Loading Inhabitant Tax Data

This section provides an overview of loading inhabitant tax data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPJP_IH_PYE_TAX |

Update inhabitant tax data. View and correct recipient numbers after running the Pre-Load Inhabitant Tax process. Enter inhabitant tax data for new hires, if necessary. Enter the employment record number from which the tax needs to be deducted. Enter one-time collection of balance for employees who terminate, if necessary. Manually enter inhabitant tax amounts from the municipality if you do not use the electronic file load process. |

|

|

GPJP_IH_COL_STAT |

View the year-to-date inhabitant tax amounts for each employee. |

|

|

GPJP_RC_IH_MUN2 |

Load inhabitant tax amounts from electronic file. Run the Load Inhabitant Tax process to load the tax amounts from the municipality if you are using electronic file data. |

You can either enter the inhabitant tax amounts manually or load the tax amounts from an electronic file.

After a payee's inhabitant tax data is loaded, the data can be changed through the reloading process. You can overwrite or delete the data when the status is Updated by User.

When loading inhabitant tax data, you can:

Load the file that was sent from a Municipal office into the table.

Modify the rows that were loaded by the process, if necessary.

Create new rows, especially for new employees whose information has not yet been submitted to the Municipal office.

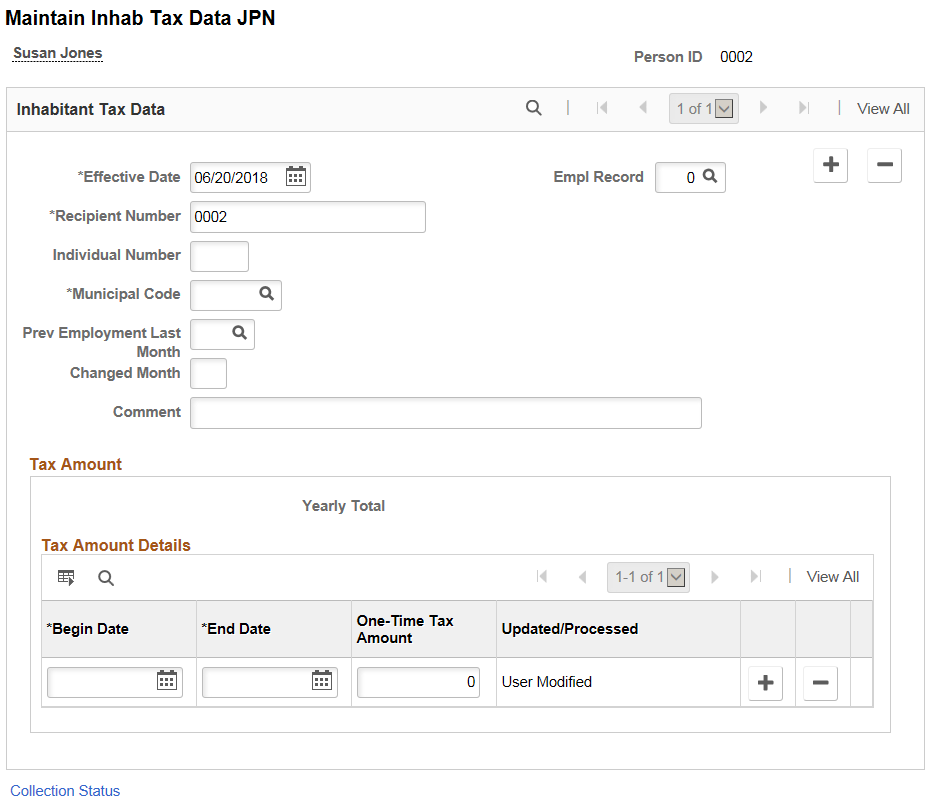

Use the Maintain Inhab Tax Data JPN page (GPJP_IH_PYE_TAX) to update inhabitant tax data.

The Maintain Inhab Tax Data JPN page (GPJP_IH_PYE_TAX) is used to view and correct recipient numbers after running the Pre-Load Inhabitant Tax process.

View and correct recipient numbers after running the Pre-Load Inhabitant Tax process. Enter inhabitant tax data for new hires, if necessary. Enter the employment record number from which the tax needs to be deducted. Enter one-time collection of balance for employees who terminate, if necessary.manually enter inhabitant tax amounts from the municipality if you do not use the electronic file load process.

