Reviewing and Maintaining IR56 Report Data

This section provides an overview of Inland Revenue reporting generated data inquiry pages.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPHK_IR56_INQ1 |

View the IR56 details generated for the employee and review an employee's personal information including their identification details, spouse details and address history. |

|

|

IR56 Job / Quarters Details Page |

GPHK_IR56_INQ2 |

View the IR56 details generated for the employee. This page provides job-related and housing quarter information provided to the employee including country departure and employee residence quarters details. The employee residence quarters details default from the details you set up on the Employee Housing Quarters page. The country departure details default from the details you set up on the Departure Details page. |

|

GPHK_IR56_INQ3 |

View the IR56 details generated for the employee and enter employee monetary and tax details. Specific group boxes for each report type also appear. |

After you set up and generate the data required for Inland Revenue reporting and generate those forms, you can review the results and maintain available fields. The IR56 Inquiry component enables you to view and amend the generated IR56 data.

To access the component, enter the specific Inland Revenue report type, tax year, run number, employee ID, or pay entity. The inquiry pages display the information generated for an employee for specific report types. The fields on these inquiry pages contain three types of values:

Values generated from related tables that you cannot modify.

Values that you can enter only on the inquiry page because there is no way of calculating the value.

Values generated by the IR56 data creation process, which you can override by entering an adjustment amount.

The adjustment amount is captured and maintained in a separate field.

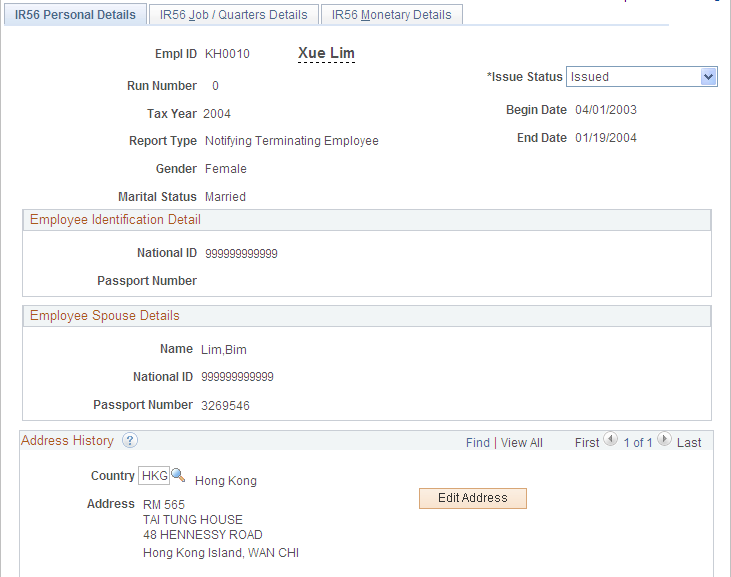

Use the IR56 Personal Details page (GPHK_IR56_INQ1) to view the IR56 details generated for the employee and review an employee's personal information including their identification details, spouse details and address history.

Navigation:

This example illustrates the fields and controls on the IR56 Personal Details page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Issue Status |

Displays the level of the report. The value is Not Issued when the process generates the data, but the printing process has not been completed. When you run the printing process, the value changes to Issued. To stop a particular record from being processed, select On Hold. This status stops both the electronic file process and the printing process from processing the record. You can also change the status back to Not Issued. |

Electronic File Status |

If you are creating an IR56B for an employee after you have sent the electronic file to the IRD, there are additional records that weren't included in the initial file. The new electronic file status is Supplementary. The status of the initial file is Sent. |

Employee Identification Detail and Employee Spouse Details

In addition to employee details, statutory reports must report details of the employee's spouse. The Workforce Administration menu in HR provides the Dependent Information (DEPEND_BENEF) and Dependent Identification (IDENTIFICATN_DEP) components to maintain spouse details.

Field or Control |

Description |

|---|---|

Name |

Displays the employee's full name details. The Name History page in Workforce Administration enables you to enter employee names in non-English characters. You can enter names in Chinese and English at the same time in separate fields. PeopleSoft enables you to enter employee names in alternate characters. This feature is available in the Workforce Administration - Personal Details component in HR. Note: The Chinese name is used in correspondence with the Inland Revenue Board and is used on the employee's payslip. |

National ID |

It is necessary to store the employee and spouse Hong Kong Identity Card (IC) numbers or Tax File Numbers. This information is used in correspondence with the Inland Revenue Department. It is also necessary to store the Identity Card numbers of the employee's dependants. The details are retrieved from the National ID table (PERS_NID) under Personal Data. The DEP_BENEF_NID table contains different IDs for an employee's spouse. |

Passport Number |

Displays the employee or spouse passport number (required for noncitizens). The CITIZEN_PSSPRT table contains passport details of both employees and their dependants. |

