Defining the Multiple Employment Funding Base

This topic provides an overview of multiple employment funding base and discusses how to enter multiple employment data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPES_MULT_EMP |

Calculate the funding base of social security contributions for employees with multiple jobs. |

In PeopleSoft Global Payroll for Spain, you can calculate the social security contribution funding base for employees with multiple jobs. You define multiple employment funding bases using the Multiple Employment Data page.

Example: Applying Distribution Percentages to the Standard Bases and Ceilings

In this example, assume that an employee has two jobs with these characteristics:

Hours and Salary for Job 1:

Hours Worked: 5 hours per day.

Contribution Group: 2.

Base Salary: 1.202,02 EUR per month.

Additional Salary: 291,49 EUR per month.

Overtime: 345,58 EUR in current month.

Number of Extra Periods: 0.

Hours and Salary for Job 2:

Hours Worked: 3 hours per day.

Contribution Group: 3.

Base Salary: 294,50 EUR per month.

Additional Salary: 24,04 EUR per month.

Number of Extra Periods: 0 (including base salary).

Assume that the social security calculation generates these maximum and minimum common contingency bases to use in the normalization process for Job 1:

|

Base |

Standard Base Amount |

|---|---|

|

Maximum Base |

3166.20 EUR |

|

Minimum Base |

843.30 EUR |

Assume also that the social security calculation generates these upper and lower professional contingencies ceilings to use in the normalization process:

|

Ceiling |

Standard Ceiling Amount |

|---|---|

|

Upper Professional Contingencies Ceiling |

3166.20 EUR |

|

Lower Professional Contingencies Ceiling |

728.10 EUR |

If the distribution percentage for the common contingency base for Job 1 (provided by Social Security) is 75 percent, the system recalculates maximum and minimum bases for common contingencies in the following way:

|

Base |

Standard Base Amount |

Recalculated Base |

|---|---|---|

|

Maximum Common Contingencies Base |

3166.20 EUR |

3166.20 × 75% = 2691.27 EUR |

|

Minimum Common Contingencies Base |

843.30 EUR |

843.30 × 75% = 632.48 EUR |

And if the distribution percentage for the professional contingency base for Job 1 (provided by Social Security) is 75 percent, the system recalculates the upper and lower ceilings for professional contingencies in the following way:

|

Ceiling |

Standard Ceiling Amount |

Recalculated Ceiling |

|---|---|---|

|

Maximum Professional Contingencies Ceiling |

3166.20 EUR |

3166.20 × 75% = 2691.27 EUR |

|

Minimum Professional Contingencies Ceiling |

728.10 EUR |

728.10 × 75% = 546.08 EUR |

Note: The maximum and minimum base percentages in these tables are defined on the Multiple Employment Data page.

