Preparing Employee Social Insurance Payee Data

This section provides an overview of preparing employee social insurance data .

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPJP_SC_PYE_DATA |

Enter and update employee social insurance data. Enter a new enrollee's monthly remuneration amount and other social insurance personal information. Run the Update SI Monthly Remun process to automatically update this page. You can enter updates manually, as in the case of Regular Decision by Insurance Provider. |

|

|

GPJP_SC_DEP_DATA |

Maintain a payee dependent's social insurance data. |

Enter or update an employee's monthly remuneration amount and other social insurance personal information on the Maintain Social Ins Data JPN page. Manually enter this information when you initially set up the system and when you enroll a new employee. The system automatically updates the monthly remuneration amount when you run the Update SI Monthly Remun process (GPJP_UPD_REM). You can then edit the data.

Understanding Effective Dates

The following list explains the effective date for occasional revision and regular decision that is entered by the Monthly Remuneration Update process:

Occasional revision.

The effective date of the revised monthly standard remuneration and grade is the first day of the month after the payroll month for which the eligibility for occasional revision is established.

For example, if the payee becomes eligible for occasional revision when you run the occasional revision processing after finalizing May payroll, the effective date of the revised monthly standard remuneration grade is June 1. The social insurance premiums for June, which are calculated with the new grade, are deducted from the payee's salary in the July payroll.

Regular decision.

The effective date of the revised monthly standard remuneration and grade is September 1. The social insurance premiums for September, which are calculated with the new grade, are deducted from the payee's salary in the October payroll.

Calculating Standard Remuneration and Premiums for Multiple Jobs

When an employee receives salaries from multiple jobs, monthly remuneration is, by law, the sum of the salaries paid from all jobs. Monthly standard remuneration is calculated by the Occasional Revision or Regular Decision processes based on the monthly remunerations for the appraisal months. Social insurance from salary is calculated based on the monthly standard remuneration and deducted from the salary that is paid from the employment record number that the user assigned on the Maintain Social Ins Data JPN page.

When an employee receives bonuses from multiple jobs, the standard bonus is the sum of the bonuses paid from all jobs. Social insurance from the bonus is calculated based on the standard bonus, and deducted from the bonus that is paid from the employment record number that the user assigned on the Maintain Social Ins Data JPN page.

|

Employment Record Number |

Salary |

Monthly Remuneration |

Monthly Standard Remuneration |

Health Insurance Premium |

|---|---|---|---|---|

|

0 |

300,000 JPY |

400,000 JPY (300,000 + 100,000) |

410,000 JPY |

32,000 JPY (410,000 JPY * 8%) |

|

1 |

100,000 JPY |

0 |

0 |

0 |

The following steps describe how to calculate social insurance when salaries are paid from more than one job:

Create five user-defined earnings elements (these are not delivered by PeopleSoft):

Separately Paid Cash Remuneration (Salary)—This should be accumulated to the Total Amount of Cash Remuneration (Salary) (ER AC CASH REM SAL) accumulator.

Separately Paid Non-Cash Remuneration (Salary)—This should be accumulated to the Total Amount of Non-Cash Remuneration (Salary) (ER AC NCSH REM SAL) accumulator.

Separately Paid Fixed Wage—This should be accumulated to the Total Amount of Fixed Wage (ER AC FIX WAGE SAL) accumulator.

Separately Paid Cash Remuneration (Bonus)—This should be accumulated to the Total Amount of Cash Remuneration (Bonus) (ER AC CASH REM BON) accumulator.

Separately Paid Non-Cash Remuneration (Bonus)—This should be accumulated to the Total Amount of Non-Cash Remuneration (Bonus) (ER AC NCASH REM BO) accumulator.

Add the earnings that you set up in step 1 into the Process List and the Element Group.

Use positive input to enter remunerations paid from Employment Record Number 1 into the corresponding earnings in Employment Record Number 0.

The combined Social Insurance Premium for Employment Record Numbers 0 and 1 is calculated by the payroll process for Employment Record Number 0.

Calculating Health Insurance Premiums on Bonus Amounts for Rehired Employees

The bonus amount for Health Insurance premium calculations should be accumulated for a rehired payee regardless of employment record number if the payee's SI Establishment is not changed. Example:

Payee A gets a bonus (5,000,000 JPY) on December 10th in 2007.

