Understanding Global Payroll for Thailand Tax Calculation

Global Payroll for Thailand provides payroll rules and elements to support the following tax calculation features:

Weekly, semi-monthly, and monthly payroll period types for tax calculations and payroll runs.

The Withholding, Gross Up All Cycles (GUPA) and Gross Up One Cycle (GUPO) tax allocation methods are supported for each of the payroll period types.

Only one tax calculation method within a single payroll period can apply to a payee's regular earnings. However the tax allocation method for a payee's regular earnings can change for different payroll periods at the beginning of a pay period. The tax allocation method cannot be changed in the middle of a period.

A payee can have multiple tax allocation methods applied to irregular earnings within a single payroll period.

The tax allocation method can be assigned to irregular earning, such as bonus, overtime, or car allowance, through positive input or element assignment.

Termination tax. The Withholding tax allocation method is used for payees with a length of service of five or more years. For payees with a length of service less than five years, the termination earnings are treated as irregular earnings for tax calculations. For more details, see Understanding Termination Processing of Global Payroll for Thailand.

The following tax allowances and deductions are supported for regular and irregular earnings:

Charitable Donation Allowance.

Child Allowance.

Child Education Allowance.

Education Donation Allowance.

Expense Allowance

Home Mortgage Interest Allowance.

Long Term Equity Fund.

Mutual Fund.

Non-taxable deductions.

Parents Allowance.

Parents Health Insurance.

Patron of Disabled/Incapacitated Person Allowance

Payee Life Insurance Premium.

Pension Insurance Premium.

Personal Allowance

Political Party Donation.

Provident Fund Allowance.

Social Security Fund

Spouse Allowance.

Spouse Life Insurance Premium.

Tax Exempt of Employee Over 65.

Other Allowances

Generate a tax log report to track the tax calculation process.

Tax reporting to the Thailand Revenue Department.

Normal cycle and off cycle processing.

Other supported tax functionality.

Mid-period hires or terminations.

Retroactive amount tax processing. The retroactive earnings amount, is considered irregular earnings, and the tax allocation method of the retroactive amount is the same as the basic retroactive salary element in the retroactive period. The retroactive amount can be a negative value. If the total of the retroactive amount and other irregular earnings with the same tax allocation method is a negative value, then the taxes for that allocation method are not processed.

Negative tax payment processing.

Mid-year changes to deduction allowance information is allowed. The new information will be captured during the payroll run for the next payroll period.

Element segmentation tax calculation of basic salary.

When calculating personal income tax for declaration to the Revenue Department, there are two tax calculation methods to choose from: the Calculation In Advance Method (CAM) and the Accumulative Calculation Method (ACM).

CAM is the method that the Revenue Department recommends employees use. Most companies use ACM to calculate taxes, but governmental organizations still use CAM to calculate the taxes for their officers.

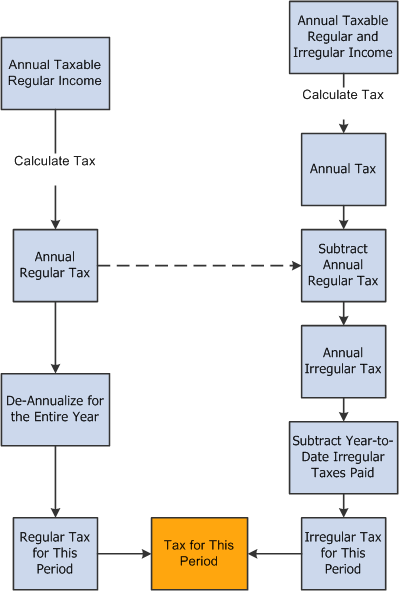

Global Payroll for Thailand enables organizations to choose either calculation method. Both ACM and CAM follow the same high level processing flow as shown in the following graphic:

This image illustrates the high-level processing flow that both the Accumulative Calculation Method or ACM, and Calculation In Advance Method or CAM, calculation methods follow.

The difference between the two tax calculation methods is in the detailed processing steps, such as annualizing regular taxable incomes, and de-annualizing the total calculated tax.

Tax Calculation Variables

Global Payroll for Thailand uses the following variables to control the tax calculation method:

TAX VR CAL CAT specifies the tax calculation category, either ACM or CAM.

