Entering Deduction Data for the Year-End Adjustment (YEA)

This section provides overviews of deduction data entry for YEA and manual adjustments to YEA data for multiple jobs.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Load YEA Self Service Data JPN (load year-end adjustment self service data Japan) Page |

GPJP_RC_YEALOAD_SS |

Load self-service deduction data. Payroll administrators run the Load YEA Self Service process (GPJP_YEASSLD) to load updated self-service employee personal data, life and nonlife insurance, and spouse and housing loan deduction information into the YEA Adj Data table and the corresponding page (GPJP_YEA_PYEADJ). |

|

GPJP_RC_YEA_SEC |

Select individual employees to load their data. |

|

|

GPJP_YEA_PYEADJ |

Enter deduction data (housing acquisition deduction, insurance, and spouse deduction) and edit YEA type. Indicate whether employees are subject to adjustment. |

|

|

GPJP_YEA_PYEPRI |

Enter prior employment data, such as income, tax, social insurance premium, and the prior employer's name and address. |

|

|

GPJP_IT_PYE_TAX |

Enter the salary payer number and employee tax deduction information that is collected by report, such as employee type and disability type. |

|

|

GPJP_IT_DEP_TAX |

Enter spouse or dependent deduction information that is collected by the report, such as disability type. |

Before processing the YEA reports, you must enter deduction information for YEA into the GPJP_YEA_PYEADJ table and ensure that data in the GPJP_IT_PYE_TAX and GPJP_IT_DEP_TAX tables is up-to-date.

Much of this data is collected through either the self-service or the manual method of YEA data collection. The method of entering the data differs according to the collection method.

Note: Even if you use data that is collected through the self-service pages, you must still access the YEA Adj Data (year-end adjustment data) page if you need to edit the employee's YEA type. You must also access the Prior Employment page to enter prior employment data.

|

Data and Payroll Table That Is Loaded |

Self-Service Method |

Manual Method |

|---|---|---|

|

Employee tax deduction data on (GPJP_IT_PYE_TAX) |

Automatically updated when the employee saves information that is entered on the Employee Tax Information self-service page. |

Collected on the Dependent Deduction report and manually entered on the Maintain Income Tax Data JPN page (GPJP_IT_PYE_TAX). |

|

Dependent tax deduction data on (GPJP_IT_DEP_TAX) |

Automatically updated when the employee saves information that is entered on the Edit Dependent Tax Information self-service page. |

Collected on the Dependent Deduction report and manually entered on the Maintain Dep Tax Data JPN page (GPJP_IT_DEP_TAX). |

|

Insurance, spouse, and housing loan special deduction data on (GPJP_YEA_PYEADJ) |

Run the Load YEA Self Service Data process (GPJP_YEASSLD), which loads data that is entered by employees on the Employee Personal Information and insurances and deductions self-service pages. |

Collected on the Insurance and Spouse Special Deduction report and manually entered on the YEA Data page (GPJP_YEA_PYEADJ). |

The Japanese government introduced a new benefit system where parents with children get payment from the government in proportion to the number of their children aged 15 or under. It also started funding high schools so that they can make tuition fees free of charge (public schools) or decrease the fee (private schools with higher fees).

In compensation for these new benefits, income deductions for parents with children aged 15 were repealed, effective January 1st, 2011. As of this same date, parents with children aged 16~18 will enjoy smaller amount of income deduction. That is, children aged 16~18 are no longer classified as Specified Dependent, but are regarded as Ordinary Dependents.

To accomplish this PeopleSoft created a new SQL view called GPJP_IT_DEP_VW. This SQL view joins GPJP_IT_DEP_TAX and DEP_BEN.

In array element IN AR DEPENDENTS the record name was changed from GPJP_IT_DEP_TAX to the GPJP_IT_DEP_VW SQL view. BIRTHDATE was added as the retrieved item. BIRTHDATE was not on this array because there was no reason to evaluate a dependents’ age for tax withholding before this new legal requirement:

When an employee has multiple jobs, YEA Report Data JPN is loaded for each employment record independently. The data is always loaded using the tax type that was in effect as of the payment date for the year-end adjustment process. When the tax type changes during the year, you may need to make a manual adjustment on the Prior Employment page so that the system bases the year-end adjustment and Withholding Tax report on the proper salary amount.