Payee A is terminated on December 31st in 2007.

Payee A is rehired on January 1st in 2008 using the Add Employment Instance.

Payee A gets a bonus (500,000 JPY) on January 10th in 2008.

In this case, the payee's health insurance premium for the January 10th bonus should be deducted only for 100,000 JPY since the total bonus amount from April 2007 - March 2008 exceeds 5,400,000 JPY.

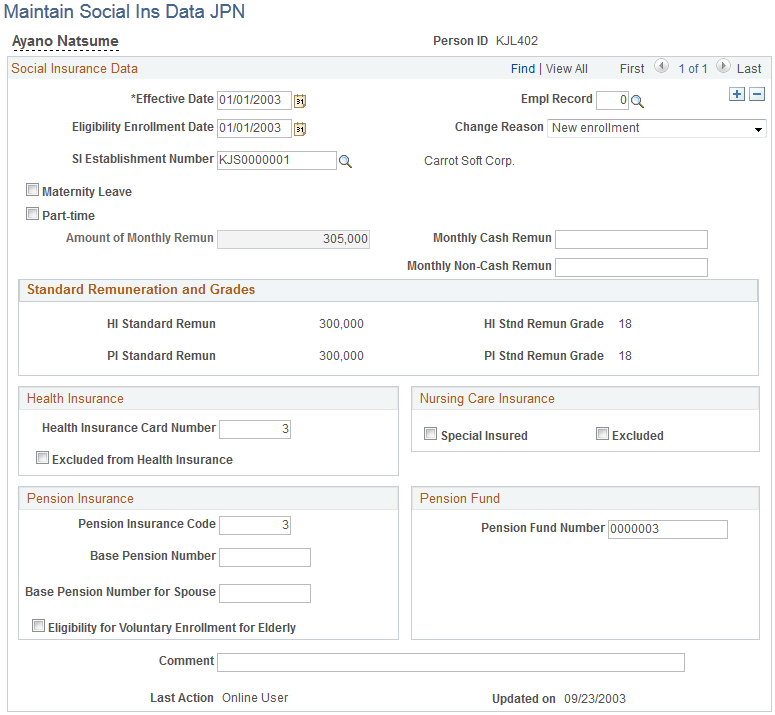

Use the Maintain Social Ins Data JPN page (GPJP_SC_PYE_DATA) to enter and update employee social insurance data.

Enter a new enrollee's monthly remuneration amount and other social insurance personal information. Run the Update SI Monthly Remun process to automatically update this page. You can enter updates manually, as in the case of Regular Decision by Insurance Provider.

Navigation:

This example illustrates the fields and controls on the Maintain Social Ins Data JPN page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Effective Date |

Enter the date on which this page's information takes effect. By using an effective date prior to the date upon which the payroll system was global payroll, the system enables you to enter informational data that will not be included in any global payroll calculation. In this case, the system doesn't validate the consistency between the employment record number on the Maintain Social Ins Data JPN page and the pay system flag on the Job table. |

Empl Record (employment record number) |

Enter the employment record number to which the system will apply the social insurance deduction. You can link the social insurance data only to the employment record number whose current pay system flag on the Job table is Global Payroll. |

Eligibility Enrollment Date |

Enter the date on which the employee is eligible for enrollment in the social insurance establishment. The system does not use this field. Instead, the system considers the effective date of the change reason of new enrollment or re-enrollment as the eligibility enrollment date. |

Change Reason |

Enter the value used to track the Enrollment/Termination status of social insurance. Values are:

If you do not select an employment record, the system will deduct social insurance premiums from multiple employment records. You should create the data with the Effective Date set to the end date of the month previous to the month when the Employment Record changes. Note: Loss by Age (PI), Loss by Age (HI), and Loss by Disability are used only for reporting purposes. The system evaluates a payee's eligibility for premium deduction based on the payee's age and whether the Excluded from Health Insurance check box is selected. Other Loss values are used both for eligibility evaluation and report generation. |

SI Establishment Number (social insurance establishment number) |

The system calculates the employee's premiums using the rates that you defined for the establishment you select here. |

Maternity Leave |

Select if the employee is on maternity leave. The system does not deduct social insurance premiums for employees on maternity leave. In addition, if the system locates a row with this check box deselected and the payee's record includes a previous effective dated row in which this check box has been selected, the Load Social Insurance Monthly Remuneration process assumes that the payee has returned from maternity leave. |