TAX VR CAL NUMBER specifies the number of calculation periods the system uses to calculate income taxes when you are using CAM.

Using CAM is not accurate when calculating the tax payment for each pay period, and the payment amount must be adjusted at the end of the year. When you choose CAM for tax calculation, you must specify the number of periods that the system uses CAM to calculate income taxes. The system then uses ACM to calculate income taxes for the remainder of the year.

You can override the default values for these variables at the pay entity, pay group, and payee levels.

PeopleSoft Global Payroll for Thailand supports the following three tax calculation types:

Withholding Tax Income (WH).

The employer, or entity that pays the income, withholds tax at the source and identifies the condition of payment in the ITF1 and ITF1 A reports as Deduct at Source.

Gross Up One Cycle (GUPO).

The employer, or entity that pays the income, pays tax for the payee for one cycle of the tax calculation and the payee pays the tax for the remainder of the cycles. The employer, or pay entity, identifies the condition of payment in the ITF1 and ITF1 A reports as Company Paid Once.

Gross Up All Cycles (GUPA).

The employer, or entity that pays the income, pays the tax for the payee for all cycles of the tax calculation and the payee will not pay any taxes for that income. The employer, or entity that pays the income, identifies the condition of payment in the ITF1 and ITF1 A reports as Company Paid All.

Tax Calculation Types Logic

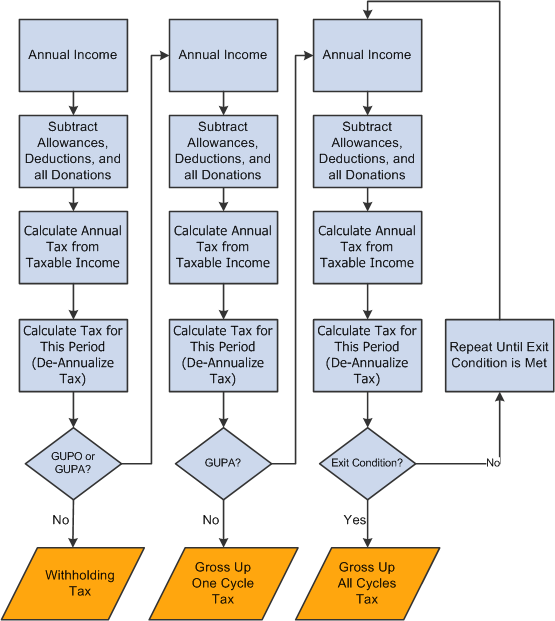

The following diagram describes the tax calculation logic of the three tax calculation types:

This diagram describes the tax calculation logic of the three tax calculation types.

For each calculation type, a repeating loop function is used in the tax calculation:

If the payee's current income uses the Withholding calculation type, the system completes the loop only once.

If the payee's current income uses the Gross Up One Cycle calculation type, then the system completes the loop twice.

If the payee's current income uses the Gross Up All Cycles calculation method, then the system continues to cycle through the loop until the difference between the tax amount of the current loop and the tax amount of the previous loop is less than 0.0001.

In each tax loop, the system performs the following steps:

Calculates the annual total income based on the income for the current period and the year-to-date income.

Subtracts each tax allowance and obtains the total taxable income.

Looks up the tax rate for the total taxable income in the tax rate table.

Calculates the annual tax amount.

Calculates the tax for the current period.

Determining Tax Calculation Type

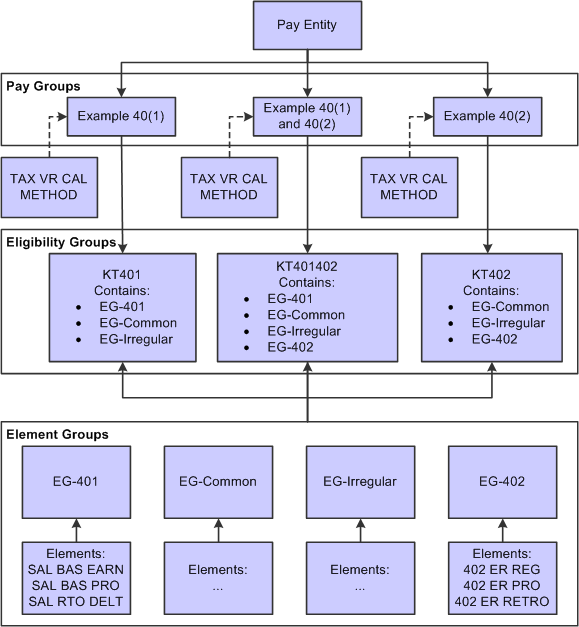

The following diagram illustrates a typical organizational structure for Global Payroll for Thailand:

This diagram describes a typical organizational structure for Global Payroll for Thailand.