Example: Employee is Paid from One Employment Record Each Month

|

Empl Rcd # |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sept |

Oct |

Nov |

Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

0 |

Kou |

Kou |

Kou |

Kou |

No |

No |

No |

No |

Kou |

Kou |

Kou |

Kou |

|

1 |

No |

No |

No |

No |

Kou |

Kou |

Kou |

Kou |

No |

No |

No |

No |

Assume that the payment date is December 30. Because the employee's tax type as of this date is Kou, as long as the employee meets other conditions that are required for the year-end adjustment, the adjustment is processed on Empl Rec Nbr 0. The year-end adjustment is based on the salaries that were paid for Empl Rec Nbr 0 from January to April and from September to December, and the Withholding Tax report is printed.

To include salaries that were paid from May to August for Empl Rcd Nbr 1 in the year-end adjustment purposes, you must access the Prior Employment page for Empl Rcd Nbr 0 and enter the salaries and deductions for Empl Rcd Nbr 1 before you run the year-end adjustment process for Empl Rec Nbr 0.

Use the Load YEA Self Service Data JPN (load year-end adjustment self service data Japan) page (GPJP_RC_YEALOAD_SS) to load self-service deduction data.

Payroll administrators run the Load YEA Self Service process (GPJP_YEASSLD) to load updated self-service employee personal data, life and nonlife insurance, and spouse and housing loan deduction information into the YEA Adj Data table and the corresponding page (GPJP_YEA_PYEADJ).

Navigation:

Use the YEA Data (year-end data) page (GPJP_YEA_PYEADJ) to enter deduction data (housing acquisition deduction, insurance, and spouse deduction) and edit YEA type.

Navigation:

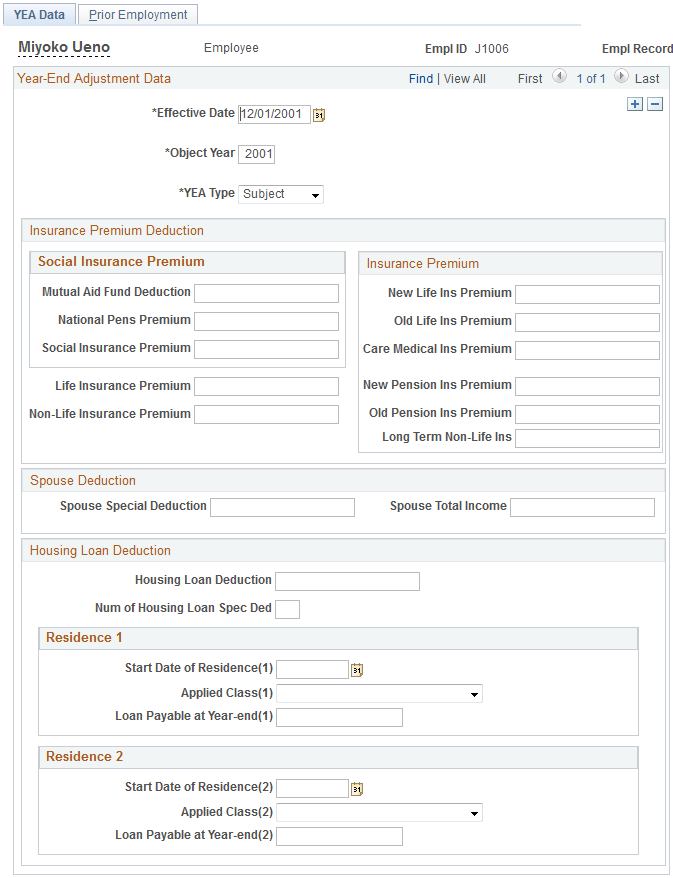

This example illustrates the fields and controls on the YEA Data page with Object Year below 2020. You can find definitions for the fields and controls later on this page.

