Understanding the Pension Plan Business Process

A pension plan is a product that enables you to save earnings and accrue capital. Employees can withdraw at retirement or due to disability; beneficiaries can withdrawal due to death of the employee. Pension plans also provide fiscal savings in your Impuesto sobre la Renta de las Personas Físicas (IRPF) income tax.

Both the promoter (company) and the contributor (employee) can make contributions to an employee's pension plan. A promoter is the organization that participates in the constitution of funds based on the terms regulated by law. A contributor is the employee for which the pension plan is created.

When the company contributes to an employee's pension plan, the system considers this earning as salary. It is therefore taxable. Depending on the pension plan definition, it can also be contributive. The amount appears as an earning in kind on the affected employee's payslip and in the Tax Deductions report. Earnings in kind are goods or services that employees receive as a benefit for free or for a reduced price.

When employees contribute to pension plans, companies can administer these employee contributions by deducting the amount from employee payrolls. The amount appears as a deduction on the affected employee's payslip.

PeopleSoft Global Payroll for Spain supports the following types of pension plans:

|

Pension Plan Type |

Description |

|---|---|

|

Individual System |

A pension plan in which the promoter is an entity and the contributors are persons. In an individual system pension plan the company makes the annual contributions either annually or periodically. These contributions are considered earnings in kind. They are taxable and, when the contributions are not an improvement to retirement benefits, they contribute to social security as any other in kind income. Companies can also make deductions directly for the employee using a payroll deduction. Companies can furthermore pay some money as contributions of an individual pension plan, in which case the contribution is considered the same as any other monetary income (taxable and contributive). |

|

Collective System |

A pension plan in which the promoter is an entity, corporation, society, or legal entity and the contributors are their own employees. In this model a company can be the promoter of only one pension plan. In a collective pension plan, the company makes the annual contributions either annually or periodically. These contributions are considered earnings in kind. They are tax-free and, when the contributions are not an improvement to retirement benefits or are made by the promoter, they are contributive. Companies can also make deductions directly for the employee using a payroll deduction. |

You define whether a pension plan is based on the individual or collective employees through the Pension Plan Type field on the Pension Plan page.

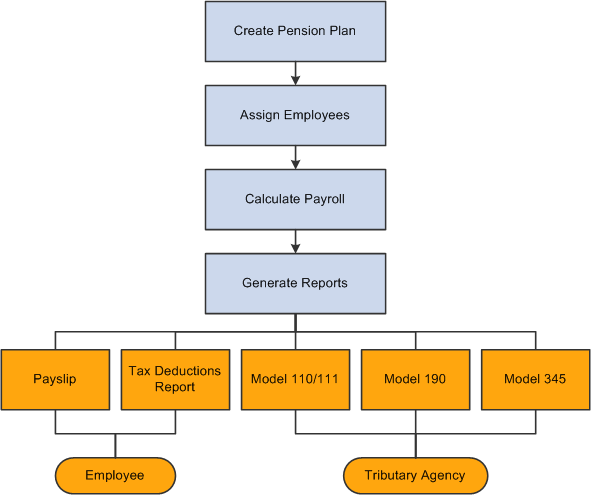

This diagram illustrates the business process flow for pension plans from creating the pension plan, assigning employees, and calculating payroll to generating payslips and reports:

The following reports reflect pension plan data: Model 345, Model 110, Model 111, Model 190, Payslip, and Tax Deduction report. Specifically, these reports account for the payroll elements and corresponding accumulators that pertain to pension plans so that pension plan contributions are reflected in the reports.

The product documentation explains each of these reports and their generation in detail.