In the previous graphic, a pay entity is the business organization that pays payees.

Pay groups combine payees with the same frequency, same pay periods and same payment dates during a payroll process. You must define at least one pay group for each typical pay frequency used in your organization.

The pay groups described in the previous graphic are not delivered in PeopleSoft Global Payroll for Thailand. The example pay groups illustrate three different income streams:

Section 40(1) income only in the Example 40(1) pay group.

A mix of Section 40(1) and Section 40(2) income in the Example 40(1) and 40(2) pay group.

Section 40(2) income only in the Example 40(2) pay group.

TAX VR CAL METHOD is the element user key that specifies the tax calculation type, Withholding, Gross Up One Cycle, or Gross Up All Cycles.

PeopleSoft Global Payroll for Thailand delivers the following eligibility groups that specify which types of regular income a payee receives:

KT401 is the eligibility group for Section 40(1) income.

KT401402 is the eligibility group for a combination of Section 40(1) and Section 40(2) income.

KT402 is the eligibility group for Section 40(2) income.

Global Payroll for Thailand delivers the following element groups:

EG-401.

Contains the SAL BAS EARN, SAL BAS PRO, and SAL RTO DELT elements for processing of Section 40(1) income.

EG-Common.

Contains all common earning and deduction elements, which are eligible to all pay groups. For example, deduction elements for tax allowance, social security contribution and provident fund contribution are eligible to all payees.

EG-Irregular.

Contains all earning elements for irregular income. This element group is eligible to all pay groups. The 'Eligibility Assignment' of all members of this element group will be set to 'By Payee'. By this means, if you want a payee gets an element processed, you have to assign this element through the payee level Earnings/Deductions Assignment page or enter positive input. This guarantees those elements that are not only eligible to the current payee, but also have been assigned through positive input or element assignment will be resolved. This can greatly improve system performance.

EG-402.

Contains the 402 ER REG, 402 ER PRO, and 402 ER RETRO elements for processing Section 40(2) income.

Each of the delivered element groups in Global Payroll for Thailand belongs to the following eligibility groups:

|

Element Group |

Eligibility 1 |

Eligibility 2 |

Eligibility 3 |

|---|---|---|---|

|

EG-401 |

Eligibility Group-KT401402 |

Eligibility Group-KT401 |

|

|

EG-402 |

Eligibility Group-KT401402 |

Eligibility Group-KT402 |

|

|

EG-Irregular |

Eligibility Group-KT401402 |

Eligibility Group-KT401 |

Eligibility Group-KT402 |

|

EG-Common |

Eligibility Group-KT401402 |

Eligibility Group-KT401 |

Eligibility Group-KT402 |

Determining Tax Calculation Types for Irregular Income

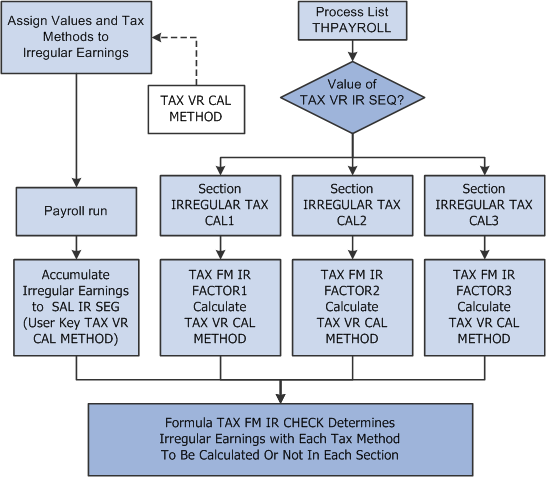

The tax calculation methods of irregular income are determined through positive input or element assignment while assigning values to irregular incomes.

