Accommodating MPF Exemption Rules and Limits

This section provides overviews of accommodating MPF exemption rules and limits, the MPF contribution holiday rule, age eligibility rules, and permitted period termination rules, and discusses how to:

Define casual employees for MPF contributions.

Exclude employees from MPF calculations.

Apply maximum and minimum limits to MPF contributions.

This section discusses the exceptions and limits for MPF contributions.

Although it is mandatory for employers to pay MPF contributions for each employee, the following exemptions and limits exist:

An employee does not have to contribute to MPF for the first thirty days (contribution holiday) of employment.

If the employee is paid on a monthly calendar basis, reaches the age of 65 prior to the period begin date, and is not terminated, then MPF contribution is not required by either the employer or the employee for that month.

If an employee terminates within the first sixty days of employment (permitted period), the employer is exempted from making the MPF contribution.

For casual employees, the sixty-day (permitted period) rule for employers and thirty-day (contribution holiday) rule for employees does not apply.

Mandatory contributions are subject to maximum and minimum levels.

For example, employees earning less than 5000 HKD per month in relevant income do not have to contribute to MPF, but the employer still needs to contribute 5 percent of the employee's income, even if the employee earns less than 5000 HKD in relevant income in the month. Employer mandatory contributions have no minimum levels.

Note: No age eligibility or minimum and maximum rules are applied to employee voluntary deductions. However, employer voluntary deductions do check for these rules.

This section discusses generation control resolution and the MPF deduction.

A generation control resolves the MPF deduction if the employee's service days are greater than thirty days. For example, for the EEMPFMN1 deduction, the MPF generation control MPF GC EEMN1, using formula MPF FM RSLV EEMN1, resolves if the employee's service days are greater than thirty days (not within the holiday contribution period) and no additional exemptions apply.

Depending on whether the employee is hired or rehired, days of service are calculated as:

Period End Date − Hire Date + 1

or

Period End Date − Rehire Date + 1

If the contribution holiday end date MPF DT HOL END DT is before or the same as the PERIOD END DATE, then the formula MPF FM HOL END DT resolves. The formula determines if the period is greater than the contribution holiday end date.

The formula MPF FM END HOL PRD compares the holiday contribution end date to the pay period begin date. The rule states that if the holiday end date does not fall on the first day of a pay period then the employee's MPF contribution will be waived until the next full pay period. Contributions begin when the pay period begin date is greater than the contribution holiday end date. For example, suppose a monthly paid employee is hired on February 1, 2007, and the holiday end period is April 3, 2007. Because the April pay period starts on the 1st, the employee will not have to contribute MPF until the next pay period (May 1, 2007).

This section discusses the formulae used to check the employees age before resolving and determining the payment of MPF contributions.

The formula MPF FM AGE 65 checks if the employee is 65 years of age. The formula calls GP AGE IN YEARS to calculate the employee's age and resolves when the following conditions are true:

The employee's age is 65.

The employee's birthday falls within the period and on or before the payment date. The formula MPF FM 65 BIRTHDAY is used to check if the employee's 65th birthday falls within the pay period.

Note: GP AGE IN YEARS calculates the number of years from the employee's birthdate to the period end date.

The generation controls MPF GC ERMN1 and MPF GC ERMN2 stop resolving MPF mandatory deductions once the employee has reached 65 before the period begin date. The following example illustrates how the payment date determines the payment of MPF contributions.

Employees Turning 65 Before The Period End Date

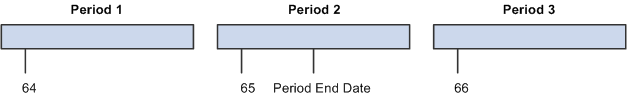

Suppose an employee turns 65 before the period end date. In Period 1, MPF is resolved; in Period 2, MPF is also resolved because the employee turns 65 before the period end date, however, the MPF values are prorated up to the day before the employee's 65th birthday. In Period 3, since the employee is already 65, MPF isn't resolved. The following diagram illustrates this scenario:

The following diagram illustrates a scenario in which an employee turns 65 before the period end date:

Note: If the employee ceases employment immediately upon reaching the age of 65 and all outstanding relevant income is paid or payable on the day before the employee's 65th birthday, the final payment is considered a relevant income and contributions are payable on it.

This section discusses MPF and termination rules.

Termination is only considered if the employee terminates from a primary job. The array MPF AR PRIM JOB retrieves the hire date, rehire date, and termination date from the job table for the employee's primary job. The formula MPF FM TERM CONTRB checks if the employee terminates before the employee's birthday, using the following elements:

MPF FM TERMINATE - Determines if the termination is within the permitted period.

MPF VR TERM DATE - Resolves the termination date.

MPF DT BIRTHDAY - Resolves the birth date.

The formula MPF FM TERM CONTRB resolves if the termination date is before the employee's birthday. If the employee turns 65 within the contribution period and terminates before age 65, then the MPF contribution is deducted.

Note: If an employer decides to make the first contribution during the first sixty days of employment (permitted period), MPF is calculated and deducted for the employee.

Working with Contributions on the Last Day of Employment

The contribution period for a terminated employee can also end on the date the employee is terminated. If the employee's contract states that the final contribution should be paid on the last date of employment, then the mandatory contributions for the relevant employee should be paid to the trustee on or before the tenth day after the date of cessation of employment.

For example, suppose a relevant employee paid on a calendar month basis ceases employment on April 10, 2007 and all outstanding relevant income is paid on that day, the mandatory contributions for the last contribution period should fall due on April 20, 2007. However, if their salary for April is payable under the employment contract on April 30 (following the normal pay cycle) the contribution period would end on April 30, and the mandatory contributions would be due on May 10.

Note: In the period the employee terminates, the maximum and minimum limits are not prorated.

Contributions for casual employees are calculated each pay or contribution period. Casual employees are processed in a separate pay group from other employees as they are most often paid daily.

As there is a difference between the way that casual employees and non-casual employees are calculated, you can mark an employee as a casual employee. The variable MPF VR CASUAL FLG (casual pay group staff flag) is delivered as customary data and is attached at the pay group override level to indicate whether the pay group is for casual employees.

This section discusses how to exclude specific employees from MPF calculations.

Although all members of the workforce between the ages of 18 and 65 are eligible for MPF, you may have to exclude an employee from MPF calculations. The CM SE INITIALISE section (common initialize section paid by eligibility) is delivered as an example. You can change the section to pay by payee and exclude specific employees from MPF calculations by entering the deduction as inapplicable at the deduction assignment level. By doing this, the employee is exempted from MPF calculations in every pay run.

Mandatory contributions are subject to maximum and minimum levels. For example, employees earning less than 5000 HKD per month in relevant income do not have to contribute to MPF. However, the employer still needs to contribute 5 percent of the employee's income, even if the employee earns less than 5000 HKD in relevant income in the month. Employer mandatory contributions have no minimum levels. For employees earning more than 20000 HKD per month, mandatory contributions for employer and employee are capped at 1000 HKD (5 percent of 20000 HKD).

Note: MPF calculations for pay periods other then monthly are identical, except that the maximum and minimum levels of relevant income will vary.

The MPF BR MINMAX REVL bracket stores the minimum (variable MPF VR MIN LEVEL) and maximum (variable MPF VR MAX LEVEL) relevant income ceiling for each period frequency. The following table lists the maximum and minimum levels of contribution for the different pay periods:

|

Pay Period |

Min Level of Relevant Income |

Max Level of Relevant Income |

|---|---|---|

|

Daily |

160 |

650 |

|

Weekly |

1120 |

4550 |

|

Biweekly |

2240 |

9100 |

|

Fortnightly |

2240 |

9100 |

|

Monthly |

5000 |

20000 |

|

Quarterly |

8000 |

40000 |

|

Yearly |

48000 |

240000 |

This rule enables you to run multiple calendars in a period. For example, you can run a regular pay run and thirteenth month pay in separate calendars. The rules calculate contributions as follows:

Regular Run

Relevant Income = 19000

MPF contribution = 19000 x 5%

Thirteenth Month

Relevant Income = 19000

MPF Contribution = 1000 x 5%

MPF contribution is calculated on 1000 HKD instead of 19000 HKD in the thirteenth month pay run because MPF is capped at 20000 HKD.

Note: If an employee has concurrent jobs, the maximum and minimum limits are applied per employee, not per job. The holiday period is applied to the earliest hire date (or rehire date) of the employee's primary job regardless of whether the employee has concurrent jobs.

Commencing Employee MPF Contributions

Contributions for the period in which the employee's contribution holiday ends are calculated on a prorated basis. Prorating may be performed based on the number of days in the month. On this basis, the minimum levels of relevant income for one day in October (a 31 day month) and one day in November (a 30 day month) would be 129 HKD and 133 HKD respectively. Accordingly, the minimum levels of relevant income for the week from October 29, 2007 to November 4, 2007 would be:

919 HKD (3 x 129 + 4 x 133)

Note: You can use 160 HKD and 650 HKD as the daily minimum and maximum levels of relevant income. The minimum and maximum levels for contribution periods longer than a day are calculated as a multiple of the daily minimum and maximum levels.

For example, suppose an employee is paid monthly and commences employment on April 11 and his or her monthly salary is 18000 HKD, and the employee's contribution holiday ends on May 10. For the purposes of calculating their mandatory contributions for the month ending May 31:

The employee's relevant income = 12194 HKD (being 18000 HKD x 21/31)

The maximum relevant income level = 13545 HKD (being 20000 HKD / 31 rounded to closest dollar x 21)

The minimum relevant income level = 2709 HKD (being 4000 HKD / 31 rounded to closest dollar x 21)

Since the relevant income is between 2709 HKD and 13545 HKD, the mandatory contributions for the month ending May 31= 609.28 HKD (being 12194 HKD x 5%).