Part-time |

Select if the employee works part-time. The system uses this value when calculating total monthly remuneration in the regular decision process and when creating the Monthly Standard Remuneration Regular report. |

Amount of Monthly Remun (amount of monthly remuneration) |

When the Change Reason is New Enrollment, Re-enrollment, or New Enrollment after Loss the system calculates this value as the sum of the monthly cash and non-cash remuneration. The system updates this value when you run the Monthly Remuneration Update process. If the employee had a retroactive pay adjustment during the calculation period, the system enters the adjusted average monthly remuneration. The system determines the employee's monthly standard remuneration and standard remuneration grades based on this value. |

Monthly Cash Remun (monthly cash remuneration) |

Enter the expected monthly cash remuneration when the payee is enrolled. The system uses this field to generate the Amount of Monthly Remun. This field becomes visible only when the Change Reason is New Enrollment or Re-enrollment. |

Monthly Non-Cash Remun (monthly non-cash remuneration) |

Enter the expected monthly non-cash remuneration when the payee is enrolled. The system uses this field to generate the Amount of Monthly Remun. This field becomes visible only when the Change Reason is New Enrollment or Re-enrollment. |

Standard Remuneration and Grades

Displays the monthly standard remuneration and the standard remuneration grade based on the value in the Amount of Monthly Remun field for the effective date.

These values are display only and are not saved to a table.

Note: For employees that have average standard remuneration greater than the highest limit or less than the lowest limit, this group box displays dummy grades. The purpose of these dummy grades is to notify the payroll administrator when payees are subject to the exception of one occasional revision. Only employees whose grades changed two or more grades are subject to occasional revision.

Health Insurance

A new Health Insurance system that is specifically used for older citizens was introduced on April 1st, 2008. After this date, payees age 75 or over become exempt from health Insurance. As payees age 75 or over are transferred to this system, they become exempt from the current health insurance system for employees.

In an ordinary case the system evaluates each payee's age as of the payment date and excludes payees age 75 or over from health insurance premium deduction. As a user you do not need to track these payees.

In other cases, where payees can be exempted from the current health insurance for employees, a payee must meets both of the these conditions before he or she is transferred to the new health insurance system:

The payee is age 65 or over.

The payee is disabled to a certain degree.

To track these payees, select the Excluded from Health Insurance check box.

Nursing Care Insurance

Field or Control |

Description |

|---|---|

Special Insured |

When you select this check box, nursing insurance is calculated and deducted, regardless of the age of the payee. |

Excluded |

When you select this check box, nursing insurance is not calculated and deducted, regardless of the age of the payee. |

Pension Insurance

Field or Control |

Description |

|---|---|

Base Pension Number |

Enter the base pension number for the employee and the spouse, if applicable. These values are used by the enrollment, termination, and address change reports. |

Base Pension Number for Spouse |

This value is for your information only. It is not used by the payroll system. |

Eligibility for Voluntary Enrollment for Elderly |

Select if the employee is 70 or older and qualifies for payroll deduction of Employees Pension Insurance contribution. Use the PI 70 Year Old Employees report to identify employees who are terminated from pension insurance due to age. |

Updating Last Action

|

Field |

Manually Entered |

Automatically Entered |

|---|---|---|

|

Last Action |

Online user |

System |

|

Updated on |

Current date |

Process run date |

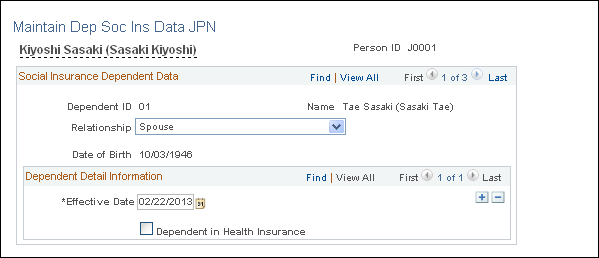

Use the Maintain Dep Soc Ins Data JPN page (GPJP_SC_DEP_DATA) to maintain a payee dependent's social insurance data.

Navigation:

This example illustrates the fields and controls on the Maintain Dep Soc Ins Data JPN page. You can find definitions for the fields and controls later on this page.

Select Dependant in Health Insurance if the dependent is included in the employee's health insurance plan.