The following diagram illustrates how to determine the tax calculation types and sequences for irregular income:

This diagram illustrates how to determine the tax calculation types and sequences for irregular income.

Although a single type of irregular income can use any of the three tax calculation types, Global Payroll for Thailand delivers one earnings element for each type of irregular income. Use the following steps to identify the tax calculation type for each type of irregular income:

Add the TAX VR CAL METHOD variable to each irregular income earning element as a user key.

Enter one of the tax calculation types in the TAX VR CAL METHOD variable through positive input or the Earning/Deduction Assignment page.

Use the Configuration by Element page or the Configuration by Category page to ensure that the end user assigns a value to the TAX VR CAL METHOD variable.

Add the TAX VR CAL METHOD variable as a user key for the related accumulators.

Since a payee can have all of the tax calculation types on irregular income during the same period, the pay group cannot be used to determine which tax calculation method should be used for a given irregular income. All earnings elements for irregular income use the TAX VR CAL METHOD user key to indicate which tax calculation type to use. Payroll administration needs to assign a value to this user key using supporting element overrides when entering irregular income using Positive Input or the Earning/Deduction assignment page.

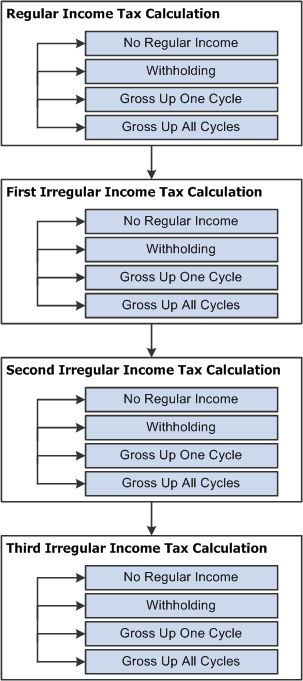

The following graphic describes the overall flow of tax calculations in Global Payroll for Thailand:

This diagram describes the overall flow of tax calculations in Global Payroll for Thailand.

The Global Payroll for Thailand process list has four sections for tax calculation:

Regular Income Tax Calculation.

This section calculates the personal income tax for regular income. Based on the current payee's type of regular income, this section chooses the tax calculation type to calculate the regular tax.

First Irregular Income Tax Calculation.

A payee can have three different types of irregular income within one payroll period: withholding, gross up all cycles and gross up one cycle. There are three separate sections to calculate different types of irregular incomes. Based on the configuration, this section can calculate withholding, gross up all cycles, and gross up one cycle irregular income taxes. If the organization specifies that this section calculates withholding tax, but the current payee does not have any withholding irregular income, then this section is skipped.

Second Irregular Income Tax Calculation.

You can specify the tax calculation type for this section.

Third Irregular Income Tax Calculation.

You can specify the tax calculation type for this section.

Tax calculations for Global Payroll for Thailand are not completely accurate until the end of a tax year, since the calculations are based on the projection of annual regular income. So the tax amount must be adjusted at the end of tax year. For example, tax allowance declaration data can change within a tax year, so any tax calculation before the change in declaration data is inaccurate. In addition, changes to the calculation sequence for different types of irregular income result in different tax amounts.

Principles Used in Year-End Tax Recalculation

From an entire tax year perspective, the regular income tax amount does not need to be recalculated at the end of the year. However, the irregular income tax amount must be recalculated based on the final year to date regular income, including the final year to date original regular income and the year to date tax for regular income. The total irregular tax amount paid is the same as moving the year to date withholding income, the year-to-date original gross up all cycles irregular income, and the year to date original gross up one cycle irregular income to the last period of the year.

All irregular withholding taxes should be paid by the employee. So the year to date withholding irregular income can be used for the year end tax recalculation.

All irregular gross up all cycles taxes should be paid by the employer, and a corresponding amount of gross up all cycles irregular income is added to the employee's income. For example, during the 2007 tax year, the only gross up all cycles irregular income occurs in May. The amount of this income is 50,000 THB, and the calculated tax amount is 10,000 THB. Before the recalculation at the end of the year, the year to date gross up all cycles irregular income is 50,000+10,000=60,000 THB, but the year to date original gross up all cycles irregular income of 50,000 THB should be the amount used for the year end tax recalculation.