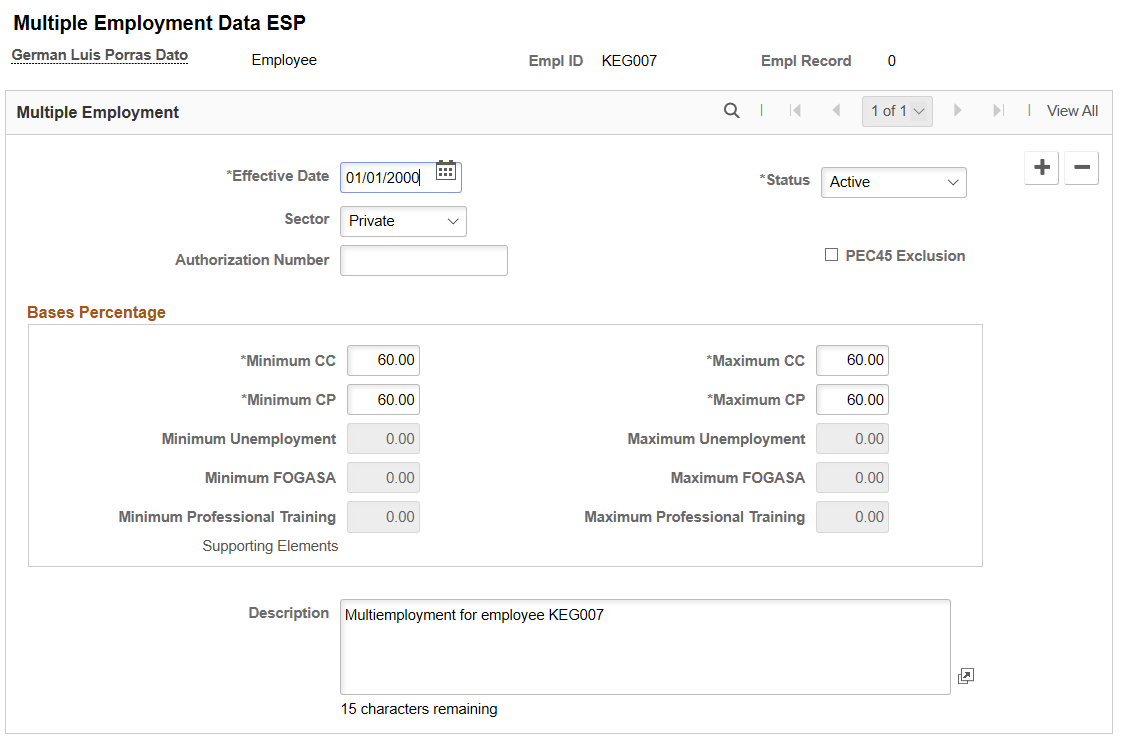

Use the Multiple Employment Data page (GPES_MULT_EMP) to calculate the funding base of social security contributions for employees with multiple jobs.

Navigation:

This example illustrates the fields and controls on the Multiple Employment Data page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Sector |

Select Public or Private. |

Authorization Number |

Enter the employee's social security authorization number used for multiple employment. This information will be included in the TC2 report that is sent to Social Security. |

PEC45 Exclusion |

Select the check box if the employee is working for multiple companies, with excluded contingencies in the other company. Employee with contributing peculiarity 45. Selecting this field will make the following fields and Supporting Elements link editable.

By default, the value entered for CP general base will be displayed in these fields. |

Minimum CC (minimum common contingencies base percent) |

Enter the percentage to be applied to the minimum base used to calculate the funding base for common contingencies. |

Maximum CC (minimum common contingencies base percent) |

Enter the percentage to be applied to the maximum base used to calculate the funding base for common contingencies. |

Minimum CP (minimum professional contingencies base percent) |

Enter the percentage to be applied to the lower ceiling used in the calculation of the professional contingencies base. |

Maximum CP (minimum professional contingencies base percent) |

Enter the percentage to be applied to the upper ceiling used in the calculation of the professional contingencies base. |

Minimum Unemployment |

Enter the percentage to be applied to the lower ceiling used in the calculation of the Unemployment Social Security base. |

Maximum Unemployment |

Enter the percentage to be applied to upper ceiling used in the calculation of the Unemployment Social Security base. |

Minimum FOGASA |

Enter the percentage to be applied to lower ceiling used in the calculation of the FOGASA Social Security base. |

Maximum FOGASA |

Enter the percentage to be applied to upper ceiling used in the calculation of the FOGASA Social Security base. |

Minimum Professional Training |

Enter the percentage to be applied to upper ceiling used in the calculation of the Professional Training Social Security base. |

Maximum Professional Training |

Enter the percentage to be applied to lower ceiling used in the calculation of the Professional Training Social Security base. |

Click the Supporting Elements link to inform the daily Social Security bases in those scenarios not covered automatically by the standard processing.

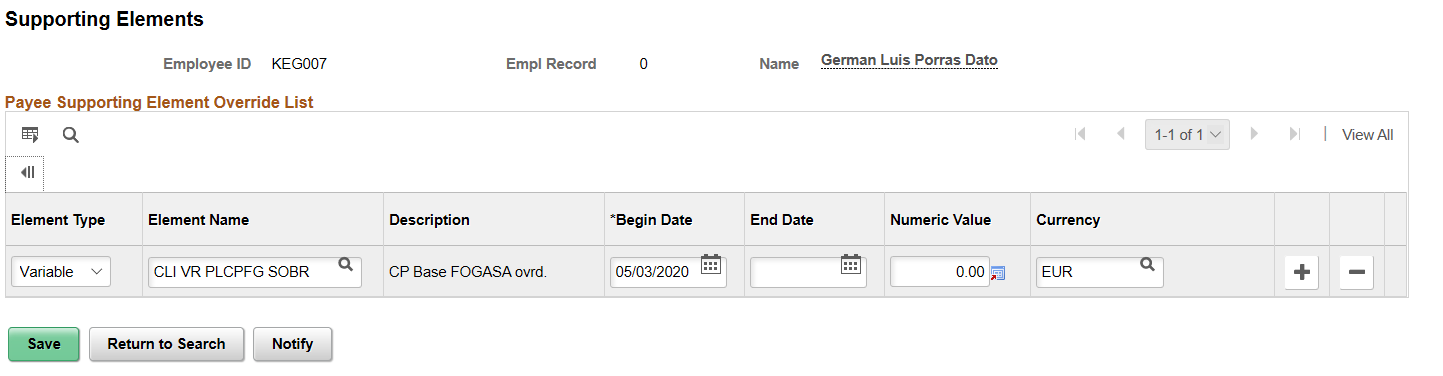

This example illustrates the fields and controls on the Supporting Elements page.