_SC_EST_DATA |

Set up social insurance premium rates. Enter the social insurance premium rates for each social insurance establishment. |

Before setting up social insurance premium rates, you must define social insurance establishments.

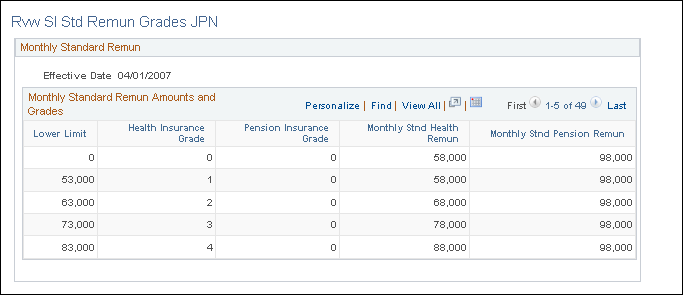

Use the Rvw SI Std Remun Grades JPN (review social insurance standard remuneration grades) page (GPJP_SC_STD_REMUN) to view the values and grades on the Monthly Standard Remuneration table.

Navigation:

This example illustrates the fields and controls on the Rvw SI Std Remun Grades JPN page. You can find definitions for the fields and controls later on this page.

View the information on the Monthly Standard Remuneration table, which the system uses to determine an employee's monthly standard remuneration amount and the grade for health insurance and pension insurance premium calculations.

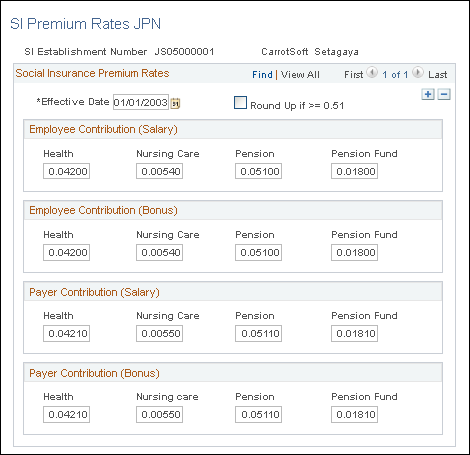

Use the SI Premium Rates JPN (social insurance premium rates) page (GPJP_SC_EST_DATA) to set up social insurance premium rates.

Enter the social insurance premium rates for each social insurance establishment.

Navigation:

This example illustrates the fields and controls on the SI Premium Rates JPN page. You can find definitions for the fields and controls later on this page.

Enter the premium rates used to calculate employee and payer contributions for salary and bonus payments.

Field or Control |

Description |

|---|---|

Round Up if >= 0.51 |

If this check box is selected, the payee's contribution to social insurance is rounded up if the fraction is greater than or equal to 0.51. If the check box is deselected, the amount is rounded up if the fraction is greater than or equal to 0.6. |