Address History

Field or Control |

Description |

|---|---|

Edit Address |

To change any of the default address details, select this link to access the Edit Address page. |

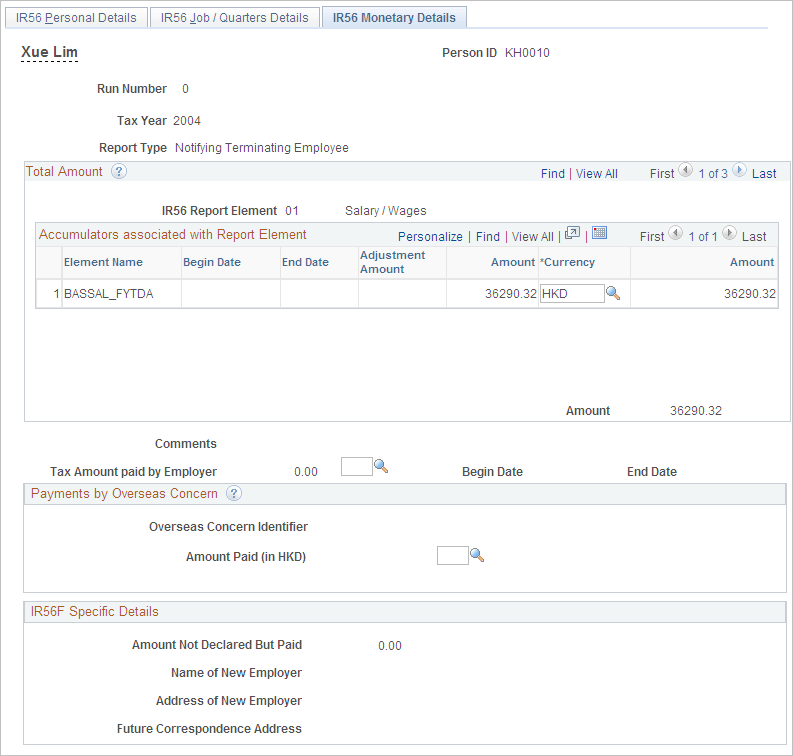

Use the IR56 Monetary Details page (GPHK_IR56_INQ3) to view the IR56 details generated for the employee and enter employee monetary and tax details.

Specific group boxes for each report type also appear.

Navigation:

This example illustrates the fields and controls on the IR56 Monetary Details page. You can find definitions for the fields and controls later on this page.

Total Amount

Field or Control |

Description |

|---|---|

IR56 Report Element and Element Name |

Displays predetermined categories that appear in Inland Revenue reports. Associate payroll accumulators (element names) that must be reported against an IR56 report element instead of rerunning payroll to populate the accumulators. Associate payroll accumulators with IR56 report elements on the IR56 Report Data HKG page. |

Begin Date and End Date |

Displays the dates during which the element and accumulator link are effective. Note: These fields are editable if the issue status not Issued. |

Adjustment Amount, Amount, and Currency |

The first instance of the Amount field displays the amount calculated by the data creation process (in HKD) and it initially appears identically in two other locations in the group box. The first field remains the same, regardless of any adjustments (element additions or subtractions) you make. Instead of modifying this generated amount, you enter additional adjustment rows which enable you to add or subtract any additional amounts (in any currency) not calculated during the initial data creation process. You can enter amounts to add or negate a value generated by the process for an accumulator associated with a report element. For example, if you have to subtract 300 USD from the initial amount because the employee has been temporarily employed by a different pay entity, enter – (minus) 300 in the Adjustment Amount field and select USD as the Currency in the new row. The amount in the Amount field at the bottom of the Total Amount group box automatically adjusts by subtracting the equivalent of 300 USD and displaying the new total. Similarly, if you want to add 300 USD, enter 300 in the Adjustment Amount field. Note: The Adjustment Amount field is editable if the issue status not Issued. The IR56 creation process supports multiple currency processing which impacts the way year to date values are processed and stored in the IR56 result table. In addition to entering manual adjustments, you can enter the currency code in which you are paying the amount. The process calculates the value in local HKD currency and displays the amount reported on the IR56 reports. |

Tax Amount paid by Employer |

Displays the amount of taxes paid by an employer for an employee. This information is needed for IR56 reporting. |

Payments by Overseas Concern

If the employee received an amount from an overseas concern, select the organization that made the payment and enter the amount.

Field or Control |

Description |

|---|---|

Overseas Concern Identifier |

Select the code used to track the overseas concern. Define the overseas concern name and identifier on the Overseas Concern Details page. |

Amount Paid (in HKD) |

Enter the amount paid by the overseas concern to the employee and select the currency for the amount (it can be any currency that is defined in the system). If the amount is unknown, then leave the 'Payment by Overseas Concern' group box blank. |

IR56E/F/G/M Specific Details

For each report type that you select, an additional group box appears, enabling you to enter details specific to the report.