Setting Up Union Fees

PeopleSoft Global Payroll for Spain enables you to pay your employees' union fees as part of the regular payroll processing cycle.

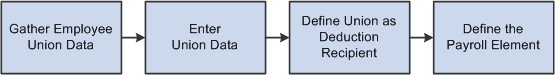

This diagram illustrates the four steps required for setting up your system to automatically pay union fees during the regular payroll processing cycle.

To set up union fees:

Gather the employee's union data.

If employees want their union fees to be paid by the payroll process, the employee must provide the information necessary to set up the automatic payments. The employee must provide:

Union code.

Union date (the date on which the employee was first affiliated with the union).

The employee's function in the union (if applicable).

Union fee.

Fee start and end dates (the initial date on which the fees should be paid through payroll and, if applicable, the date on which the payment of fees should stop). Unless an end date is specified, the system will continue to pay the union fees until an end date is provided.

Exemptions or free working hours to partake in union activities (if applicable).

Enter union data.

When you have the information about an employee's union affiliation, enter that information on the Job Labor page in the Job Data component,

Note: The Fee Start Dt (fee start date) and Fee End Dt (fee end date) fields can be left blank. If Fee Start Dt is blank, then PeopleSoft Global Payroll for Spain uses 01/01/1900 as the default value. If Fee End Dt is blank, then PeopleSoft Global Payroll for Spain uses 01/01/3000 as the default value.

Define the union as the recipient of the deduction.

After associating an employee with a union, you must set up union fee deduction information. Define the union as a recipient of the deduction on the Recipient page The Recipient page provides detailed information about the third-party recipient for a deduction. The Recipient page enables you to indicate who gets a deduction. This provides a direct relationship between the union and bank account into which the union fee deduction is deposited.

Define the payroll element.

If you are defining the general recipient as a general recipient, then link the general recipient to the deduction element that calculates the union fee. To link the general recipient to a deduction, access the Recipient page of the Deductions component and select the deduction recipient.

If the recipient is defined as an individual recipient, then the final step is to define the payroll element to use as the deduction (union fee) for the employee. Use the Assign Deduction Recipients page to do this. This associates an employee with an element name (the payroll element for the union fee) and a recipient (the union and, therefore, the appropriate bank account).

Union Fees Rules and Processing Flow

When you have completed the preceding setup steps, the designated union fee to be paid by the employee is deducted during payroll processing and transferred to the identified union bank account. Section GEN SE DEDUCCIONES contains the necessary elements to perform the union fee deduction and occurs only during the regular payroll process (not during extra period processing).