Navigation:

This example illustrates the fields and controls on the Maintain Inhab Tax Data JPN page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Effective Date |

The Pre-Load Inhabitant Tax process sets this date to June 1 of the object year for employees who are reported to the municipality. Use June 1 of the object year for manual entry of Inhabitant Tax Data for new hires regardless of their actual dates of hire. |

Empl Record (employment record number) |

Select the record number of the employment record from which you want to collect inhabitant tax data. |

Recipient Number |

If the employee ID is not the correct recipient number, you can change it. |

Individual Number |

View the value that was loaded by the Load Inhabitant Tax process. |

Municipal Code |

A value that is based on the employee's postal code as of January 1 of the object year. |

Prev Employment Last Month (previous employment last month) |

Enter the last month that the previous employer paid inhabitant tax. Use this field if the payee was hired during the object year. |

Changed Month |

Enter the month in the tax year in which the inhabitant tax has changed. Note: This field is enabled for dates greater than or equal to 1-Jun-2018. |

Comment |

Enter the reason for change in inhabitant tax for the given month. Note: This field is enabled for dates greater than or equal to 1-Jun-2018. |

Tax Amount Details

Field or Control |

Description |

|---|---|

One-Time Tax Amount |

Enter the monthly amount of the employee's inhabitant tax deduction for the salary for which payment falls between the begin date and end date. When you manually enter the tax amount for new hires, enter the first and last day of the month in the Begin Date and End Date fields respectively. |

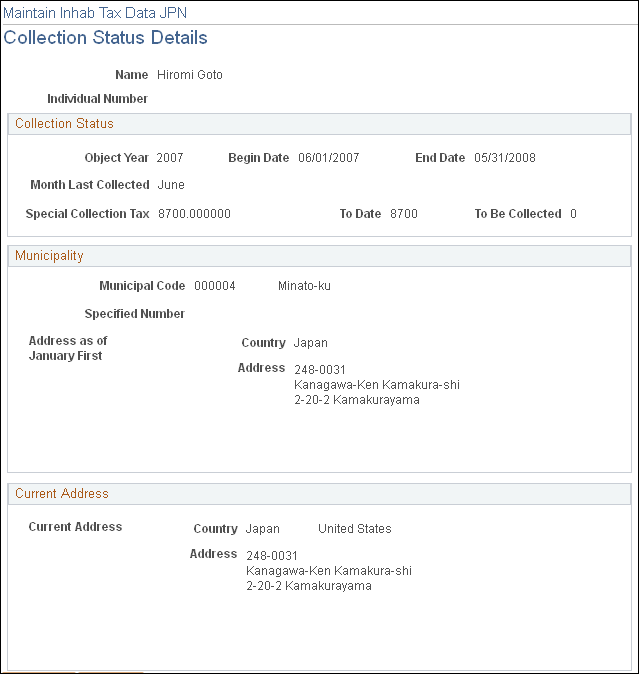

Use the Collection Status Details page (GPJP_IH_COL_STAT) to view the year-to-date inhabitant tax amounts for each employee.

Navigation:

Click the Collection Status link on the Maintain Inhab Tax Data JPN page.

This example illustrates the fields and controls on the Collection Status Details page. You can find definitions for the fields and controls later on this page.

This page summarizes the data that you need in order to complete the Change of Status Report on Special Collection.

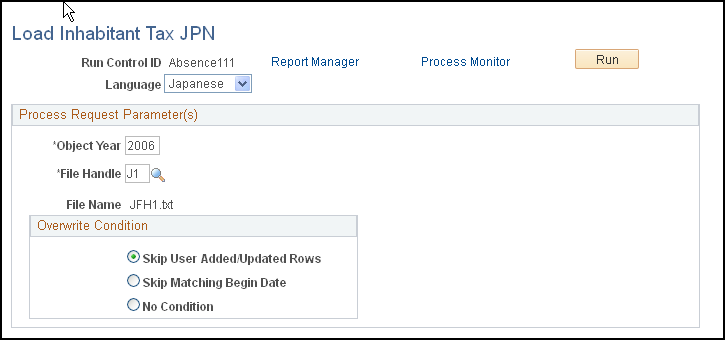

Use Load Inhabitant Tax JPN to load inhabitant tax amounts from electronic file. Run the Load Inhabitant Tax process to load the tax amounts from the municipality if you are using electronic file data.

Navigation:

This example illustrates the fields and controls on the Load Inhabitant Tax JPN page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Object Year |

The current year is the default. |

File Handle |

Select the file handle that identifies the municipality file that you want to load to the Inhabitant Tax table. |

Record Load Options

Field or Control |

Description |

|---|---|

Delete Only Loaded/Not Overwrite |

Select to reload the file that was sent from a Municipal office into the table without overwriting user modifications and new rows. |

Delete Only Loaded/Overwrite |

Select to reload the file that was sent from a Municipal office into the table and overwrite user modifications without overwriting the new rows. |

Delete All |

Select to reload the file that was sent from a Municipal office into the table and overwrite all user modifications and new rows. |