Generating the IR56B Electronic File

This section provides an overview of flat file generation and discusses how to generate the IR56B electronic file.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPHK_IR56_EFILE |

Create a flat file that complies with Hong Kong Inland Revenue Department requirements for the submission of electronic files. |

|

|

GPHK_56B_RC_XML |

Create an XML file that complies with Hong Kong Inland Revenue Department requirements for the submission of electronic files. |

PeopleSoft provides the ability to create a flat file that complies with Hong Kong Inland Revenue Department requirements for the submission of electronic files. The output is created by an Application Engine process using a file layout object that has the same structure as that of the electronic file expected by the IRD of Hong Kong.

The employees are selected from the GPHK_IR56_TBL table and records from GPHK_IR56_TBL, GPHK_IR56_QTR, and GPHK_IR56_DTL are retrieved and processed. During the process, personal information, spouse details, and identifications details are also retrieved and the file layout object GPHK_IR56B is populated.

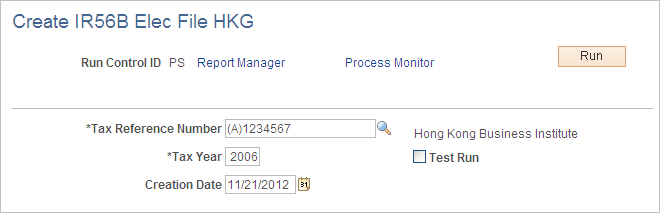

Use the Create IR56B Elec File HKG page (GPHK_IR56_EFILE) to create a flat file that complies with Hong Kong Inland Revenue Department requirements for the submission of electronic files.

Navigation:

This example illustrates the fields and controls on the Create IR56B Elec File HKG page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax Reference Number |

IR56 reports run by tax reference number, which has a major impact on the way the system creates and stores IR56 data. For every employee attached to the pay entity (sharing the tax reference number), the system combines amounts for each year to date element by currency code and stores them in the IR56 result tables. After the process is completed, you can use the IR56 Monetary Details page to enter adjustments to reflect the amount that should be reported on the IR56 documents. |

Tax Year |

Displays the period for which the report must be created. Hong Kong has set the tax period to be April 1 to March 31. Note: Although the tax year is not required for the IR56G and IR56F reports, you must still enter it. |

Test Run |

Select this check box to create (but not send) the electronic file, so that you can view and check your data. When selected, employee records are not marked as sent and the supplementary status is not applicable. |

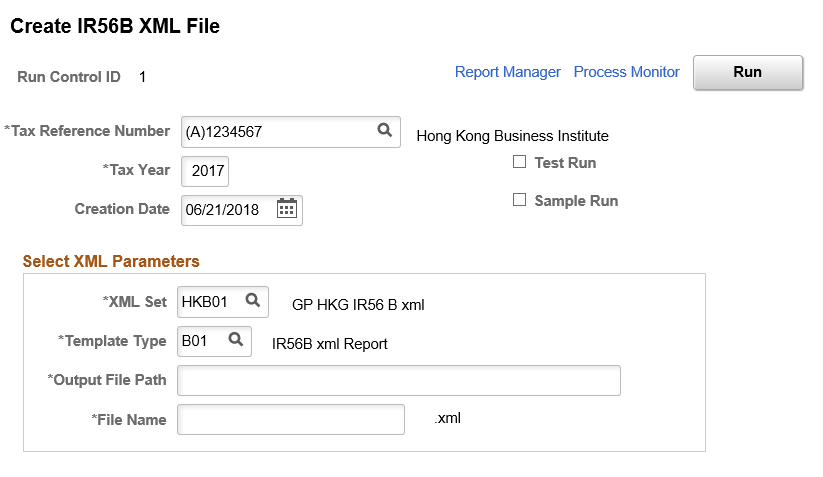

Use the Create IR56B XML File HKG page (GPHK_IR56_EFILE) to create an XML file that complies with Hong Kong Inland Revenue Department requirements for the submission of electronic files.

Navigation:

This example illustrates the fields and controls on the Create IR56B XML File HKG page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax Reference Number |

Select the Tax Reference Number. |

Tax Year |

Displays the period for which the report must be created. Hong Kong has set the tax period to be April 1 to March 31. Note: Although the tax year is not required for the IR56G and IR56F reports, you must still enter it. |

Test Run |

Select this check box to create (but not send) the electronic file, so that you can view and check your data. When selected, employee records are not marked as sent and the supplementary status is not applicable. |

Sample Run |

Select this check box to run a sample electronic file, so that you can view and check your data. |

XML Set |

Select the name of the XML set table. |

Template Type |

Select the name of the template type of the XML report to be generated. |

Output File Path |

Specify the directory where generated XML files are stored. This directory needs to have the right permission for file storage, and is required if the selected output type is File. |

File Name |

Enter the name of the file to be generated. |