A part of the irregular gross up one cycle tax should be paid by the employer, and a corresponding amount of relative gross up one cycle irregular income is added to the employee's income. For example, during the 2007 tax year, the only gross up one cycle irregular income occurs in June. The amount of this income is 50,000 THB, and the calculated tax amount that employer should pay is 8,000 THB. Before the year end recalculation, the year to date gross up one cycle irregular income is 50,000+8,000=58,000 THB, but the year to date original gross up one cycle irregular income of 50,000 THB should be the amount used for the year end tax recalculation.

Calculation Logic In the Last Period of One Tax Year

The irregular tax calculation process in the last period of the tax year differs from the process during other periods of the year. For example, assume that the irregular tax calculation sequence is:

Withholding.

Gross up all cycles.

Gross up one cycle.

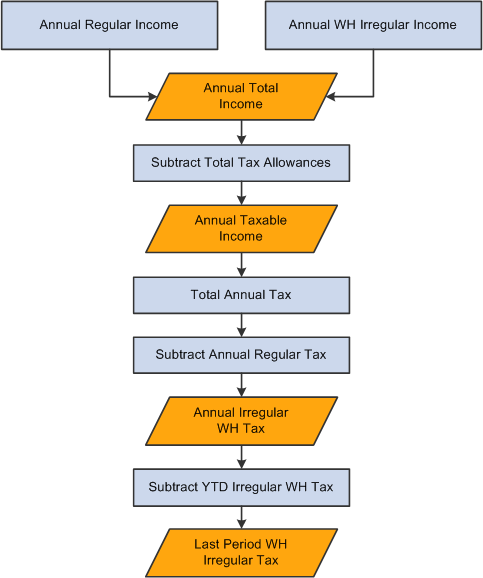

The following diagram shows the process flow for calculating the withholding tax in the last period of the year:

This diagram shows the process flow for calculating the withholding tax in the last period of the year.

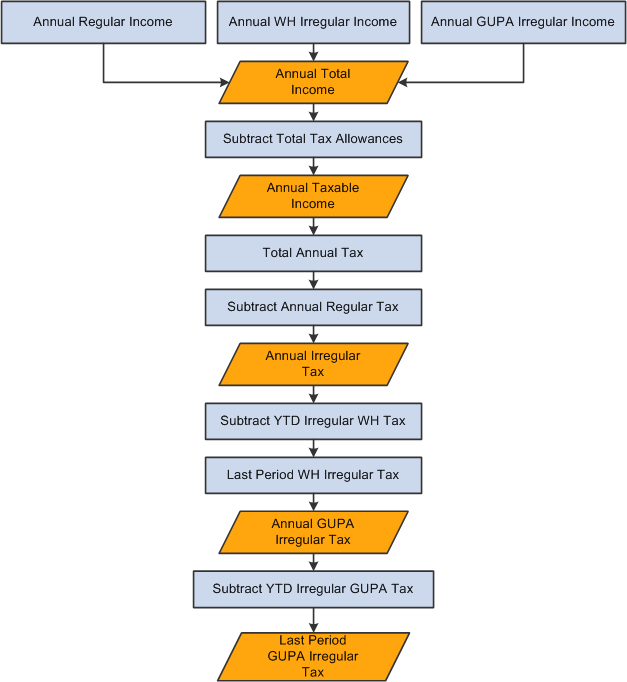

Then, the gross up all cycles irregular tax is calculated based on the withholding tax results:

This diagram shows that the gross up all cycles irregular tax is calculated based on the withholding tax results.

Finally, the gross up one cycle tax is calculated based on the result of the withholding and gross up all cycles tax.

PeopleSoft Global Payroll for Thailand supports retroactive processing of basic salary.

The amount of retroactive taxes is categorized as irregular earnings, whether the amount is positive or negative. The tax calculation type for the retroactive amount is the same as the retroactive element in the retroactive period.

If the negative retroactive tax amount plus any other irregular earnings with the same tax calculation type is negative, then the amount is not processed.

The PeopleSoft system delivers a query that you can run to view the names of all delivered elements designed for Global Payroll for Thailand.