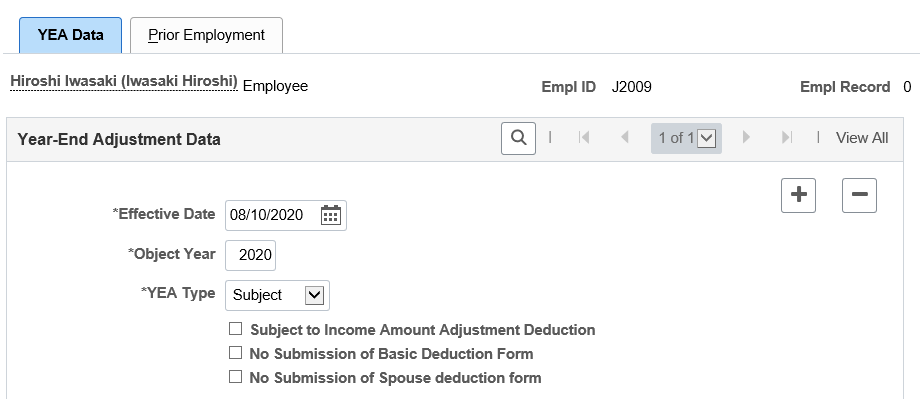

This example illustrates the fields and controls on the YEA Data page with Object Year 2020 and above. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

YEA Type (year end adjustment type) |

Select a value to indicate whether the employee is subject to income amount adjustment deduction. The default is Subject. Select Not Subject to exclude the employee from the YEA process. |

If user declaration is done outside the system and not though the Self-Service option, you have the flexibility to enter YEA data declaration directly in Maintain Year End Adj JPN page.

If you enter Object Year as ‘2020’ or above, the following checkboxes are displayed.

Field or Control |

Description |

|---|---|

Subject to Income Amount Adjustment Deduction |

Select the checkbox to enable income amount adjustment deduction for an employee. This checkbox is enabled only for employees falling in either of the following categories:

The administrator needs to select the “Subject to Income Amount Adjustment Deduction” check box in “Maintain Income Tax Data JPN” page or “Maintain Dependent Dep Tax Data JPN” page for the above mentioned categories. If the user selects the check box in the “Maintain Year End Adj Data JPN” page without selecting the check box in the respective page then, the application displays error message as “Neither Employee nor Dependent has Subject to Income Amount Adjustment Deduction selected”. |

No Submission of Basic Deduction Form |

Select the check box if the employee has not submitted Basic Deduction Form. If this check box is selected, then the employee will not get Personal Basic Exemption. |

No Submission of Spouse Deduction Form |

Select the check box if the employee has not submitted Spouse Deduction Form. If this check box is selected, then the spouse deduction amount will be considered as zero. |

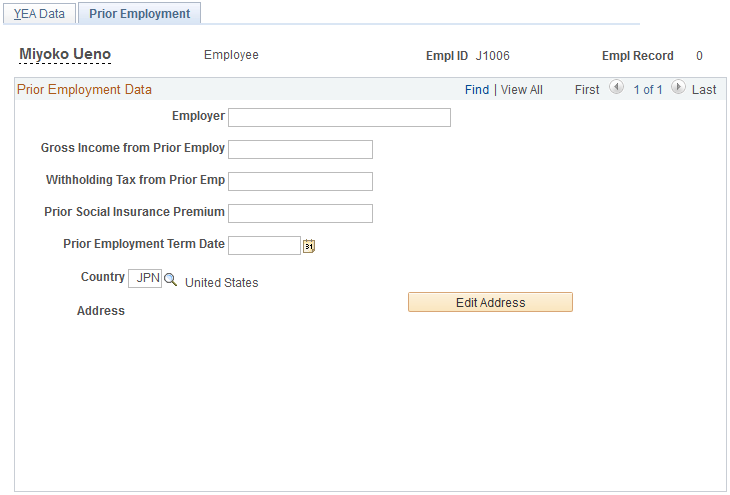

Use the Prior Employment page (GPJP_YEA_PYEPRI) to enter prior employment data, such as income, tax, social insurance premium, and the prior employer's name and address.

Navigation:

This example illustrates the fields and controls on the Prior Employment page.

Use the Maintain Income Tax Data JPN page (GPJP_IT_PYE_TAX) to enter the salary payer number and employee tax deduction information that is collected by report, such as employee type and disability type.

Navigation:

Use the Maintain Dep Tax Data JPN page (GPJP_IT_DEP_TAX) to enter spouse or dependent deduction information that is collected by the report, such as disability type.

Navigation: