Entering Garnishments

Use the Assign Garnishments FRA page to create a new garnishment. Enter the garnishment amount, the start date and end date, the type of garnishment, and other instructions.

When you save the garnishment data, the system identifies deduction elements for each garnishment type based on the Garnishment Elements setup data.

Note: To see the names of the deduction elements used for garnishment processing and the names of the variables that store the garnishment ID, start date, and initial amount, access the Rates and Elements page using the component name, GPFR_GAR_DAT.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPFR_GAR_DAT |

Set up a new garnishment or display the details of an existing garnishment. |

Use the Assign Garnishments FRA page (GPFR_GAR_DAT) to set up a new garnishment or display the details of an existing garnishment.

Navigation:

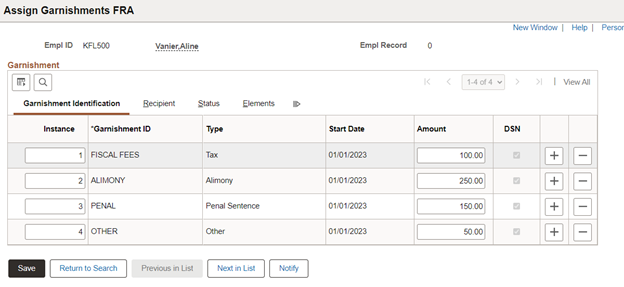

This example illustrates the fields and controls on the Assign Garnishments FRA page: Garnishment Identification tab.

Garnishment Identification Tab

Field or Control |

Description |

|---|---|

Garnishment ID |

Enter the garnishment number on the garnishment notification. Enter up to 40 alphanumeric characters. You should enter the SATD identification when applicable. |

Type |

Select the type of garnishment. Valid values are:

|

Start Date |

(Required) Enter the date on which the payee's earnings become subject to garnishment. The date should fall within the current processing period. You cannot change this date once the system processes the first garnishment amount. If you enter a start date that falls within an earlier processing period, the system will not begin to calculate the garnishment until you process a retroactive pay run. In addition, the results may be unpredictable and may require manual adjustment. |

Amount |

If the garnishment is for alimony, enter the amount of the monthly payment. In all other cases, enter the initial amount of the garnishment. That is, enter the total amount owed according to the garnishment notice. If you need to change the amount of the garnishment later, use positive input. See Changing a Garnishment Balance later in this section for more information. |

|

DSN |

Use this check box to identify the garnishments that will be reported through DSN. Only those garnishments with this check box ON, will be included in the DSN file. The option of paying garnishment notified by DGFIP through DSN was introduced starting DSN 2024. |

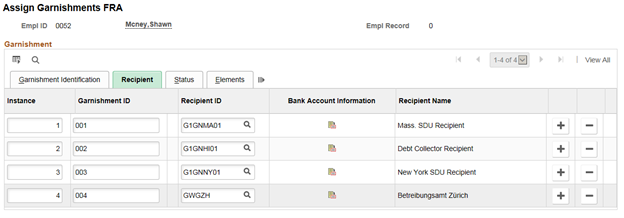

Recipient Tab

Recipient information is required for the correct payment of the garnishment, unless the garnishment will be paid through DSN.

This example illustrates the fields and controls on the Assign Garnishments FRA page: Recipient tab.

Field or Control |

Description |

|---|---|

Recipient ID |

Select the garnishment recipient. |

Recipient Name |

Enter the name of the garnishment recipient. This field is required only if the recipient does not have a Recipient ID. |

Bank Account Information |

Select to add information about the bank account that will receive the garnishment payment. Specify the payment method, country code, bank ID, bank branch ID, account number, account name, and currency code. |

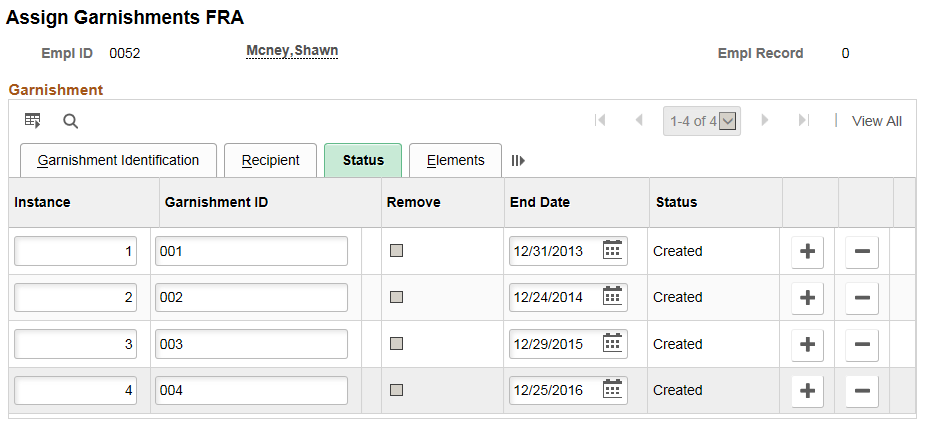

Status Tab

This example illustrates the fields and controls on the Assign Garnishments FRA page: Status tab.

Field or Control |

Description |

|---|---|

Remove |

Select this check box only if you want to remove a garnishment. To delete the garnishment, you must remove it first, save the page, and then click the minus (-) button to the right. |

End Date |

Enter the final payment date. |

Status |

Displays the status. Valid values are: Created: Appears when you click the plus (+) button to add a new row. Processed:The status is set to Processed when you save the garnishment data. Updated: Indicates that you modified the garnishment data. Removed: Indicates that the system has deleted the deduction. |

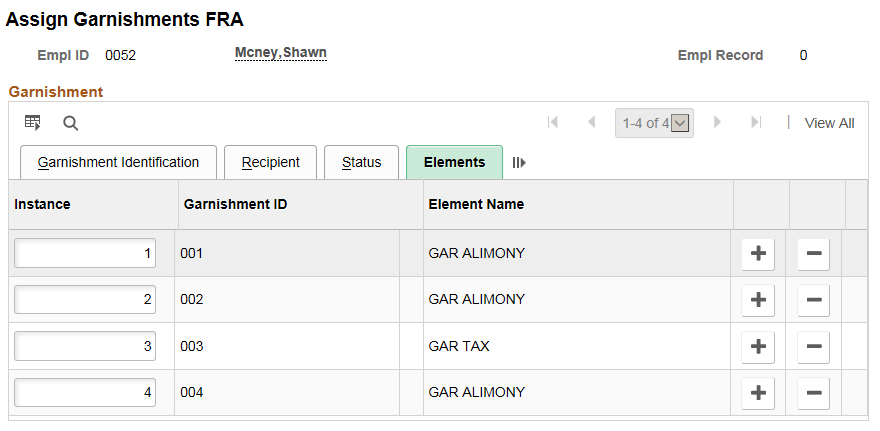

Elements Tab

This example illustrates the fields and controls on the Assign Garnishments FRA page: Elements tab

Field or Control |

Description |

|---|---|

Element Name |

Displays the name of the deduction element that calculates the garnishment amount during payroll processing. The elements for garnishments are:

Note: In case of multiple garnishments of the same type, the system will create different instances of the corresponding deduction. The number of garnishments that the same employee can have is therefore unlimited. |